- 30 Marks

TAX – May 2022 – L2 – SA – Q1 – The Nigerian Tax System

Discuss the tax filing obligations and implications of non-compliance for a new company, covering both corporate tax and VAT.

Question

Mr. Danko Chinyere, who has worked in a neighboring African country for many years, returned to Nigeria in August 2018. He incorporated a private limited liability company known as ChiDan Limited located in Lagos on October 30, 2018. The company deals in processing and packaging of plantain chips for local consumption.

The directors of the company opened a business bank account with one of the leading commercial banks in November 2018. The company commenced full operations on January 2, 2019.

Your firm, Adama & Co., was appointed as the tax consultant to ChiDan Limited in January 2021. At the first engagement meeting with the company, you discovered that the company was yet to register with the Federal Inland Revenue Service (FIRS). Relevant taxes, including value-added tax (VAT), were not remitted to FIRS.

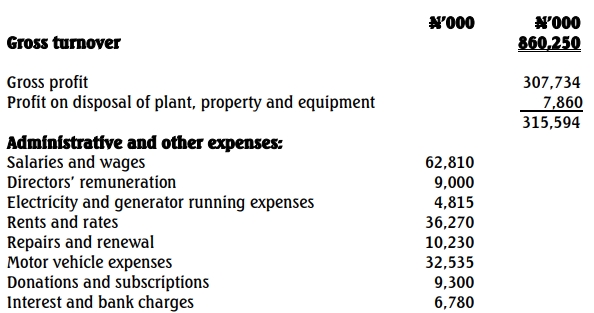

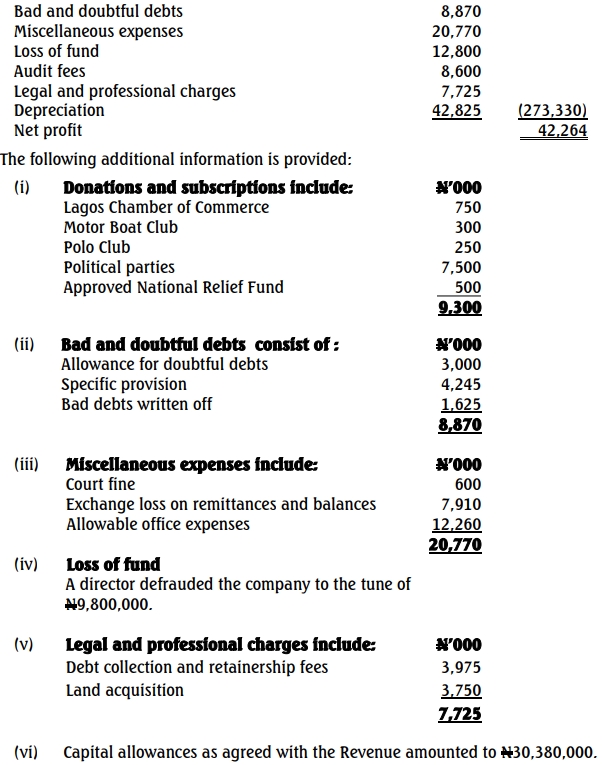

An extract of the company’s first set of financial statements made up to December 31, 2020, is as follows:

Required:

Advise management of the company on the following:

a. Due date for submission of audited financial statements to the tax office. (2 Marks)

b. Requirements for filing of VAT returns and remittance of VAT liabilities – Section 16 of VAT Act (as amended). (4 Marks)

c. Basis of assessment on commencement of business – Section 29 (3) of CITA

(as amended) (6 Marks)

d. The income tax liabilities payable for the relevant year of assessment

(18 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Commencement Rules, Corporate Tax, Nigerian Tax Law, Tax Filing, VAT Compliance

- Level: Level 2

- Topic: The Nigerian Tax System

- Series: MAY 2022