- 20 Marks

MI – Nov 2023 – L1 – SB – Q1 – Costing Methods

Create a stores ledger using the weighted average method based on given inventory transactions.

Question

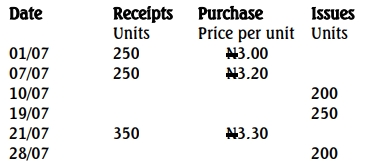

The stores data of ABC Limited for the month of July is as follows:

Required:

Prepare the store ledger account in tabular form using the weighted Average Price Method, showing daily balances as a memorandum on the table. Show workings

Find Related Questions by Tags, levels, etc.

- Tags: Cost Accounting, Inventory Management, Stores Ledger, Weighted Average Method

- Level: Level 1

- Topic: Costing Methods

- Series: NOV 2023