- 30 Marks

CR – Nov 2021 – L3 – Q1 – Consolidated Financial Statements (IFRS 10)

Prepare consolidated financial position of Makoko Group for the year ended Dec 31, 2021, and discuss accounting implications of significant influence.

Question

Makoko Intercontinental Holdings Limited is a global merchant of cash crops. A policy of strategic acquisitions over the years has placed the company in a position to source for export products competitively. The lockdown arising from the recent pandemic posed a significant challenge for the export of their products throughout the year 2020. At a board meeting to review the performance of the company for that year and discuss the impact of the pandemic, the Managing Director noted the significant drop in the general performance indices. In order to get a greater market presence and higher demand locally, the board decided to acquire the following investments on January 1, 2021:

- 60% of the equity share of Ojodu Limited;

- 50% of 10% loan notes of Ojodu Ltd at par;

- 40% stake in the ordinary shares of Egbeda Confectioneries Limited.

In the opinion of the board, both Ojodu Limited and Egbeda Confectioneries Limited are the biggest local customers of Makoko Intercontinental Holdings Limited and a control through shareholding would give the investing company greater stake in the operational decisions of the investee companies. Importantly, it would also boost revenue by allowing unrestricted access to local markets. It is believed that this will forestall any adverse impact of further lockdowns that may hinder export sales in the future.

