- 20 Marks

PM – Nov 2024 – L2 – Q2 – Cost Management Strategies

Evaluation of Ope-Olu Limited's inventory holding cost and the impact of switching to a JIT production system.

Question

Ope-Olu Limited produces and sells household items. For a particular product, the marketing department has prepared the following quarterly expected demand for next year:

| Quarter | Expected Demand (Units) |

|---|---|

| 1 | 400,000 |

| 2 | 440,000 |

| 3 | 760,000 |

| 4 | 560,000 |

The existing production facility can only produce 540,000 units per quarter under regular time. However, it is possible to increase output by 40% if working overtime is introduced.

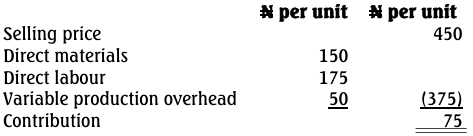

It is the policy of the company to manufacture units using a constant level of production system. This means that although the opening and closing levels of inventory for the year are zero units, there are increases and decreases in the quarterly inventory levels. Based on this policy, the unit selling price, variable production costs, and contribution for next year are expected to be as follows:

Additional Information:

- Overtime is paid at 150% of the normal rate, and the unit variable production overhead cost will increase by 25% for those units produced during overtime.

- The company incurs a holding cost (based on average inventory) of N25 per unit per quarter for each item that is held in inventory.

- The company is considering switching to a Just-in-Time (JIT) production system due to fluctuating sales demand.

Required:

a. Discuss generally, the key conditions that are necessary for the successful implementation of a JIT manufacturing system. (7 Marks)

b. Calculate the cost of holding inventory for each of the quarters and the year in total under the current production system. (6 Marks)

c. Calculate the financial impact of changing to a JIT production system. (7 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cost Analysis, Demand forecast, Inventory Holding, JIT, Overtime Production

- Level: Level 2

- Topic: Cost Management Strategies