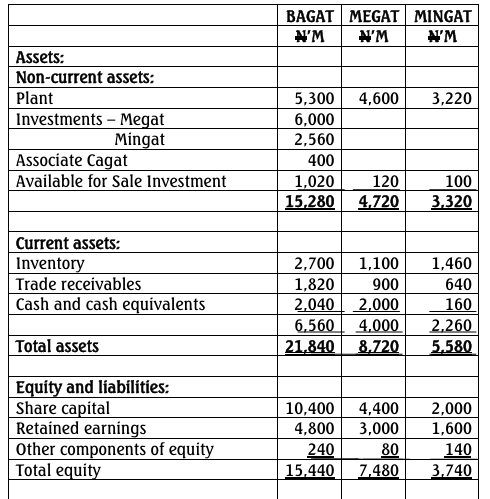

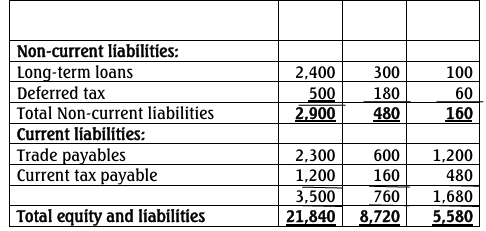

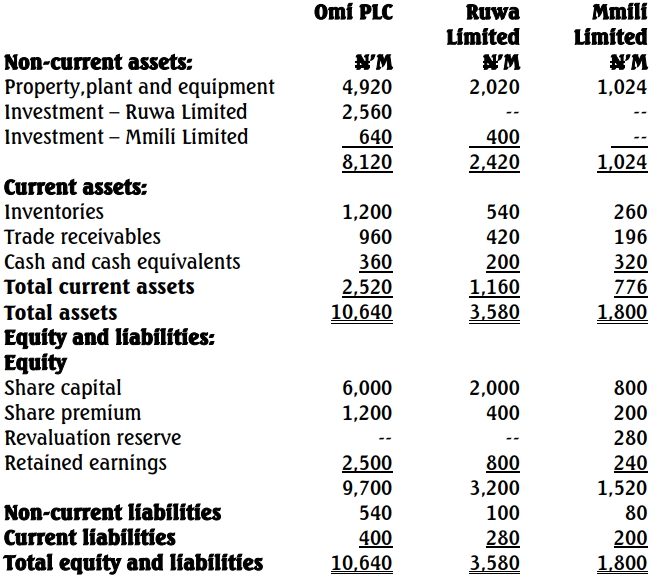

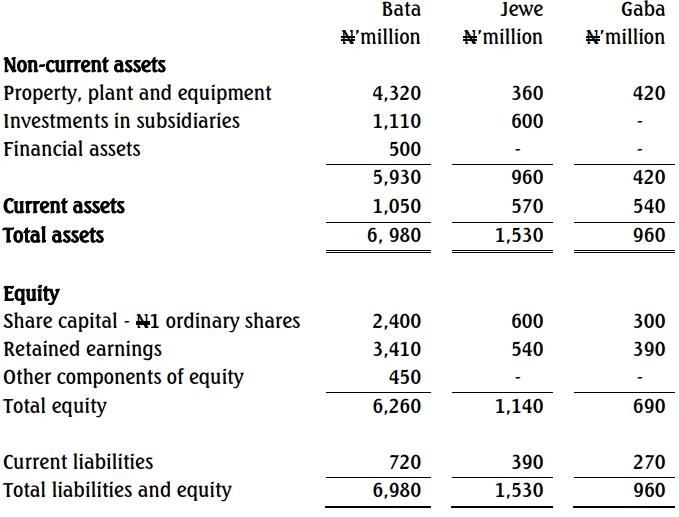

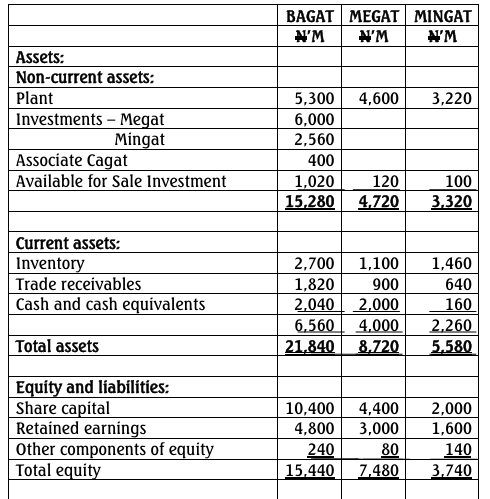

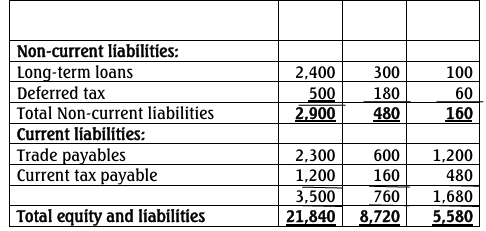

Bagat Plc has two subsidiaries (Megat and Mingat) and one associate (Cagat). Since the adoption of IFRS by Government Bagat has been preparing its consolidated financial statements in accordance with the principles of International Financial Reporting Standards (IFRS). The draft Statements of Financial Position of Bagat and its two subsidiaries as at 31 May 2013 are as follows:

