- 20 Marks

FR – Nov 2019 – L2 – Q4 – Financial Statement Analysis

Assessment of impairment loss for a cash-generating unit including intangible assets and goodwill.

Question

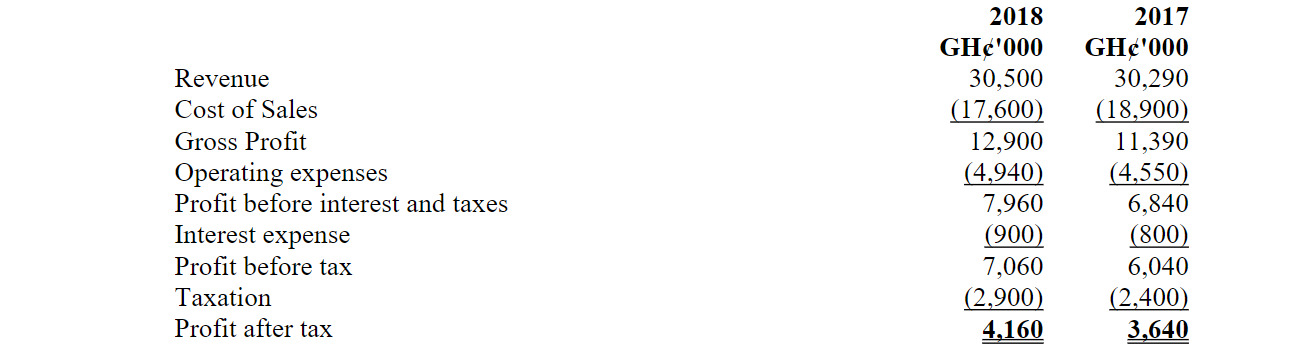

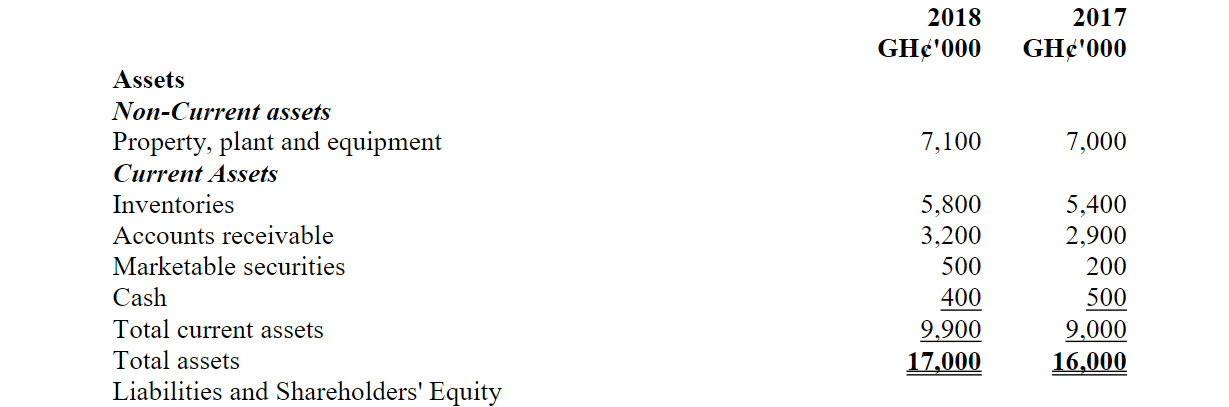

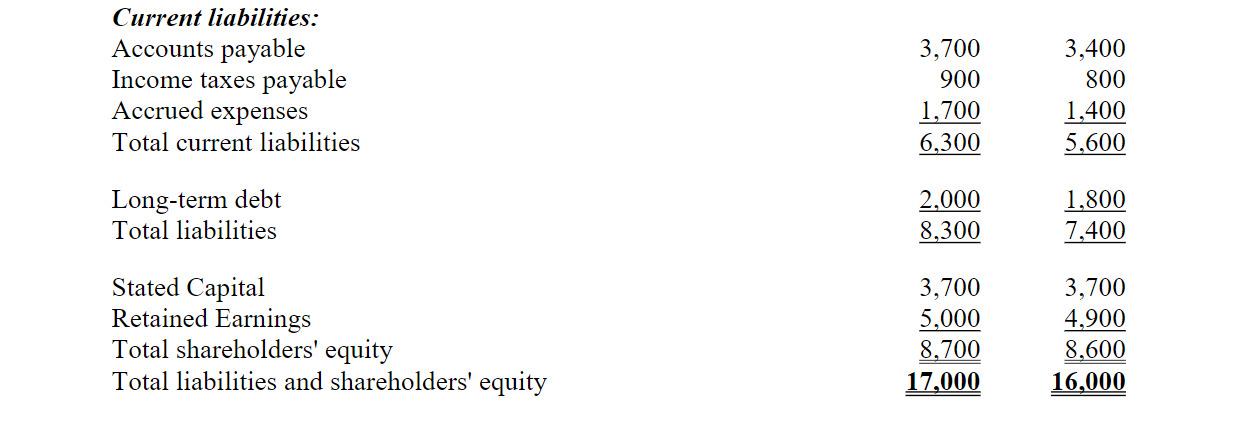

Hukpor Ltd (Hukpor) manufactures a variety of consumer products. The company’s founders have managed the company for thirty years and are now interested in selling the company and retiring. Seekers Ltd is looking into the acquisition of Hukpor and has requested the company’s latest financial statements and selected financial ratios in order to evaluate Hukpor’s financial stability and operating efficiency. The summary of information provided by Hukpor is presented below:

Statements of Financial Position as at 31 December

Selected Financial Ratios of Hukpor Ltd for 2017

Current ratio 1.61:1

Acid-test ratio 0.64:1

Inventory turnover 3.17 times

Times interest earned 8.55 times

Debt-to-equity ratio 86%

Required:

a) Calculate ratios for the years 2018 for Hukpor in comparison with ratios for 2017. (5 marks)

b) For each of the ratios computed for 2018, analyse Hukpor’s performance for 2018 based

on the results of the ratio computed, in comparison with the results for 2017. (10 marks) c) Explain FIVE (5) limitations of accounting ratios. (5 marks)

(Total: 20 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cash-Generating Unit, Fair Value, IAS 36, Impairment, Value in Use

- Level: Level 2