- 20 Marks

MA – March 2023 – L2 – Q5 – Cost-volume-profit (CVP) analysis

Prepare a profit statement based on demand and propose an optimal production plan considering resource limitations and price adjustments.

Question

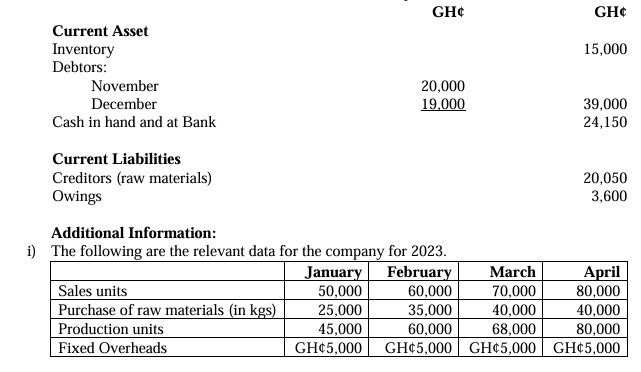

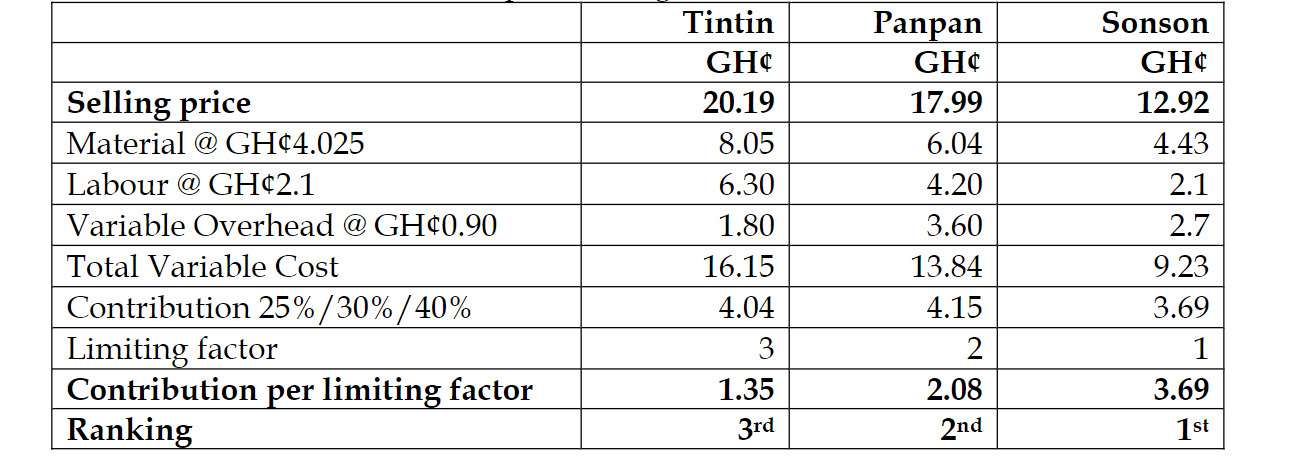

The following data relates to the planned activity of three products of Parlour Plc:

The following data relates to the planned activity of three products of Parlour Plc:

Demand (units):

Tintin: 15,000

Panpan: 10,000

Sonson: 12,500

i) Due to the general rise in prices, the company envisages that labour and variable production overhead costs will rise by 20% while material costs increase by 15%. It is the policy of the firm to maintain at all times the current mark-up (to the nearest whole number) on the total variable cost for each of the three products.

ii) The following resources are available to support the production:

Material: 60,000kgs

Labour hours: 65,000 hours

iii) The three products are complements, and the company envisages that 50% of the demand for all products has to be met for any operating year.

iv) The annual fixed cost, which will not be affected by the price adjustment, is estimated at GH¢42,500.

Required:

a) Prepare a profit statement assuming the company has capacity to meet all demand and considering the needed adjustments to reflect the proposed price changes. (8 marks)

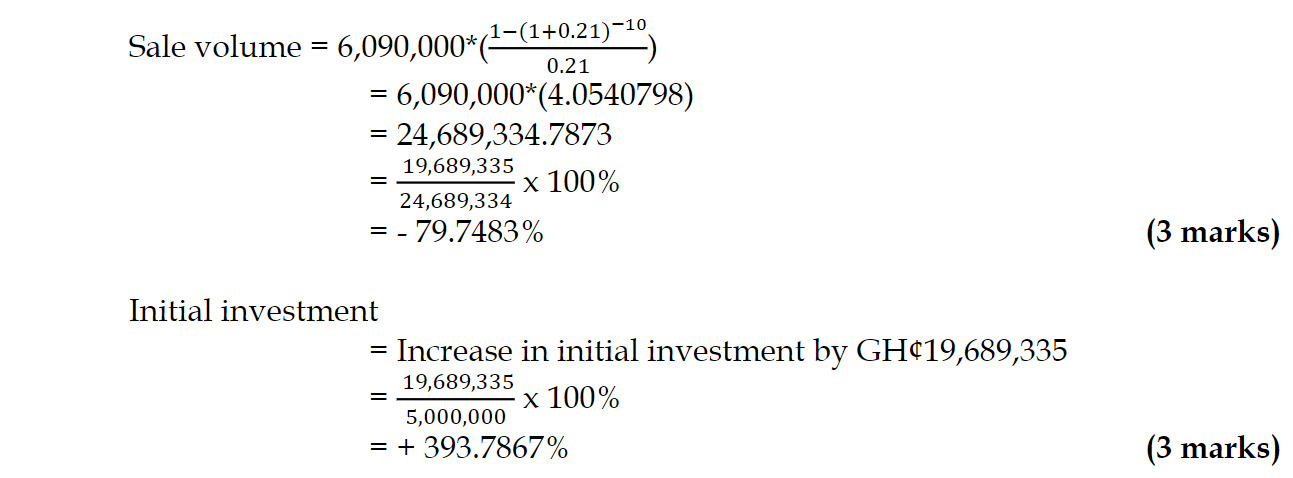

b) Based on the resource limitation and proposed adjustment, what should be the optimal production plan? (10 marks)

c) Determine the associated profit from the optimal production plan. (2 marks)

Find Related Questions by Tags, levels, etc.

- Topic: Cash Budgets and Master Budgets, Decision making techniques

- Series: MAR 2023