- 20 Marks

Question

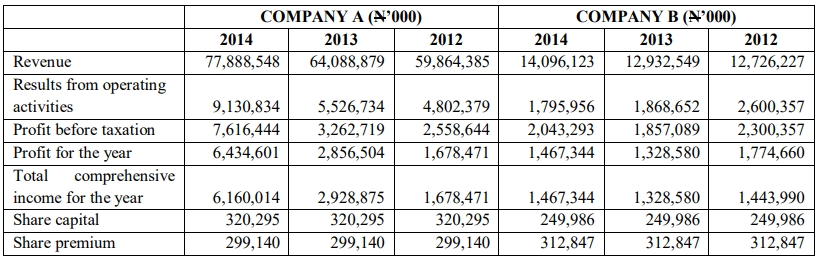

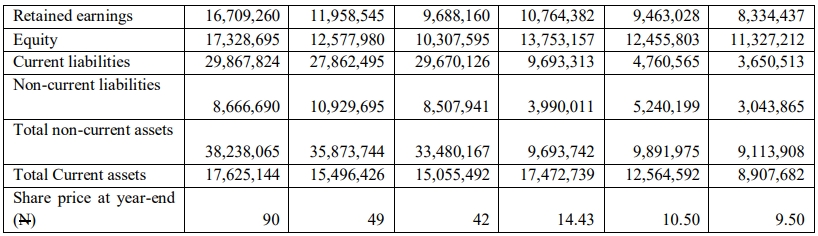

Real Expansion Plc is a large group that seeks to grow by acquisition. The directors have identified two potential entities and obtained copies of their financial statements. The accountant of the company computed key ratios to evaluate the performance of these companies relating to:

- Profitability and returns;

- Efficiency in the use of assets;

- Corporate leverage; and

- Investor-based decisions.

The computation generated hot arguments among the directors, and they decided to engage a Consultant to provide expert advice on which company to acquire.

Extracts from these financial statements are given below:

Required:

(a) As the Consultant to the company, carry out a financial analysis on the financial statements and advise the company appropriately. (15 Marks)

(b) State the major limitations of ratio analysis for performance evaluation. (5 Marks)

Answer

LIMITATIONS OF RATIO FOR FINANCIAL ANALYSIS

Traditional ratio analysis is becoming outdated because of a number of draw- backs identified with ratio analysis which include:

(i) Absence of valid universal definition of standard ratios

(ii) Dual meanings and implications of some ratios. This fact calls for the need for further enquiries or investigations before coming to conclusions when using ratios for financial analysis. Difference in meaning of certain terms e.g. profit (gross, net, before taxation or after taxation etc) assets (tangible or intangible), should preference share be part of debt?

(iii) Incomparable financial statements in the face of different accounting policies, degrees of diversification and other policies.

(iv) Impact of seasonality on accounting figures may render ratios based on those figures unreliable for comparative analysis.

(v) Management can easily manipulate accounting figures. Financial ratios are not very useful when viewed in isolation.

(vi) Accounting figures and valuations are affected by changes in price level resulting from inflation, hence ratios based on amalgam of currency values are not very reliable. Also changes in technology and environment affects accounting figures.

(vii) Information in annual report is in summary form and may be inadequate or unsuitable when detail analysis is needed.

(viii) Accounting information presented in annual report is historic, suffer short-term changes hence of little value for future decisions or predicting the future.

- Tags: Efficiency, Financial Ratios, Investor decision, Leverage, Performance Evaluation, Profitability

- Level: Level 3

- Uploader: Kofi