- 15 Marks

TAX – May 2017 – L2 – SC – Q5 – Taxation of Trusts and Estates

Computation of assessable income for trust beneficiaries and net assessable income in the hands of the trustee.

Question

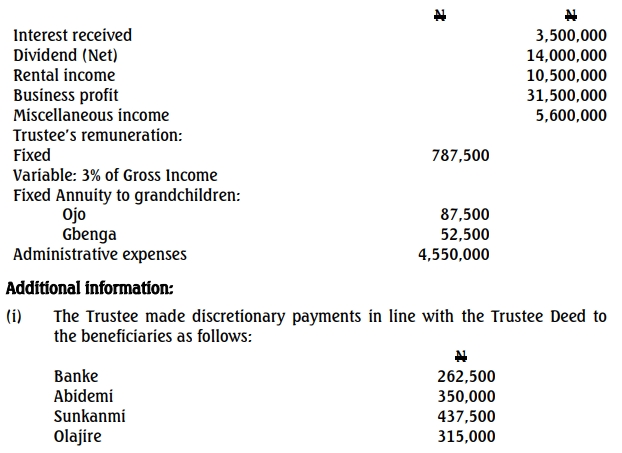

Alhaji Oluwambe is the trustee of a Settlement created by late Chief Jongbo in favor of his four children, grandchildren, and others. He submitted the following information to Okun State Board of Internal Revenue for assessment purposes for the fiscal year ended December 31, 2014:

ii. Each beneficiary is entitled to 1/6 share of 1/3 of the distributable income.

iii. Capital allowance agreed with the tax authority was N7,350,000.

Required:

a. Compute the assessable income in the hands of each beneficiary. (14 Marks)

b. Determine the Net Assessable Income in the hands of the Trustee. (1 Mark)

Find Related Questions by Tags, levels, etc.

- Tags: Assessable Income, Beneficiary Taxation, Trust Income, Trustee

- Level: Level 2

- Topic: Taxation of Trusts and Estates

- Series: MAY 2017