- 5 Marks

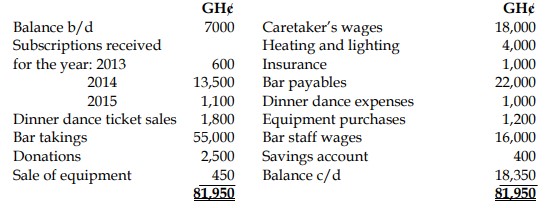

FA – Nov 2024 – L1 – Q5b – Subscription Account for a Non-Profit Organization

Prepare the subscription account for a football club considering arrears, advance payments, and new subscriptions received.

Question

At 31 March 2023, Kahuro Football Club had membership subscriptions in arrears amounting to GH¢144,000 and had received GH¢36,000 as subscriptions in advance.

During the year ended 31 March 2024, the club received GH¢1,872,000, which included 26 memberships for the year ending 31 March 2025, charged at GH¢1,200 per annum.

At 31 March 2024, 16 members owed a subscription fee of GH¢1,200 each.

Required:

Prepare the subscription account for Kahuro Football Club for the year to 31 March 2024

Find Related Questions by Tags, levels, etc.