Question Tag: Statement of Financial Position

- 20 Marks

FR – Nov 2024 – L2 – Q3 – Financial Statements Preparation

Preparation of Fahnbulleh LTD’s Statement of Comprehensive Income and Statement of Financial Position using IFRS.

Question

Fahnbulleh LTD (Fahnbulleh) is a well-known company manufacturing thrill rides. During the current economic climate, Fahnbulleh has experienced some difficulties and has had to close down its Merry Go Round division.

The company’s trial balance as at 31 October 2023 is as follows:

| Account Description | Dr (GH¢’000) | Cr (GH¢’000) |

|---|---|---|

| Revenue | 1,296,000 | |

| Cost of Sales | 546,480 | |

| Distribution Costs | 127,080 | |

| Administrative Expenses | 142,560 | |

| Investment Income | 28,080 | |

| Investment Property | 270,000 | |

| Interest Paid | 17,280 | |

| Income Tax | 10,800 | |

| Property, Plant & Equipment (PPE) – Carrying Value at 1 Nov 2022 | 1,620,000 | |

| Inventories (31 October 2023) | 108,000 | |

| Trade Receivables | 135,000 | |

| Bank | 64,800 | |

| Payables | 43,200 | |

| Deferred Tax (1 Nov 2022) | 75,600 | |

| 8% Loan Note | 432,000 | |

| Ordinary Share Capital (GH¢1 per share) | 540,000 | |

| Retained Earnings (1 Nov 2022) | 605,520 | |

| Totals | 3,031,200 | 3,031,200 |

Additional Information:

-

Revenue Adjustments:

- Revenue includes VAT of GH¢72 million.

-

Property, Plant & Equipment (PPE):

- A building with a carrying value of GH¢54 million was revalued on 1 November 2022 to GH¢72 million.

- The building had an estimated useful life of 25 years when purchased, and this has not changed after the revaluation.

- All other PPE should be depreciated at 20% per annum (reducing balance method).

- All depreciation should be charged to cost of sales.

-

Closure of the Merry Go Round Division (Discontinued Operations):

- Closure Date: 1 October 2023

- Division’s Results (1 Nov 2022 – 1 Oct 2023):

Item GH¢’000 Revenue 58,800 Cost of Sales 38,700 Distribution Costs 12,240 Administrative Expenses 11,880 - The division’s net assets were sold at a loss of GH¢19.2 million, recorded in cost of sales.

-

Investment Property Revaluation (IAS 40):

- Investment property value increased by 5%, which should be incorporated into the financial statements.

-

Income Tax and Deferred Tax (IAS 12):

- The estimated income tax provision for the year: GH¢140.4 million.

- Deferred tax liability should be adjusted for temporary differences (GH¢129.6 million) at a 25% tax rate.

-

Damaged Inventory (IAS 2):

- Inventory worth GH¢46 million was damaged.

- It can be reconditioned at a cost of GH¢12 million and sold for GH¢52 million.

- Appropriate adjustments should be made.

Required:

Prepare and present the Statement of Comprehensive Income for the year ended 31 October 2023 and the Statement of Financial Position as at 31 October 2023 for Fahnbulleh LTD.

Find Related Questions by Tags, levels, etc.

- 20 Marks

FA – Nov 2024 – L1 – Q4- Preparation of Financial Statements for a Sole Trader

Prepare the Statement of Profit or Loss and Statement of Financial Position for a sole trader from given financial data and adjustments.

Question

The following list of assets, liabilities, and equity as at 30 June 2023 was extracted from the books of Akuorkor, a sole trader:

Trial Balance as at 30 June 2023

| Item | GH¢ |

|---|---|

| Plant and equipment – cost | 100,000 |

| Accumulated depreciation – Plant & Equipment | 36,000 |

| Office fixtures – cost | 25,000 |

| Accumulated depreciation – Office Fixtures | 2,500 |

| Inventory | 15,250 |

| Trade receivables and prepayments | 17,500 |

| Trade payables and accrued expenses | 8,800 |

| Bank overdraft | 4,425 |

| Loan (10% interest per annum) | 47,500 |

| Capital | 58,525 |

Summary of Receipts and Payments for the Year Ended 30 June 2024

| Receipts | GH¢ |

|---|---|

| Capital introduced | 11,000 |

| Cash from customers | 213,750 |

| Total Receipts | 224,750 |

| Payments | GH¢ |

|---|---|

| Cash drawings (Note 5) | 11,225 |

| Loan repayments (Note 7) | 10,000 |

| Payment to suppliers | 87,800 |

| Rent | 11,000 |

| Wages | 45,000 |

| Office expenses | 6,250 |

| Total Payments | 171,275 |

Additional Information:

- Closing inventory on 30 June 2024 was GH¢13,925.

