- 1 Marks

FA – Nov 2011 – L1 – SA – Q16 – Bases of Accounting: Accrual vs. Cash

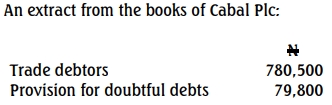

This question asks for the trade debtor's balance to be shown in the balance sheet after making a 5% provision for doubtful debts.

Find Related Questions by Tags, levels, etc.

- Tags: Provision for Doubtful Debts, Trade Debtors

- Level: Level 1

- Topic: Bases of Accounting: Accrual vs. Cash

- Series: NOV 2011