- 30 Marks

TAX – Nov 2023 – L2 – Q1 – Personal Income Tax (PIT)

Compute the personal income tax payable by a proprietor with specific adjustments for disallowable expenses and capital allowances.

Question

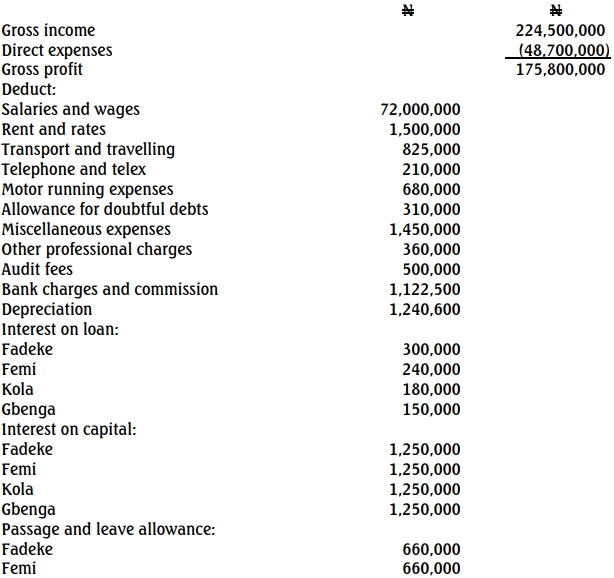

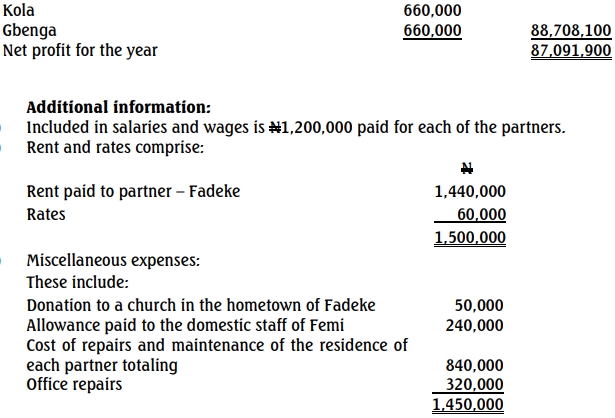

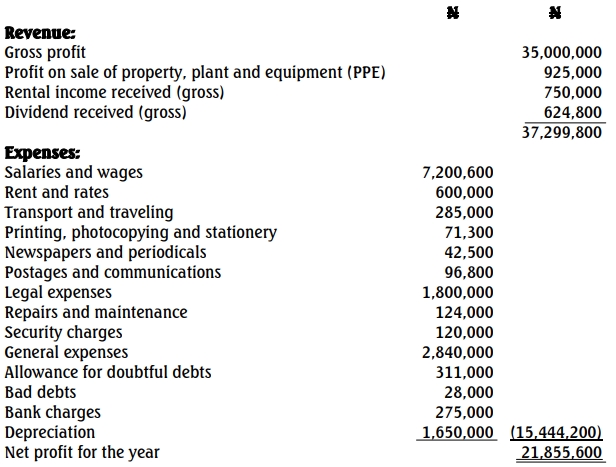

Alhaji Nura Imam, having spent over 20 years as an employee of Apex Limited, retired on November 1, 2020. On January 2, 2021, he registered a business under the name of Nura Imam Enterprises. The profit or loss account of the enterprise for the year ended December 31, 2021, is as follows:

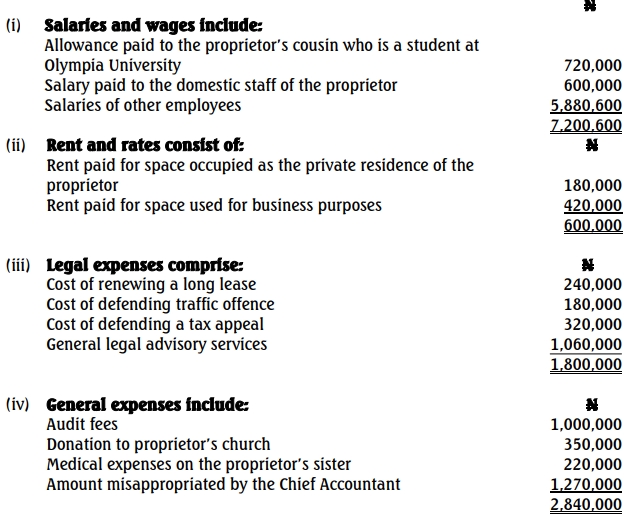

You were provided with the following additional information:

(v) Agreed capital allowance on qualifying capital expenditure was N1,240,000.

(vi) Alhaji Imam received a gratuity of N4,000,000 during the year.

(vii) Alhaji Imam is blessed with five children, all within the ranges of 10 to 21 years.

(viii) The proprietor has a life assurance policy on which he pays a premium of N1,200,000 annually.

Required: Compute the personal income tax payable by Alhaji Nura Imam for the relevant assessment year. (30 Marks)

Find Related Questions by Tags, levels, etc.