Retail Specialist Co. Ltd (RSCL) is a large company, operating in the retail industry, with a year ended 31 December 2018. You are a manager in Jen & Co, responsible for the audit of Retail Specialist Co. Ltd (RSCL), and you have recently attended a planning meeting with Olivia Danso, the finance director of the company. As this is the first year that your firm will be acting as auditor for Retail Specialist Co. Ltd (RSCL), you need to gain an understanding of the business risks facing the new client. Notes from your meeting are as follows:

Retail Specialist Co. Ltd (RSCL) sells clothing, with a strategy of selling high fashion items under the RSCL brand name. New ranges of clothes are introduced to stores every eight weeks. The company relies on a team of highly skilled designers to develop new fashion ranges. The designers must be able to anticipate and quickly respond to changes in consumer preferences. There is a high staff turnover in the design team.

Most sales are made in-store, but there is also a very popular catalogue, from which customers can place an order online, or over the phone. The company has recently upgraded the computer system and improved the website, at significant cost, in order to integrate the website sales directly into the general ledger, and to provide an easier interface for customers to use when ordering and entering their credit card details. The new online sales system has allowed overseas sales for the first time.

The system for phone ordering has recently been outsourced. The contract for outsourcing went out to tender and Retail Specialist Co. Ltd (RSCL) awarded the contract to the company offering the least cost. The company providing the service uses an overseas phone call centre where staff costs are very low.

Retail Specialist Co. Ltd (RSCL) has recently joined the Ethical Trading Initiative. This is a ‘fair-trade’ initiative, which means that any products bearing the RSCL brand name must have been produced in a manner which is clean and safe for employees, and minimises the environmental impact of the manufacturing process. A significant advertising campaign promoting Retail Specialist Co. Ltd (RSCL)’s involvement with this initiative has recently taken place. The RSCL brand name was purchased a number of years ago and is recognised at cost as an intangible asset, which is not amortised. The brand represents 12% of the total assets recognised on the statement of financial position.

The company owns numerous distribution centres, some of which operate close to residential areas. A licence to operate the distribution centres is issued by each local government authority in which a centre is located. One of the conditions of the licence is that deliveries must only take place between 8 am and 6 pm. The authority also monitors the noise level of each centre, and can revoke the operating licence if a certain noise limit is breached. Two licences were revoked for a period of three months during the year.

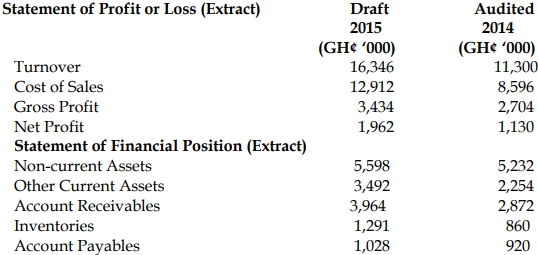

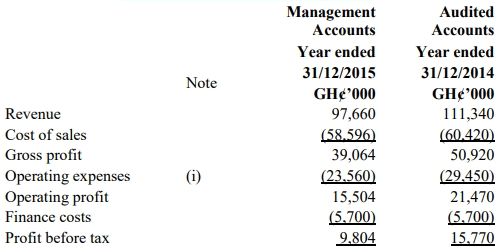

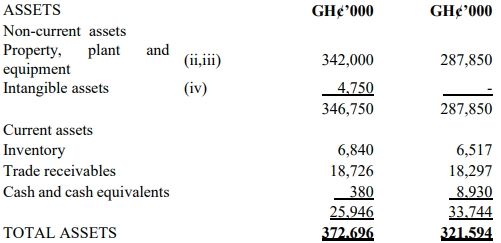

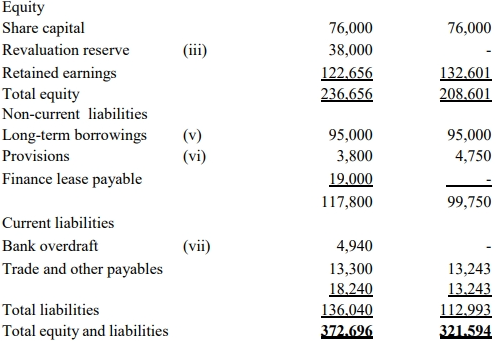

To help your business understanding, Olivia Danso has e-mailed to you extracts from the draft statement of comprehensive income, and the relevant comparative figures, which are shown below.

Extract from draft Statement of Comprehensive Income

Year ending 31 December

| Revenue: Retail outlets |

2018 Draft (GH¢ million) |

2017 Actual (GH¢ million) |

| Phone and on-line sales |

1,030 |

1,140 |

| Total revenue |

425 |

395 |

| Operating profit |

1,455 |

1,535 |

| Finance costs |

245 |

275 |

| Profit before tax |

(25) |

(22) |

| Profit before tax |

220 |

253 |

Additional Information:

| Number of stores |

2018 Draft |

2017 Actual |

| Number of stores |

210 |

208 |

| Average revenue per store |

GH¢ 4·905 mn |

GH¢ 5·77 mn |

| Number of phone orders |

680,000 |

790,000 |

| Number of on-line orders |

1,020,000 |

526,667 |

| Average spend per order |

GH¢ 250 |

GH¢ 300 |

Required:

a) Prepare briefing notes to be used at a planning meeting with your audit team, in which you evaluate FIVE (5) business risks facing Retail Specialist Co. Ltd (RSCL) to be considered when planning the final audit for the year ended 31 December 2018.

(10 marks)

b) Using the information provided, identify and explain FIVE (5) risks of material misstatements that may affect the financial statements you are going to audit. (10 marks)