- 10 Marks

CR – Nov 2023 – L3 – Q3a – IFRS 16: Leases

Financial reporting treatment for a lease agreement, including CPI-based increases and variable lease payments for Avoka Grains Plantation.

Question

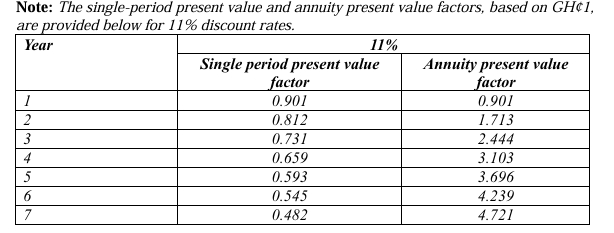

On 1 January 2022, Avoka Grains Plantation Plc (Avoka) acquired a combined harvester from Awulley Farm Technologies for a lease term of 5 years with instalments payable annually in advance. The useful life of the harvester was estimated at 5 years. Avoka paid the first instalment of GH¢60 million on 1 January 2022.

However, subsequent lease payments are subject to increase/decrease in line with the consumer price index (CPI). At the lease inception, Avoka estimated that CPI would increase by 10% annually. However, CPI increased by 14% in 2022, and consequently GH¢68.4 million was paid on 1 January 2023 as the second instalment. At 31 December 2022, Avoka estimated that the annual increase in CPI would continue to be 14% in future years.

Avoka is also required to pay a usage fee of GH¢0.3 per acre of harvest in excess of 30 million units per annum from the machine. At the lease inception, Avoka planned to use the harvester to achieve 40 million acres of harvest each year during the lease term. During 2022, Avoka harvested 40 million acres of grains and accordingly, an amount of GH¢3 million was also paid along with the second instalment. Avoka’s incremental borrowing rate is 11% per annum.

Required:

Advise Avoka Plc on the financial reporting treatment for the above in the financial statements for the year ended 31 December 2022.

(10 marks)

Find Related Questions by Tags, levels, etc.