- 20 Marks

CR – May 2015 – L3 – Q3 – Emerging Trends in Corporate Reporting

Analyze financial statements of two companies and discuss limitations of ratio analysis.

Question

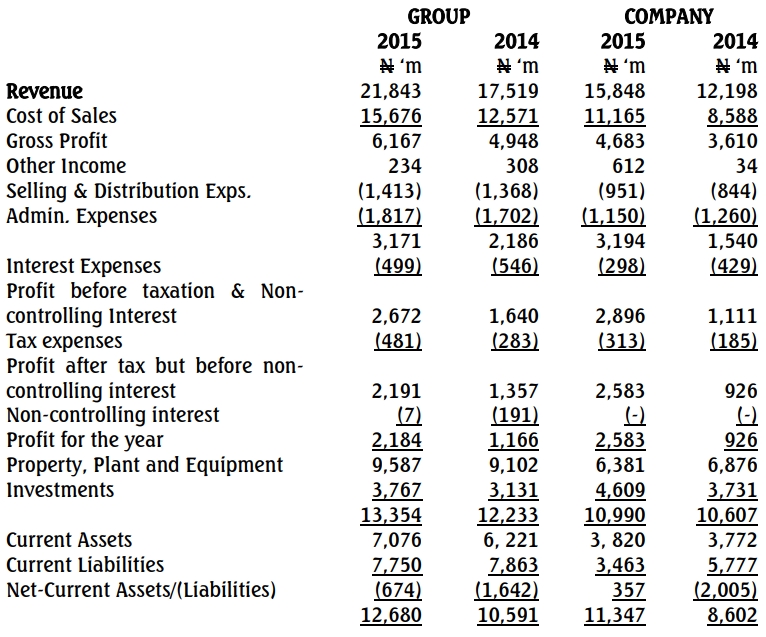

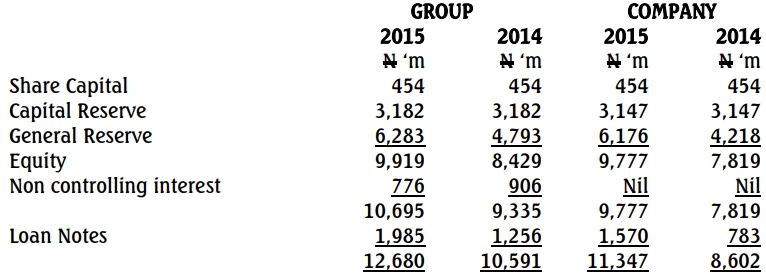

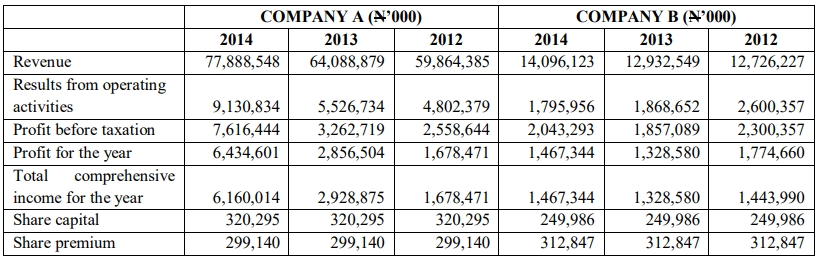

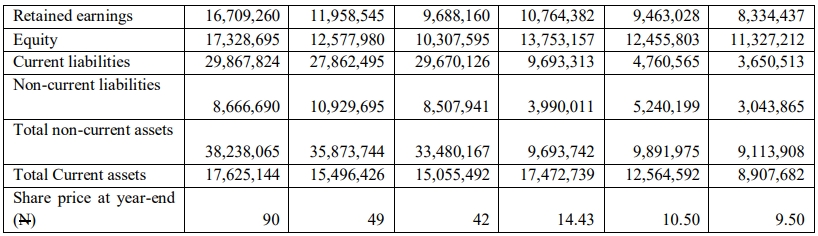

Real Expansion Plc is a large group that seeks to grow by acquisition. The directors have identified two potential entities and obtained copies of their financial statements. The accountant of the company computed key ratios to evaluate the performance of these companies relating to:

- Profitability and returns;

- Efficiency in the use of assets;

- Corporate leverage; and

- Investor-based decisions.

The computation generated hot arguments among the directors, and they decided to engage a Consultant to provide expert advice on which company to acquire.

Extracts from these financial statements are given below:

Required:

(a) As the Consultant to the company, carry out a financial analysis on the financial statements and advise the company appropriately. (15 Marks)

(b) State the major limitations of ratio analysis for performance evaluation. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Efficiency, Financial Ratios, Investor decision, Leverage, Performance Evaluation, Profitability

- Level: Level 3