- 15 Marks

CR – Nov 2024 – L3 – Q4a – Corporate Reconstruction

Prepare the capital reduction account and the statement of financial position for Mensimah Ltd after reconstruction.

Question

Mensimah LTD (Mensimah) has been experiencing poor trading conditions over the last three years. As a result, it has been difficult to generate revenues and profits in the current year leading to very high inventory levels. Also, Mensimah has defaulted in paying interest due to the loan note holders for two years. Even though the debentures are secured against the land & buildings, the loan note holders have demanded either a scheme of reconstruction or the liquidation of Mensimah.

As the above trading difficulties have significantly threatened the going concern status of Mensimah, the directors as well as representatives of the shareholders and loan holders in a meeting decided to design the following scheme of reconstruction:

-

The assets were independently valued and should now be recognised at the following amounts:

Asset Category Amount (GH¢) Land 64,000 Building 64,000 Plant & Equipment 24,000 Inventory 40,000 The value of Mensimah’s investment in Adams LTD has increased to GH¢48,000 and was to be sold as part of the reconstruction scheme. As for the trade receivables, it was determined that 10% of the stated value is non-recoverable and therefore would be written off.

-

Each GH¢1 equity share is to be redesignated as an equity share of GH¢0.25. After this, the equity shareholders would be persuaded to accept a reduction in the nominal value of their shares from GH¢1 to GH¢0.25 per share and subscribe for a new issue based on one-for-one at a price of GH¢0.30 per share.

-

The existing 5% loan notes are to be exchanged for a new issue of GH¢28,000 9.5% loan notes, repayable in 2028, plus 112,000 equity shares of GH¢0.25 each. In addition, they will subscribe for GH¢7,200 loan notes, repayable in 2028, at par value at the rate of 9.5%.

The 8% loan notes holders who have not received any interest for the past two years, are to receive 16,000 equity shares of GH¢0.25 each in lieu of the interest payable. It is agreed that the value of the interest liability is equivalent to the fair value of the shares to be issued. Moreover, the 8% loan notes holders have agreed to defer repayment of their loan until 2028, on condition that they are paid a higher interest rate of 9.5%.

-

The deficit on retained earnings is to be written off and the bank overdraft is to be repaid immediately.

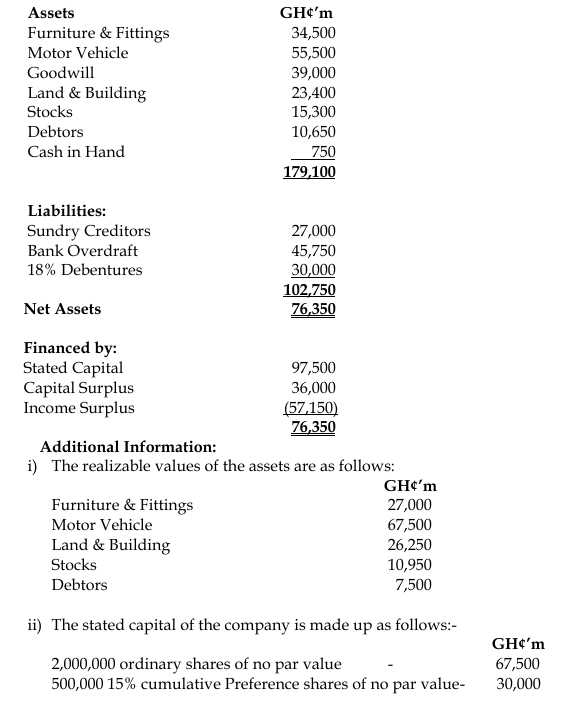

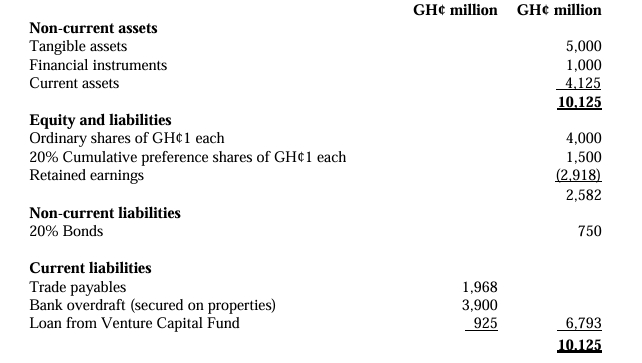

Mensimah’s statement of financial position as at 31 December 2023 is as follows:

| Assets | GH¢’000 |

|---|---|

| Non-current assets | |

| Land & buildings | 154,597 |

| Plant & equipment | 48,603 |

| Investment in Adams LTD | 21,600 |

| Total Non-Current Assets | 224,800 |

| Current assets | |

| Inventory | 96,198 |

| Receivables | 56,554 |

| Total Current Assets | 152,752 |

| Total Assets | 377,552 |

| Equity & Liabilities | GH¢’000 |

|---|---|

| Equity | |

| Equity shares (GH¢1) | 160,000 |

| Retained earnings | (31,857) |

| Total Equity | 128,143 |

| Non-current liabilities | |

| 8% loan notes | 64,000 |

| 5% loan notes | 56,000 |

| Total Non-Current Liabilities | 120,000 |

| Current liabilities | |

| Trade payables | 89,798 |

| Interest payable | 10,240 |

| Overdraft | 29,371 |

| Total Current Liabilities | 129,409 |

| Total Equity & Liabilities | 377,552 |

Required:

i) Prepare the capital reduction account for Mensimah LTD.

ii) Prepare the statement of Financial Position of Mensimah LTD immediately after the reconstruction.

iii) Determine the position of each stakeholder group if the reconstruction scheme is not implemented.

Find Related Questions by Tags, levels, etc.

- Tags: Capital Reduction, Equity restructuring, Financial Statements, Loan Notes

- Level: Level 3

- Topic: Corporate reconstruction and reorganisation

- Series: Nov 2024