- 1 Marks

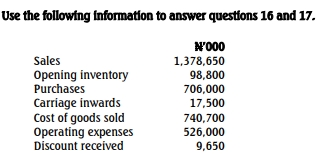

FA – May 2022 – L1 – SA – Q17 – Accounting for Inventories in Accordance with IAS 2

Calculate the closing inventory for the period using sales, purchases, and other cost data.

Find Related Questions by Tags, levels, etc.

- Tags: Closing Inventory, Financial Reporting, Inventory

- Level: Level 1

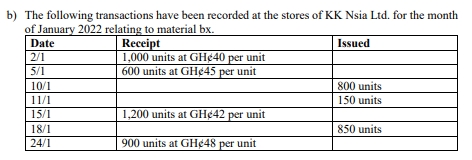

- Topic: Accounting for Inventory and Labour

- Series: MAY 2022