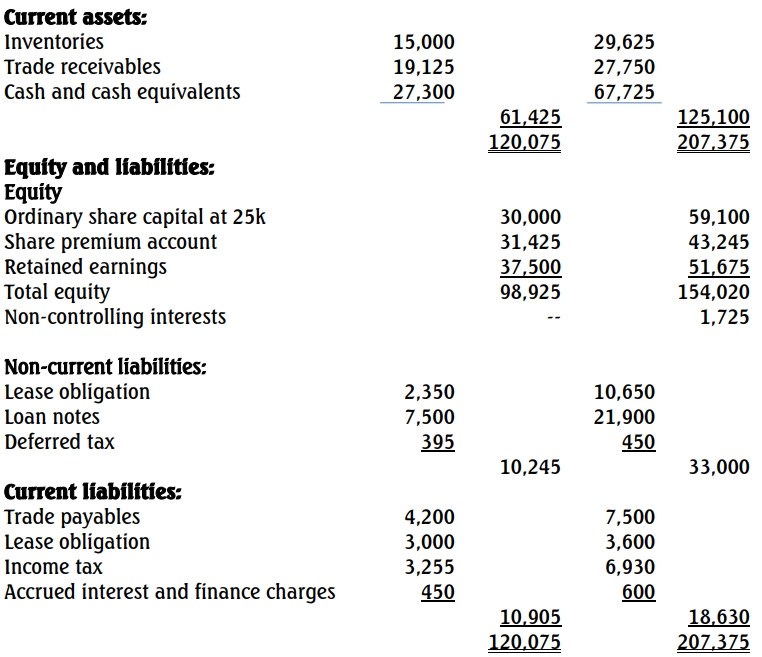

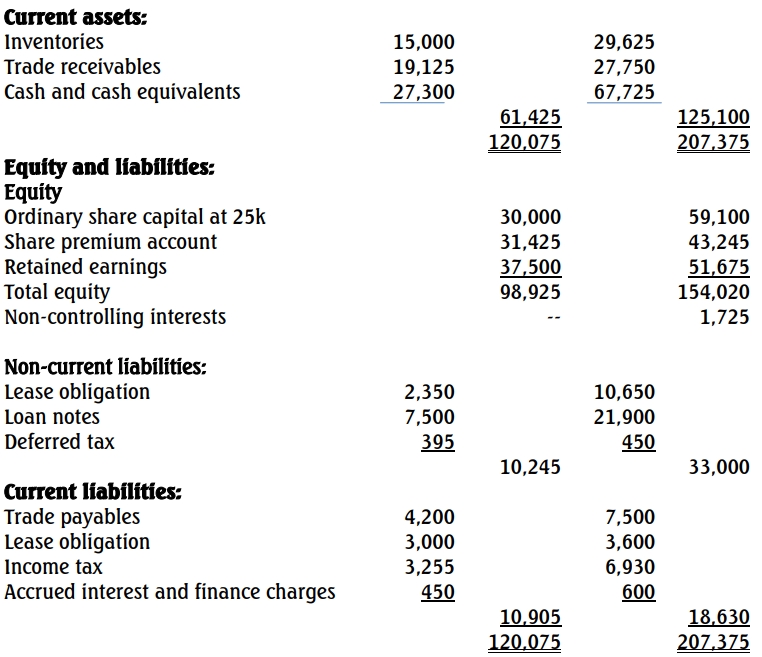

Draft Statements of Financial Position as at 31 May 2013

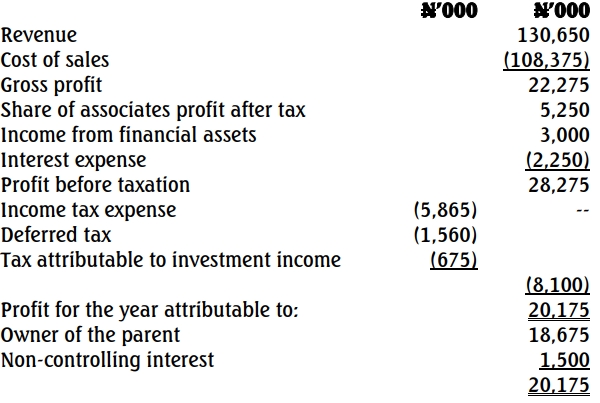

The following information is relevant to the preparation of the group financial statements:

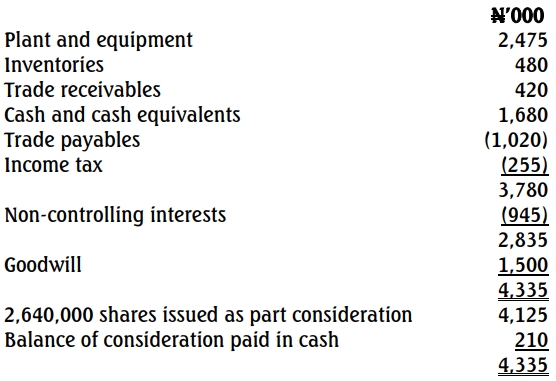

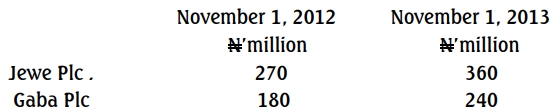

i. On 1 June, 2012, Bagat acquired 80% of the equity interest of Megat Plc. On the date of acquisition, the retained earnings of Megat were N2.72 billion and other components of equity were N80 million. There had been no new issue of capital by Megat since the date of acquisition. The purchase consideration comprised cash of N6 billion whereas the fair value of the identifiable net assets of Megat on this date was N8 billion. The excess of the fair value of the net assets is due to an increase in the value of non-depreciable land. An independent valuer has stated that the fair value of the non-controlling interests in Megat was N1.72 billion on 1 June, 2012. It is the policy of Bagat to measure non-controlling interests on the basis of their proportionate share in the identifiable net assets of the acquired subsidiary and not at fair value (full goodwill method).

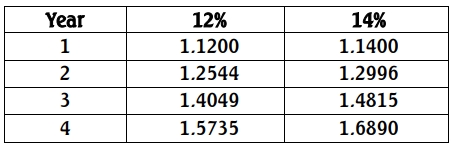

ii. Also on 1 June, 2012, Bagat acquired 70% of the ordinary shares of Mingat. The consideration for the acquisition of these shares was N2.56 billion. Under the purchase agreement of 1 June, 2012, Bagat is required to pay the former shareholders of Mingat 30% of the profits of Mingat on 31 May, 2014 for each of the financial years to 31 May, 2013 and 31 May, 2014. The fair value of this