- 20 Marks

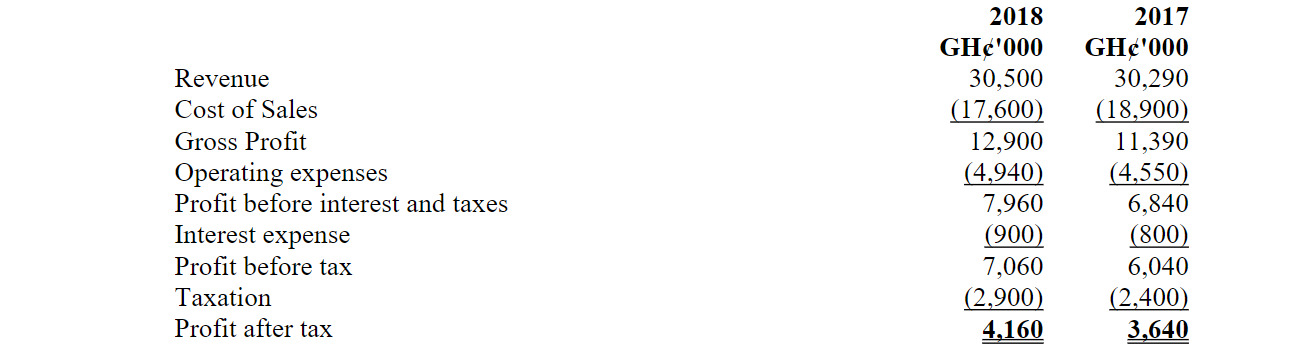

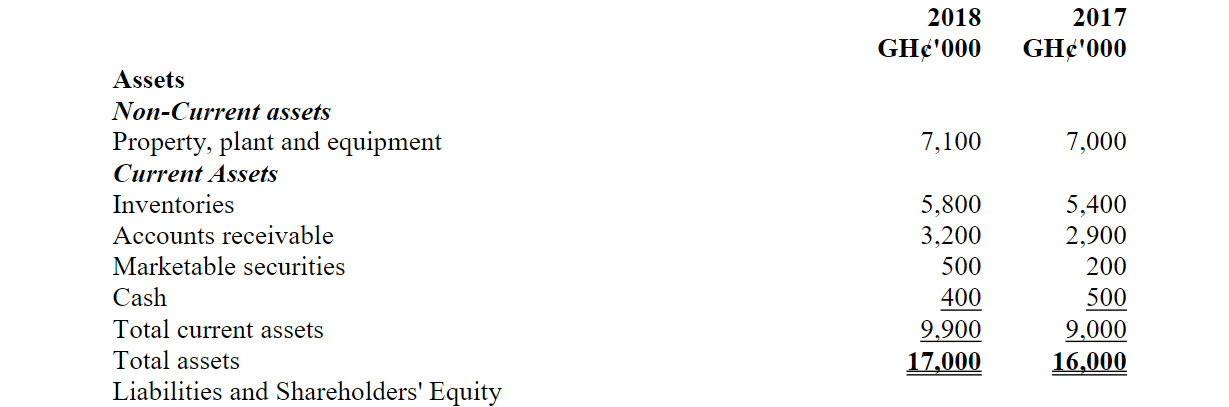

PM – Mar/Jul 2020 – L1 – SB – Q2 – Budgetary Process and Behavioural Problems for Toby Nigeria

Discussion on budgeting and behavioral issues at Toby Nigeria Limited and redrafting of a budget statement.

Question

Toby Nigeria Limited is a publishing company established in the early 1970s. The company has recently been taken over by Superior Quality Limited – a multinational company operating in Europe.

Mr. Edet Akpan, a staff of Superior Quality Limited, has been sent from the company’s headquarters to review, among other things, the budgeting and reporting system used by Toby Nigeria Limited.

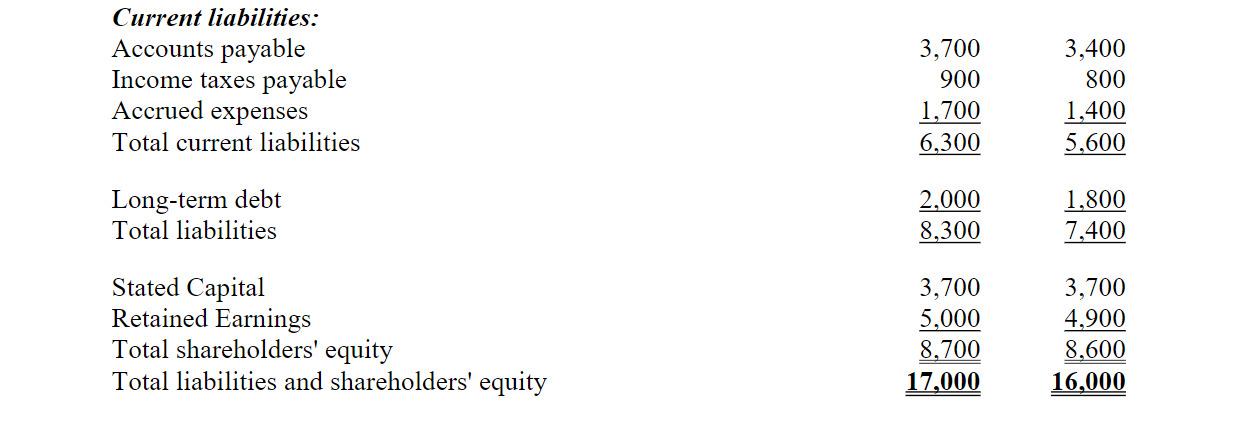

During his visit to all the departments, he discovered that monthly budgets are prepared for each department in the company. Upon request, the last budget statement for the School Stationery Production Department (SSP) for period V was presented to him.

The budget statement presented was as follows:

Budget statement for period V

Department: SSP Department

Mr Tola Ademola, the School Stationery Manager, revealed that the budget statement presented was based on 40,000 units with a standard labour content of 3 hours per unit.

Mr. Akpan observed that Tola was not in any way enthusiastic about the budget system. He saw it as a pressure system imposed by the company’s top management to indict some of the managers. He pointed out that the system was hurriedly introduced by High Flyer Consults, about twelve months ago. The consultant never took time to talk to the managers or provide explanation that

could assist users to understand the system. The experienced School Stationery Manager was doubtful about the competence of the consultant. He was of the

opinion that the system introduced in Toby Nigeria Limited was either a ready-made one developed for another company or that the consultant did not understand the system well enough to give him the needed confidence to educate the users. He concluded by stating that he was sure his department made a loss as

against the positive figure recorded in the report and there was the possibility of reporting a loss at another period when profit was actually made. The situation reported above cuts across virtually all the departments and so the need to nip the situation in the bud became very urgent.

The task of making budgeting system more useful and acceptable in a biased environment like this, no doubt, seems difficult therefore, Mr. Akpan has requested from you an advice that will assist him in getting out of the woods.

Required:

a. Redraft the budget statement in a more informative manner. (12 Marks)

b. Discuss the behavioral problems brought out in this situation. (4 Marks)

c. Discuss the steps Mr. Akpan should take to remedy the situation. (4 Marks)

Find Related Questions by Tags, levels, etc.