- 20 Marks

CR – May 2020 – L3 – Q1 – Consolidated Statement of Financial Position

Prepare the consolidated statement of financial position for Phato Ltd and its subsidiaries as at 30 September 2019, including relevant calculations for goodwill, non-controlling interest, and asset impairments.

Question

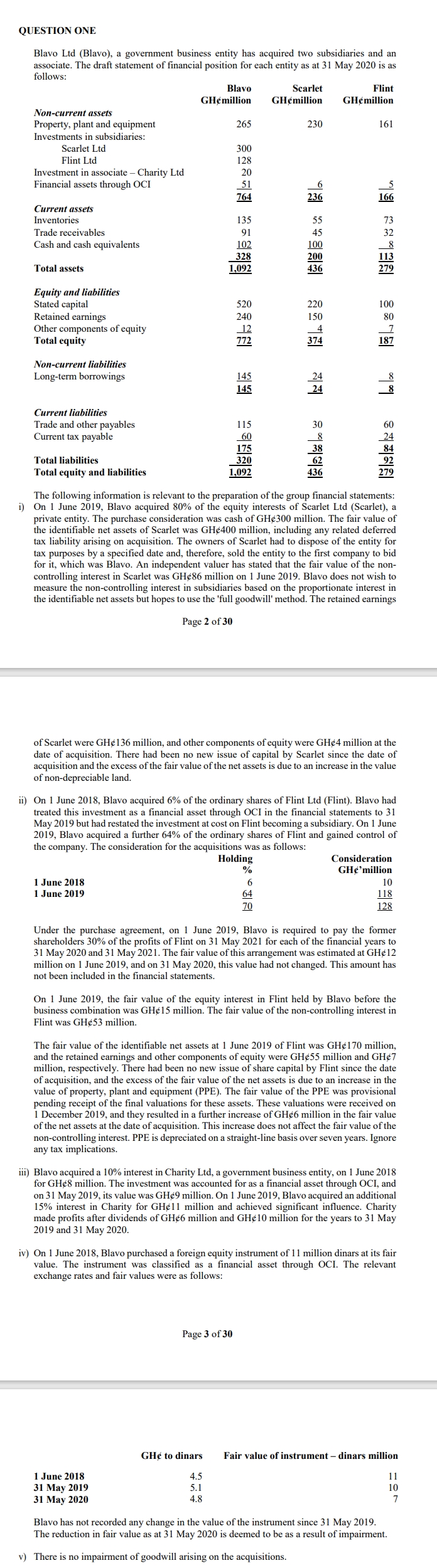

Phato Ltd, is a Public Limited Liability Company which operates in the service sector in Ghana. Phato Ltd has a business relationship with two other Ghanaian companies, Sakara Ltd and Saadi Ltd, which are public limited liability companies too. The draft statements of financial position of these three companies are as below as at 30 September 2019.

| Phato Ltd GH¢ million | Sakara Ltd GH¢ million | Saadi Ltd GH¢ million |

|---|---|---|

| Assets: | ||

| Non-current assets | ||

| Property, plant, and equipment | 460.0 | 150.0 |

| Investment in subsidiaries | ||

| Sakara Ltd | 365.0 | |

| Saadi Ltd | 160.0 | |

| Investment in Azuri Ltd | 24.0 | |

| Intangible assets | 99.0 | 15.0 |

| Total Non-current assets | 948.0 | 325.0 |

| Current assets | 447.5 | 240.0 |

| Total assets | 1,395.5 | 565.0 |

| Equity and liabilities: | ||

| Equity: | ||

| Share capital | 460.0 | 200.0 |

| Other components of equity | 36.5 | 18.5 |

| Retained earnings | 447.5 | 221.0 |

| Total equity | 944.0 | 439.5 |

| Non-current liabilities | 247.5 | 61.5 |

| Current liabilities | 204.0 | 64.0 |

| Total liabilities | 451.5 | 125.5 |

| Total equity and liabilities | 1,395.5 | 565.0 |

Additional relevant information:

- Phato Ltd, on 1 October 2017, acquired 60% of the equity interests of Sakara Ltd. The cost of the investment comprised cash of GH¢360 million. At acquisition, the fair value of the non-controlling interest in Sakara Ltd was estimated at GH¢146 million. The fair value of the identifiable net assets acquired totaled GH¢417.5 million, including retained earnings of GH¢159.5 million and other components of equity at GH¢13.5 million. The excess in fair value results from non-depreciable land.

- Sakara Ltd, on 1 October 2018, acquired 70% of Saadi Ltd for GH¢160 million. The fair value of non-controlling interest was estimated at GH¢36 million. The fair value of the identifiable net assets of Saadi Ltd at acquisition was GH¢181 million, retained earnings GH¢53 million, and other components of equity GH¢10 million.

- Phato Ltd acquired a 14% interest in Azuri Ltd for GH¢9 million on 1 October 2017. On 1 April 2019, Phato Ltd acquired an additional 16% interest in Azuri Ltd for GH¢13.5 million, achieving significant influence.

- Phato Ltd purchased patents for GH¢5 million and incurred other development costs for product development.

- Impairment tests were conducted on Sakara Ltd and Saadi Ltd.

Required:

Prepare the consolidated statement of financial position for the Phato Ltd Group as at 30 September 2019.

Find Related Questions by Tags, levels, etc.

- Tags: Business Combinations, Consolidation, Goodwill, IFRS, Impairment, Investment

- Level: Level 3