Adrac Community School was founded by Adrac Community Resident Association of

Garki, Abuja, Nigeria. The school is being supervised by a board of governors made up

of selected experienced members of the community. The school is not allowed to charge

the pupils any fee as it is a community project donated to assist members of the

community.

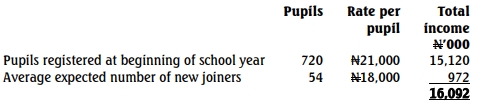

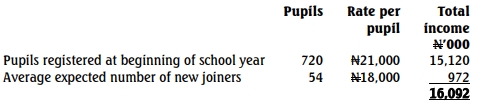

Adrac Community Residents Association pays the school ₦21,000 for each child

registered at the beginning of the school year, which is September 1, and ₦18,000 for

any child joining the school part-way through the year. The school does not have to

refund the money to the association if a child leaves the school part-way through the

year. The number of pupils registered at the school on September 1, 2019 is 720, which

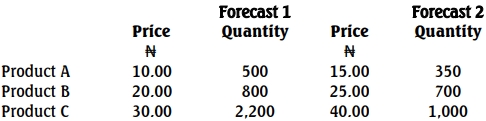

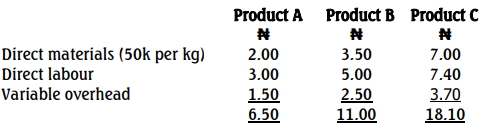

is 10% lower than the previous year. Based on past experience, the probabilities for the

number of pupils starting the school part-way through the year is as follows:

The school‟s headmistress normally prepares annual budget for consideration of the

board of governors. Since she is not too comfortable with figures, she does not

understand how to use the probability distribution provided for her annual budget.

Therefore, she just used simple average for her calculation of number of pupils expected

to join late. The revenue budget for 2019/2020 submitted by the headmistress is as

follows:

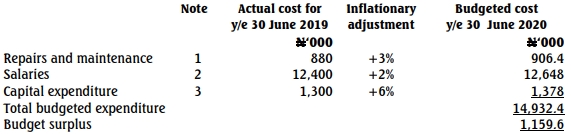

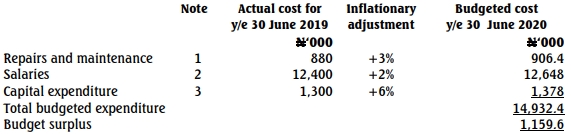

The headmistress uses incremental budgeting to budget for her expenditure, taking

actual expenditure for the previous year as a starting point and simply adjusting it for

inflation, as shown below

Notes

i. N600,000 of the costs for the year ended 30 June 2019 related to standard

maintenance checks and repairs that have to be carried out by the school every

year in order to comply with the local government health and safety standards.

These are expected to increase by 3% in the coming year. In the year ended 30

June 2019, N280,000 was also spent on redecorating some of the classrooms. There will be no redecoration in the coming year.

ii. One teacher earning a salary of N520,000 left the school on 30 June 2019 and

there are no plans to replace her. However, a 2% pay rise will be given to all staff

with effect from 1 December 2019.

iii. The full N1,300,000 actual costs for the year ended 30 June 2019 related to

improvements made to the school building. This year, the canteen is going to be

substantially improved, although the extent of the improvements and level of

service to be offered to pupils is still under discussion. There is a 0·7 probability

that the cost will be N1,450,000 and a 0·3 probability that it will be N800,000.

These costs must be paid in full before the end of the year ending 30 June 2020.

The school‟s board of governors, who review the budget, are concerned that the budget

surplus has been calculated incorrectly. They believe that it should have been calculated

using expected income, based on the probabilities provided, and using expected expenditure, based on the information provided in notes i to iii. They believe that incremental budgeting is not a reliable tool for budget setting in the school since, for

the last three years, there have been shortfalls of cash despite a budget surplus being

predicted. Since the school has no other source of funding available to it, these

shortfalls have had serious consequences, such as the closure of the school kitchen for a considerable period in the last school year, meaning that no meals were available to pupils. This is thought to have been the cause of the 10% fall in the number of pupils registered at the school on 1 September 2019.

Required:

a. Redraft the school’s budget for the year ending June 30, 2020, per the board’s recommendations. (6 Marks)

b. Discuss the advantages and disadvantages of using incremental budgeting. (4 Marks)

c. Describe the three main steps in preparing a zero-based budget. (6 Marks)

d. Discuss the extent to which zero-based budgeting could improve the budgeting process for Adrac Community School. (4 Marks)