- 6 Marks

ICMA – Nov 2024 – L1 – Q4b – Day-Rate Incentive Scheme Calculation

Calculates the cost per unit for both low and high day-rate incentive schemes.

Question

Amanda LTD – Day-Rate Incentive Scheme

Amanda LTD is a manufacturing company and its management is considering the introduction of a high day-rate incentive scheme. During one of such production periods, record shows that, if an employee makes 100 units in a 40-hour week, the employee is paid GH¢2 per hour, but if 120 units are made, the employee is paid GH¢2.50 per hour. Production overhead is added to cost at the rate of GH¢2 per direct labour hour.

Required:

i) What is the cost per unit for the low day-rate scheme?

ii) What is the cost per unit for the high day-rate scheme?

Find Related Questions by Tags, levels, etc.

- Tags: Cost Calculation, Day Rate Scheme, Incentive Scheme

- Level: Level 1

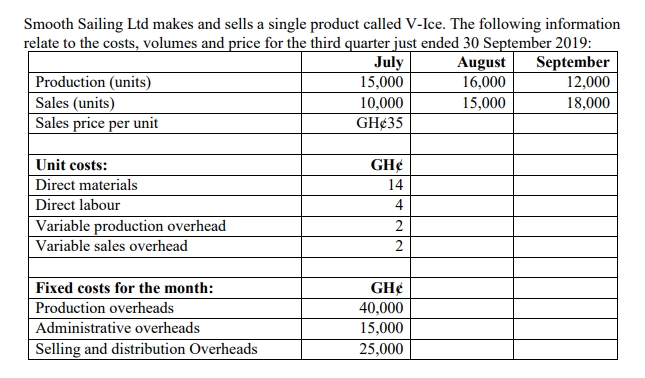

- Topic: Marginal Costing and Absorption Costing

- Series: Nov 2024