- 20 Marks

Question

The following transactions relate to Alilerimba Limited:

- Convertible Bonds

- On July 1, 2011, Alilerimba Limited issued 400,000 convertible bonds with a 3-year tenure and a total fair value of N4 million, which is also the par value.

- The bonds carried an interest rate of 16% per annum, payable annually in arrears, while similar bonds without the conversion option carried an interest rate of 19% per annum on the same date.

- The company incurred 10% issue costs. If the investors did not convert to shares, the bonds would have been redeemed at par.

- At maturity (June 30, 2014), all bonds were converted into 1 million ordinary shares with a nominal value of N4 per share. No conversions were allowed before maturity.

- The directors are uncertain how to account for the bonds up to the date of conversion. They were informed that the effective interest rate, considering issue costs, was 24%.

- Revenue Recognition for Handsets

- Alilerimba purchases handsets at N120,000 each and sells them to customers at N90,000, provided the customers also purchase prepaid credit cards.

- Prepaid credit cards are sold for N12,600 each and expire after six months. The average unused credit per card at expiry is N1,800.

- Selling costs for the handsets are estimated at N600 per unit.

- Alilerimba also sells handsets to dealers for N50,000 each, invoicing them for this amount. Dealers are allowed to return the handsets until a service contract is signed by a customer. When a service contract is signed, the handset is given to the customer free of charge.

- Dealers receive a commission of N168,000 per customer connection. Net of the handset cost (N90,000), Alilerimba pays N78,000 to dealers for each customer connection.

- Handsets cannot be sold separately by dealers, and the service contract has a 12-month duration. Dealers do not sell prepaid phones, and Alilerimba earns monthly revenue from the service contracts.

- The Chief Operating Officer, a non-accountant, has requested an explanation of the accounting principles and practices to apply for handset purchases and revenue recognition.

- Preference Shares

- Alilerimba Limited issued 8% preference shares with a redemption feature that entitles holders to receive cash.

Required:

Advise the directors of Alilerimba Limited on:

(a) The accounting treatment for the convertible bonds. (12 Marks)

(b) The accounting principles and practices to apply for the purchase of handsets and recognition of revenue from customers and dealers. (6 Marks)

(c) The provisions of IAS 32 regarding the presentation in financial statements of financial instruments entitling holders to receive cash with a redemption feature. (2 Marks)

(Total: 20 Marks)

Answer

(i) ALILERIMBA LIMITED

CONVERTIBLE BOND

Some compound instruments have both a liability and an equity component from the issuer’s perspective.

In this case, IAS 32 (Financial Instruments Presentation) requires that the component parts be accounted for and presented separately according to their substance based on the definitions of liabilities and equity.

The split is made at issuance and not revised for subsequent changes in market interest rates, share prices, or other events that change the likelihood that the conversion option will be exercised.

A convertible bond contains two components. One is a financial liability, namely the issuer’s contractual obligation to pay cash in the form of capital, and the other is an equity instrument, which is the holder’s option to convert into shares.

When the initial carrying amount of a compound financial instrument is required to be allocated to its equity and liability components, the equity component is assigned the residual amount after deducting from the fair value of the instrument as a whole, the amount separately determined for the liability component.

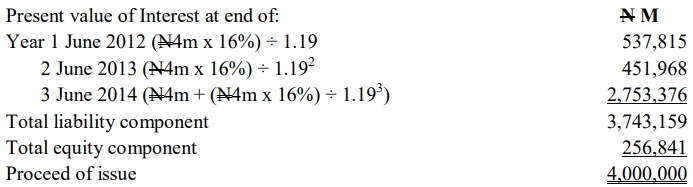

In the case of the bond, the liability element will be determined by discounting the future stream of cash flow which will be the interest to be paid and the financial capital balance assuming no conversion. The discount rate used will be 19% which is the market rate for

similar bonds without the conversion right.

The difference between cash received and the liability component is the value of the option.

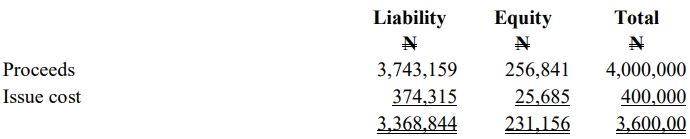

The issue cost will have to be allocated between the liability and equity components in proportion to the above proceeds.

