- 20 Marks

FM – May 2017 – L3 – Q3 – Business Valuation Techniques

Compute Free Cash Flow to Equity and value per share using FCFE model.

Question

LA Ltd., a food packaging company, has operated as a private company for the past 10 years. The company has been growing rapidly over the last few years. The Directors are now considering listing the company on the stock market. Preparatory to this, the Directors are interested in determining a fair price per share for the company. Assume today is November 1, 2016.

The following information has been extracted from the most recent audited financial statements of LA Ltd:

Statement of Profit or Loss, October 31, 2016

| ₦million | |

|---|---|

| Sales Revenue | 15,790 |

| Cost of Sales | (13,514) |

| EBITDA | 2,276 |

| Depreciation | (440) |

| EBIT | 1,836 |

| Interest Expense | (330) |

| Earnings Before Tax | 1,506 |

| Tax at 30% | (452) |

| Profit After Tax | 1,054 |

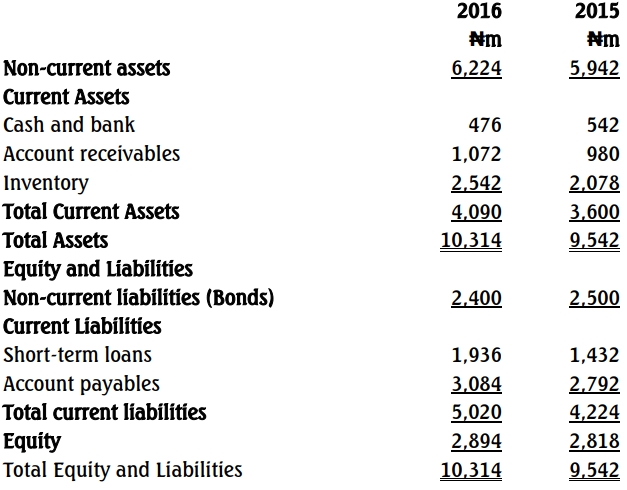

Statement of Financial Position as at October 31:

Additional Facts

- The Directors believe that the Free Cash Flow to Equity (FCFE) model should provide an appropriate valuation for the company’s shares.

- An investment banker has provided the following estimates of cost of capital:

- Cost of equity: 15%

- Post-tax cost of debt: 4%

- WACC: 12.5%

- The Directors believe that the FCFE will grow by 18% for the next 5 years and by 5% thereafter.

- The company currently has 600 million shares in issue.

Required:

a. Calculate the free cash flow available to equity for the year ended October 31, 2016. (7 Marks)

b. Use the Free Cash Flow to Equity model to calculate the current value per share. (5 Marks)

c. What are the key advantages and disadvantages of stock exchange listing? (8 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: FCFE Model, Shareholder Impact, Stock Listing, Valuation

- Level: Level 3