- 30 Marks

ATAX – May 2023 – L3 – Q1 – Taxation of Specialized Businesses

Analyze the tax implications for Hyland Nigeria Ltd, including adjusted profit, tax payable, dividend tax implications, and tax benefits for reconstituted companies.

Question

Hyland Nigeria Limited commenced business as a manufacturer of stationery on January 1, 2021. The company, in December 2020, acquired all the assets and liabilities of a foreign company operating in Nigeria, Lowland Incorporated, and reconstituted it for turnaround and profitability.

The directors of the newly reconstituted company have considered the draft financial statements and annual tax returns for the year ended December 31, 2021. During a board meeting, there was disagreement over the tax treatment of dividends received (N3,600,000) from equity holdings in another Nigerian public limited liability company. The dividends are also part of the proposed profits to be distributed to shareholders.

Additionally, one director suggested that as a reconstituted company, Hyland Nigeria Limited may qualify for tax reliefs or incentives that could positively affect profitability. Following the board’s decision, the Managing Director contacted your firm to provide professional advice on these matters.

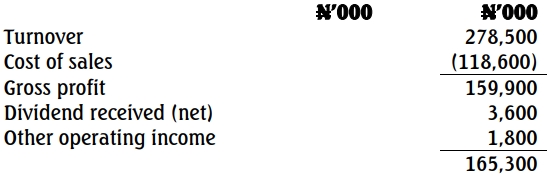

The following financial information is extracted from the company’s records:

The following additional relevant information was provided:

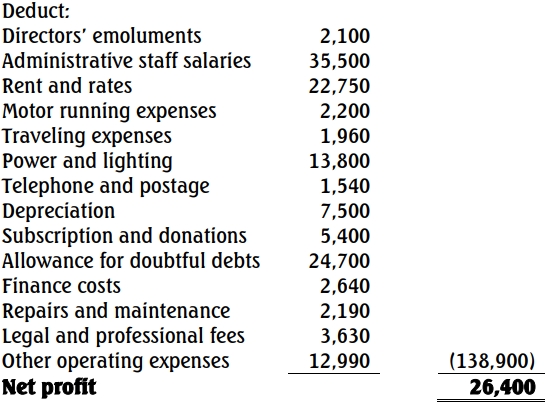

(i) Subscription and donations consisted of:

(ii) Allowance for doubtful debts included:

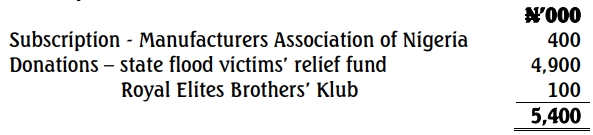

(iii) Repairs and maintenance was made up of:

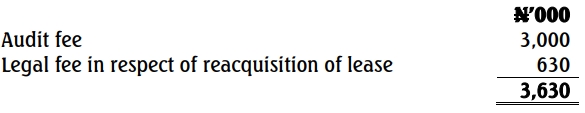

(iv) Legal and professional fees included:

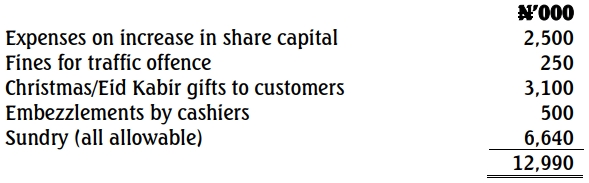

(v) Other operating expenses were:

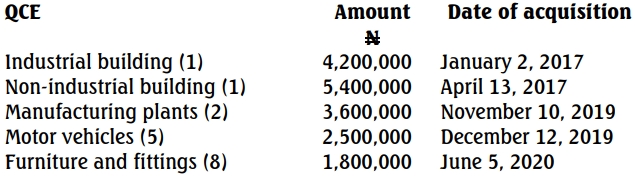

(vi) Tax written down values of qualifying capital expenditure (QCE) as at December 31, 2020:

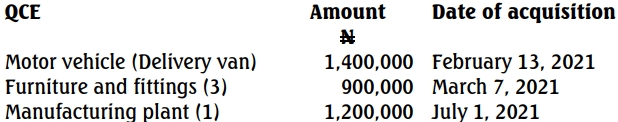

(vii) Additional assets acquired during the year ended December 31, 2021:

(viii) Unrelieved losses as at December 31, 2020 was N55,900,000.

(ix) Unutilised capital allowances as at December 31, 2020 was N16,155.000.

Required:

- Calculate the Adjusted Profit of the company for the year ended December 31, 2021.

- Compute the Tax Payable for the relevant assessment year.

- Provide professional advice on the tax implications of the dividends received for the company and its shareholders.

- Comment on tax benefits/incentives applicable to a reconstituted company in Nigeria as per the Companies Income Tax Act 2004 (as amended).

Find Related Questions by Tags, levels, etc.