- 20 Marks

FM – Nov 2022 – L3 – Q4 – Investment Appraisal Techniques

Evaluate the decision to invest in an innovative beverage using real options and the Black-Scholes model.

Question

Tayo Kayode (TK) is a highly successful beverage company listed on the Nigerian stock market. Its products are particularly attractive to the younger generation.

Eko Laboratory (EL) has developed an innovative synthetic, alcoholic beverage – the Younky.

It is believed that the product, if manufactured commercially, will be popular among the youths.

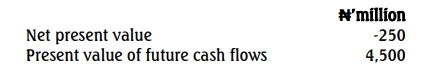

TK has been offered a license to produce the Younky on the condition that it commences production within the next twelve months. In the last board meeting, the Marketing Director, Kehinde Kay, presented the following preliminary evaluation of the project.

Kehinde recommended that the project should thus be rejected.

However, the Finance Director (FD), Ben Okon, argued that conventional NPV analysis undervalues projects with high uncertainty as the value of embedded real options is often ignored. He suggested that the possibility of delaying the project for up to twelve months effectively gives TK a call option on development and that if market forecasts improve over the next year, then the company can benefit. To get the ‘right answer,’ he concluded, option values must be incorporated.

The current long-term government bond yield is 5%. The expected standard deviation of future cash flows is estimated to be 35%.

Required:

a. Comment on the views of the Marketing and Finance Directors. (5 Marks)

b. Using the Black-Scholes option pricing model for a European call option, estimate the value of the option to commercially develop and market the Younky. Provide a recommendation as to whether or not TK should manufacture the Younky. (10 Marks)

c. Comment on modeling the possibility of delay as a European call option. (5 Marks)

(Total 20 Marks)

Find Related Questions by Tags, levels, etc.