- 6 Marks

CR – May 2021 – L3 – Q2a(i) – Impairment of Assets and CGU Valuation

Evaluate the acceptability of accounting practices used for CGU impairment test, focusing on discount rates and foreign exchange issues under IAS 36.

Question

- Gyamfi Ltd (Gyamfi) is an international company with a presence in Ghana, providing spare parts for the automotive industry. It operates in various jurisdictions, each with different currencies. In 2020, Gyamfi faced financial difficulties partly due to the COVID-19 pandemic, resulting in a decline in revenue, a reorganization, and restructuring of the business. As a result, Gyamfi reported a loss for the year.

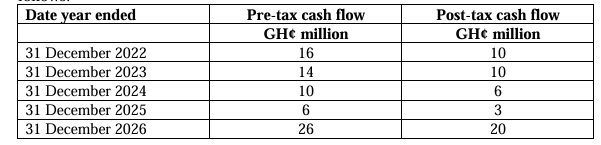

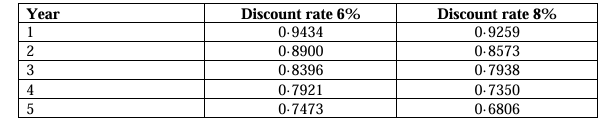

Gyamfi conducted an impairment test for goodwill, but no impairment was recognized. The company applied a single discount rate to all cash flows for all cash-generating units (CGUs), regardless of the currency in which the cash flows were generated. The discount rate used was the weighted average cost of capital (WACC), and Gyamfi used the 10-year government bond rate of its jurisdiction as the risk-free rate in the calculation.

Additionally, Gyamfi built its impairment model using forecasts denominated in the parent company’s functional currency, arguing that any other approach would be unrealistic and impracticable. Gyamfi claimed that the CGUs had different risk profiles in the short term, but there was no basis for claiming that their risk profiles were different over a longer business cycle.

Impairment of Non-Current Assets:

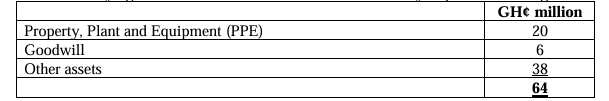

Gyamfi also tested its non-current assets for impairment. A building located overseas was deemed impaired due to flooding in the area. The building was acquired on 1 April 2020 for 25 million dinars when the exchange rate was 2 dinars to the Ghana Cedi. The building is carried at cost. As of 31 March 2021, the building’s recoverable amount was determined to be 17.5 million dinars. The exchange rate on 31 March 2021 was 2.5 dinars to the Ghana Cedi. Buildings are depreciated over 25 years.The tax base and carrying amounts of the non-current assets before the impairment write-down were identical. The impairment of the non-current assets is not deductible for tax purposes. No deferred tax adjustment has been made for the impairment. Gyamfi expects to make profits for the foreseeable future and assumes the tax rate is 25%. No other deferred tax effects need to be considered besides the ones relating to the impairment of the non-current assets.

Requirements (as per question):

i) Evaluate the acceptability of the accounting practices under IAS 36: Impairment of Assets (6 marks).

Find Related Questions by Tags, levels, etc.