arrangement was estimated at N120 million at 1 June, 2012, and this value has not changed. This amount has not been included in the financial statements. The fair value of the identifiable net assets at 1 June, 2012 of Mingat was N3.52 billion and the retained earnings and other components of equity were N1.1 billion and N140 million respectively. There had been no new issue of share capital by Mingat since the date of acquisition and the excess of the fair value of the net assets is due to an increase in the value of property, plant, and equipment (PPE). The fair value of the non-controlling interests in Mingat was N1.06 billion on this date. PPE is depreciated on a straight-line basis over seven years.

iii. Finally, Bagat acquired a 25% interest in Cagat Plc on 1 June, 2012 for N400 million achieving significant influence over that company in its financial and operating policy decisions. Cagat Plc retained earnings for the year to 31 May, 2013 was N200 million.

iv. Included in trade receivables of Bagat at 31 May, 2013 is a receivable from Megat of N30 million. Unknown to Bagat, Megat has paid this amount through a bank transfer by the close of work on 31 May, 2013, but it had not yet been reflected in the bank statement of Bagat. Megat has already passed accounting entries to reflect this transaction.

v. Goodwill arising on the purchase of Mingat was tested for impairment on 31 May, 2013, and this provided evidence of impairment to the tune of N36 million. No accounting entries have been passed to reflect the impairment.

Required:

Prepare a consolidated statement of financial position as at 31 May, 2013 for the Bagat Group. (30 Marks)