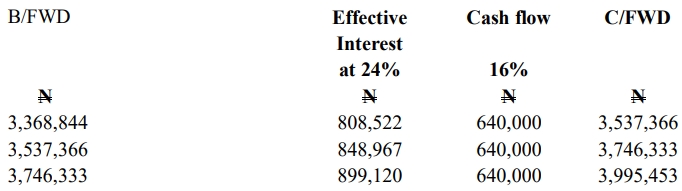

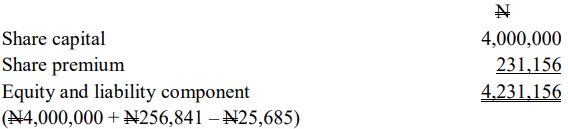

The credit to equity of N231,156 would not be re-measured. The liability component of N3,368,844 would be measured at amortised cost using the effective interest rate of 24%, as this spreads the issue costs over the tenure of the bond. The interest payments will reduce the liability at the year-end.

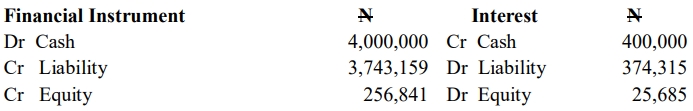

The initial entries would have been:

The liability component balance on 30 June 2014 becomes N4m as a result of the effective interest rate of 24% being applied and cash flows at 16% based on nominal value.

On conversion of the bond on 30 June 2014. ALILERIMBA Limited would issue 1 million ordinary shares of N4 each and the Original Equity Component together with the balance on the liability will become the consideration.

(ii) IAS 18 – ‘REVENUE’

IAS 18 requires the recognition of revenue by reference to the stage of completion of the transaction at the reporting date. Revenue associated with the provision of services should be recognised as the services are rendered.

ALILERIMBA Limited should record the receipt of N12,600 per credit card as deferred revenue at the point of sale.

Revenue of N10,800 (i.e., N12,600 – N1,800) should be recognised over the six months period from the date of sale.

The unused credit card value of N1,800 would be recognised when the credit card expires, as that is the point at which the obligation of ALILERIMBA Limited ceases.

Revenue is earned from the provision of services and not from the physical sale of credit cards.

IAS 18 does not deal in detail with agency arrangements but states that gross inflows of economic benefits include amounts collected on behalf of the principal, which do not result in increases in equity for the entity.

The amounts collected on behalf of the principal are not revenue. Revenue is the amount of the ‘commission.’

Additionally, where there are two or more transactions, they should be considered together if the commercial effect cannot be understood without reference to the series of transactions as a whole.

Consequently, the company should not recognise revenue when the handset is sold to the dealer, as the dealer is acting as an agent for the sale of the handset and the service contract.

The company has retained the risk of the loss in value of the handset, as the handsets can be returned by the dealer and the price set for the handset is under the control of the company.

The handset sale and the provision of the service would need to be assessed as to their separability. However, the handset cannot be sold separately and is commercially linked to the provision of the service.

The company would, therefore, recognise the net payment of N78,000 as a customer acquisition cost, which may qualify as an intangible asset under IAS 38, and the revenue from the service contract will be recognised as the service is rendered.

The intangible asset would be amortised over the 12-month contract.

The cost of the handset from the manufacturer will be charged as cost of goods sold (N120,000).

(iii) IAS 32 – Financial Instruments: Presentation

IAS 32 outlines two options for the classification of financial instruments:

- Recognise the financial liability as debt.

- Recognise the financial liability as equity.

IAS 32 states that when a financial instrument entitles the holder to receive cash or contains a redemption feature, such instruments are classified as debts.

This classification is based on the substance, not the legal form, as reflected in the financial statements.

A contractual obligation to deliver cash exists, and this obligation gives rise to a liability (debt).

When a financial instrument does not entitle the holder to receive cash or does not contain a redemption feature, these types of instruments are recognised as equity.

- Tags: Convertible Bonds, Financial instruments, IAS 18, IAS 32, Preference shares, Revenue Recognition

- Level: Level 3

- Uploader: Kofi