- 10 Marks

CR – Nov 2020 – L3 – Q2a – Intangible Assets

Prepare a note reconciling the carrying amount of Katamanso’s intangible assets, including website development costs and copyright extension fees.

Question

Katamanso Ltd (Katamanso) is a company which is a subsidiary of a media company. Katamanso’s principal asset is the rights it owns to a classic film. Katamanso had the following intangible assets as at the year end 31 December 2017:

| Intangible Asset | Cost (GH¢’000) | Accumulated Amortisation (GH¢’000) | Carrying Amount (GH¢’000) |

|---|---|---|---|

| Classic Film | 10,000 | (6,000) | 4,000 |

| Website | 150 | (90) | 60 |

| Total | 10,150 | (6,090) | 4,060 |

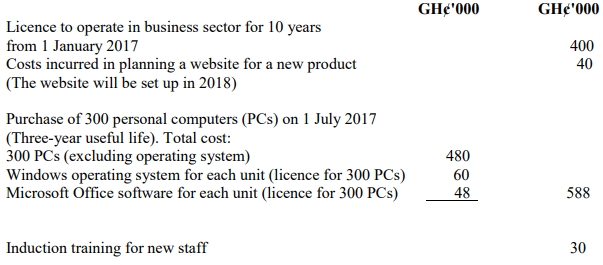

The following information includes all relevant events that occurred during the year ended 31 December 2018:

i) The film was originally published on 1 January 1970 and the rights were acquired by Katamanso on 1 January 2015 for GH¢10 million. Copyright was set at 50 years from the date the film was originally published. The film was amortized by Katamanso using the straight-line method over the remaining copyright period. However, recent legislative changes passed on 1 January 2018 have extended the copyright period from 50 years to 70 years, subject to payment of a registration fee prior to the original expiry date. This, together with associated legal costs, amounted to GH¢70,000 and was paid on 1 January 2018. As a result, the market value of the rights to the film was GH¢12.1 million at 31 December 2018, according to Katamanso’s professional valuers, who determined the valuation on 1 January 2018.

ii) During the year Katamanso developed a new interactive website to market the film and associated merchandise given its extended copyright period. The website includes its own e-commerce system for online DVD sales, direct streaming of the film, associated material, and merchandise sales. The costs incurred are as follows:

| Website Development Costs | Amount (GH¢’000) |

|---|---|

| Planning the new website | 8 |

| Registration of domain names | 18 |

| Internal design costs | 85 |

| External contractor design costs | 112 |

| New content development | 38 |

| Advertising of the new website | 22 |

The new website went live on 1 July 2018 and the old website, which was being amortised using the straight-line method over five years, was taken offline on that date and will not be used for any other purpose.

Required:

Prepare a note reconciling the carrying amount of Katamanso’s intangible assets from the beginning to the year ended 31 December 2018 as required by IAS 38: Intangible Assets.

(Note: Comparative information is not required. All amounts are material.)

Find Related Questions by Tags, levels, etc.

- Tags: Amortization, Development Costs, IAS 38, Intangible Assets

- Level: Level 3

- Topic: IAS 38: Intangible assets

- Series: NOV 2020