- 8 Marks

PSAF – Nov 2024 – L2 – Q1a – Financial Statements Preparation

Prepare the Statement of Financial Performance for Paja Teaching Hospital following IPSAS guidelines.

Question

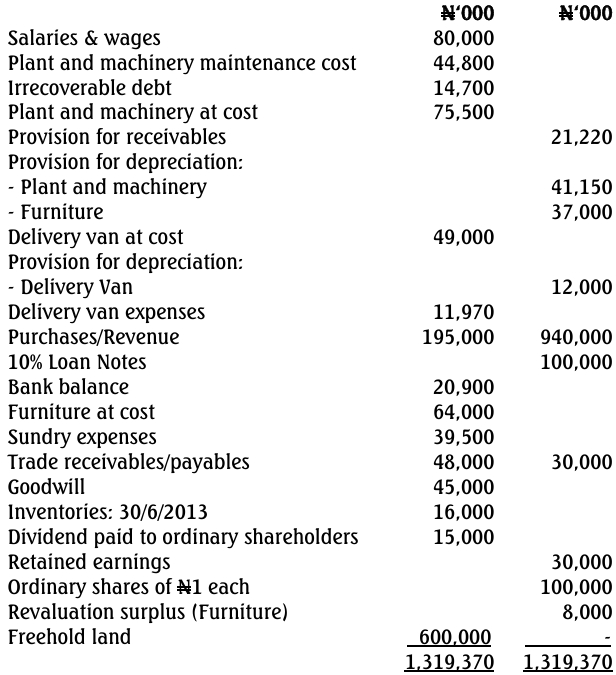

Below is a Trial Balance of Paja Teaching Hospital (PTH) under the Ministry of Health for the year ended 31 December 2023.

| Debit (GH¢000) | Credit (GH¢000) |

|---|---|

| Cash and Bank – GoG | 3,400 |

| Cash and Bank – IGF | 72,200 |

| Cash and Bank – Donor Funds | 210,400 |

| Undeposited Cash – IGF | 4,000 |

| Petty Cash | 100 |

| Investments | 2,000 |

| Debtors | 661,400 |

| Other Receivables | 17,700 |

| Withholding Tax | |

| Trust Funds | |

| Trade Payables | |

| GoG Subsidy – Employee Compensation | |

| GoG Subsidy – Goods & Services | |

| Development Partners Programmes Receipt | |

| Other Non-Operating Income | |

| Medicines & Pharmaceuticals | 433,900 |

| Surgical | 50,800 |

| Medical | 111,400 |

| Investigation | 140,900 |

| OPD | 238,400 |

| Obstetrics and Gynaecology | 135,300 |

| Dental | 8,300 |

| Pediatrics | 40,300 |

| Ear, Nose & Throat | 5,300 |

| Eye Care | 7,300 |

| Mortuary | 30,000 |

| Ambulance Fees | 300 |

| Ophthalmology | 3,000 |

| Physiotherapy | 3,300 |

| Examination Fees | 200 |

| Dialysis | 400 |

| Feeding | 30,400 |

| Employee Compensation – GoG | 3,912,500 |

| Goods & Services – GoG | 20,800 |

| Employee Compensation – IGF | 148,000 |

| Goods & Services – IGF | 978,500 |

| Capital Expenditure – IGF | 27,500 |

| Goods & Services – Partners Fund | 472,400 |

| Accumulated Fund | |

| Total | 6,530,900 |

Additional Information:

- The hospital previously used modified accrual accounting but switched to IPSAS accrual basis in 2023.

- The hospital revalued legacy assets as follows:

- Motor Vehicles: GH¢50,250,000

- Buildings: GH¢120,540,000

- Medical Equipment & Other Equipment: GH¢31,500,000

- Land: GH¢15,000,000

- Gavi supported the hospital with GH¢200,000,000 in 2023, but 20% was allocated for Q1 of 2024. The Global Fund committed GH¢250,000,000, but only GH¢200,000,000 was received.

- NHIA rejected 10% of the hospital’s total claims of GH¢100,300,000.

- Parliament approved a write-off of GH¢20,225,000 for unpaid hospital services.

- The capital expenditure consists of:

- Medical Equipment: GH¢19,236,000

- Furniture & Fittings: GH¢8,264,000

- Depreciation Policy (Straight-Line Basis):

- Building: 5%

- Motor Vehicle: 20%

- Medical Equipment: 10%

- Furniture & Fitting: 25%

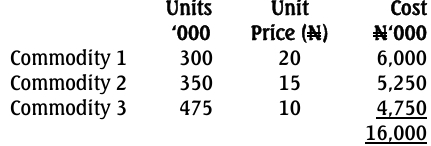

- Year-end inventory values:

| Inventory Type | Cost (GH¢000) | Replacement Cost (GH¢000) | Net Realisable Value (GH¢000) |

|---|---|---|---|

| Medicines (for resale) | 146,800 | 176,100 | 132,100 |

| Medical Consumables (For use on clients) | 29,400 | 33,800 | 30,800 |

| Office Consumables | 19,600 | 29,400 | 18,600 |

Required:

In compliance with IPSAS, the PFM Act, and the Government of Ghana Chart of Accounts, prepare:

a) A Statement of Financial Performance for Paja Teaching Hospital for the year ended 31 December 2023.

Find Related Questions by Tags, levels, etc.