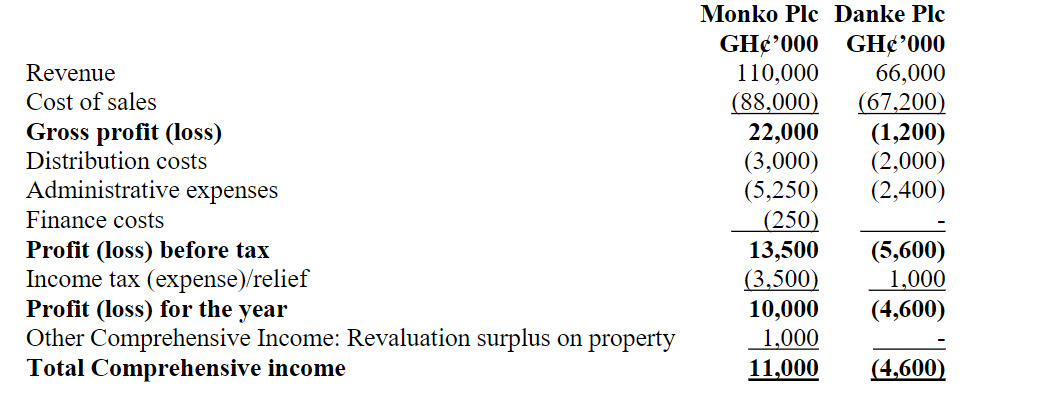

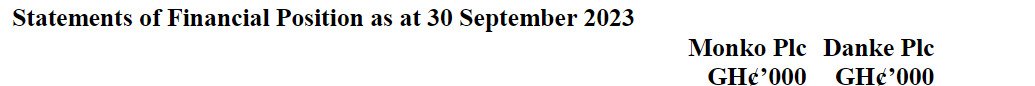

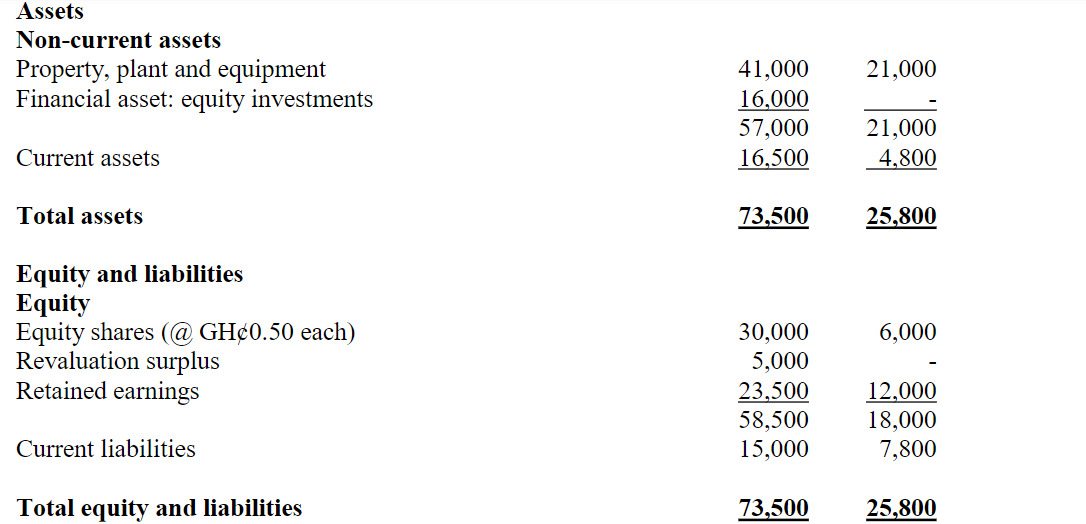

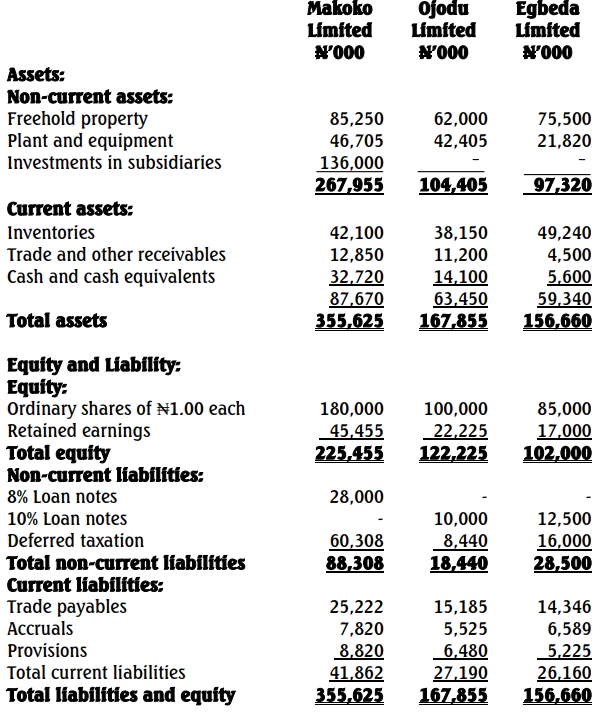

The draft financial statements of the companies for the year are as follows:

Statements of financial position as at December 31, 2021

Additional Information:

- Makoko Limited paid N90 million for the acquisition of Ojodu Limited when the retained earnings of Ojodu Limited were N13 million.

- The fair value of Ojodu’s freehold property was N6.5 million higher than the carrying amount as at the date of acquisition. This valuation has not been reflected in the books of Ojodu Limited.

- Makoko Limited paid N41 million for the shareholding in Egbeda Limited when the retained earnings of Egbeda Limited were N12 million.

- An impairment test as at December 31, 2021 showed that goodwill was impaired by N3.5 million and the investment in Egbeda Limited was impaired by N0.8 million.

- During the year, Makoko Limited sold products to Egbeda Limited at a price of N8 million. These goods had cost Makoko Limited N5 million. Half of the goods were still in the inventory of Egbeda Limited as at December 31, 2021.

- The companies issued share capital has not changed since the date of acquisition.

- No dividends were paid during the year.

- Non-controlling interests in subsidiaries are to be measured at the appropriate proportion of the subsidiary’s identifiable net assets.

Required: a. Prepare the consolidated statement of financial position for the Makoko Group for the year ended December 31, 2021. (20 Marks)

b. The Directors of Makoko Intercontinental Holdings Limited are concerned about getting significant influence, if not absolute control, of all entities they intend to buy into. The five-year strategic plan of the company (2020 – 2024) focuses on having control of the cash crops segment of the agribusiness sector of the economy. This is in order to make them ready to roll out the next developmental phase of the business, which is to migrate from exporting raw products to finished products for industrial and household use.

Towards this goal, the board requires the Group Accountant to make a presentation on the accounting implications of gaining significant influence in another entity.

Required: Discuss the issues involved in the requirements of the Board as specified above. (5 Marks)

c. A friend to the Chief Accountant of Makoko Intercontinental Holdings Limited, who is a consultant to Ojodu Limited and Egbeda Confectionaries Limited, is requesting for information on the new acquisitions from his friend, the Chief Accountant.

Required: Identify the ethical issues involved in the above scenarios and their implications. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Associate, Consolidation, Financial Position, Goodwill, Impairment, Non-Controlling Interest, Subsidiary

- Level: Level 3