- 20 Marks

AA – May 2016 – L2 – Q2 – Planning an Audit

Planning and identifying audit risks for a new client with an increased demand for products, using a standard costing system for inventory valuation.

Question

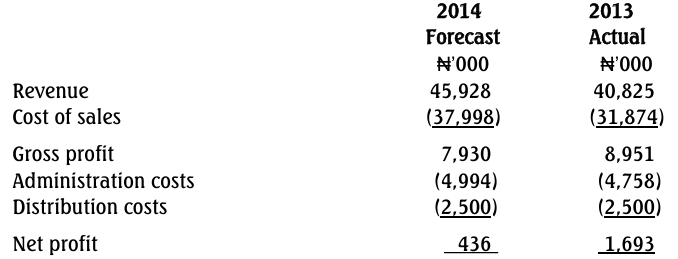

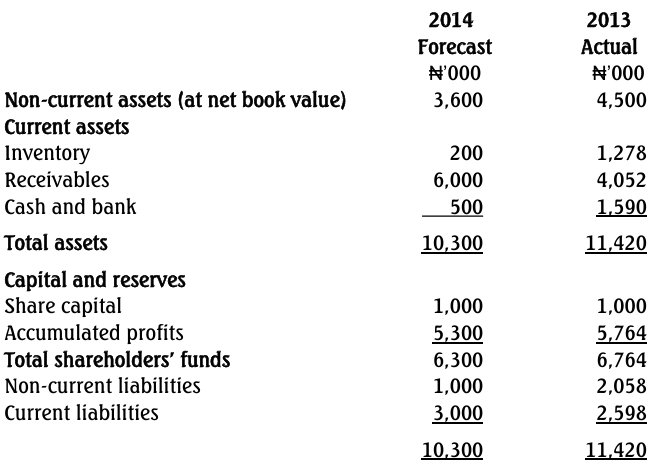

Sweet Dreams, a limited liability company, is a new audit client and you are at the

planning meeting for the forthcoming audit. The company has grown rapidly and has

May 31 as year-end. The financial statements have not been audited in previous years

since the organization has only just converted from a partnership to a company.

The company’s bankers have requested that an audit be undertaken on the financial

statements for the year ending May 31, 2016. Higher levels of inventory required to

meet the increasing demand for its products have necessitated a request for an increase

in the bank’s overdraft facility.

The company makes beds, buying its materials directly. At the year-end, inventory

comprises raw materials, work-in-progress and finished goods. It does not undertake

continuous inventory counting but does intend to perform a full inventory count on

May 31, 2016. It uses standard costing system to value finished products and work-inprogress.

Find Related Questions by Tags, levels, etc.

- Tags: Audit Planning, Audit Risk, Control Systems, Inventory Management, Material Misstatement

- Level: Level 2

- Topic: Audit evidence, Planning an Audit, Risk Assessment and Internal Control

- Series: MAY 2016