- Depreciation policies:

- Plant & Equipment: 20% per annum reducing balance.

- Office Equipment: 10% per annum on cost.

- Fixtures & Fittings: Straight-line method over 4 years with a full year’s charge in the year of acquisition.

- GH¢2,500 worth of fixtures & fittings was introduced into the business.

- Prepayments and accrued expenses as at 30 June 2023:

- Rent paid in advance: GH¢1,250

- Accrued wages: GH¢2,150

- Cash drawings included:

- Wages: GH¢3,375

- Payments to suppliers: GH¢2,100

- Advertising leaflets: GH¢1,300 (Half not yet distributed).

- Bank balance per statement: GH¢53,350 after adjusting for unpresented cheques.

- Loan repayments include GH¢4,750 in interest payments.

- Assets and liabilities as at 30 June 2024:

- Rent paid in advance: GH¢1,350

- Accrued wages: GH¢2,625

- Amounts due to suppliers: GH¢6,100

- Amounts due from customers: GH¢11,150

- Major customer went into liquidation owing GH¢8,000; only 20% recoverable.

Required:

Prepare:

i) Statement of Profit or Loss for Akuorkor for the year ended 30 June 2024.

ii) Statement of Financial Position as at 30 June 2024.

Find Related Questions by Tags, levels, etc.

- 20 Marks

AAA – Nov 2018 – L3 – Q2 – Regulatory Investigations and Disciplinary Actions

Assessment of joint audit advantages, agenda setup, and addressing regulatory issues in audit planning

Question

Yusuf Olatunji & Co., (Chartered Accountants) have been auditors to XBC Bank Limited. There has been some regulatory and compliance issues for which the bank was sanctioned and paid penalties to both the Central Bank of Nigeria and the Financial Reporting Council of Nigeria. At the board of directors meeting to consider the last annual report audited by the firm, some of the problems caused by the auditors were raised. Following the reoccurrence of such issues, it was proposed that another audit firm be engaged in addition to the present firm. To achieve their objective, a bigger firm that has international affiliation was considered to take a leading position in a joint audit arrangement and to ensure appropriate compliance.

Your firm has been approached for the appointment. A meeting was scheduled between your firm, Yusuf Olatunji & Co., and the executive management of the bank. In preparation for the meeting, you are informed that you will address the meeting on the advantages and disadvantages of joint audit, being an area some members of the management team have expressed concerns.

After the meeting, your firm was subsequently appointed, and the necessary formalities were properly followed. Your partner has directed that you liaise with Yusuf Olatunji & Co. to obtain the necessary materials for the preparation of the audit and that you review your firm’s audit manual with respect to the concerns of management on joint audit.

Your assessment of the documents obtained from the other auditor revealed the following, amongst others:

- Part of the penalty was on improper disclosure relating to a material property, plant, and equipment (PPE) acquired during the previous year and a substantial loan above the limit authorised for a sector of the economy;

- The classification of unresolved transactions as debit balances in the statement of financial position, resulting in an increase in operating profit and the payment of higher taxes than projected;

- The IT operations of the bank had weak controls such that it was possible for some staff to over-ride some of them;

- The net current assets have continued to fall and, in the preceding year, have fallen below industry average despite an increase in gross earnings.

Required:

a. Evaluate the advantages and disadvantages of joint audit. (8 Marks)

b. Prepare an agenda for the scheduled meeting between the two audit firms. (4 Marks)

c. Develop the appropriate audit approach to address each of the issues identified from the review of the documents obtained from Yusuf Olatunji & Co. (8 Marks)

Find Related Questions by Tags, levels, etc.

- 10 Marks

FR – Nov 2023 – L2 – Q7b – Presentation of Financial Statements (IAS 1)

Lists minimum line items for the statement of financial position and changes in equity as per IAS 1

Question

IAS 1- Presentation of Financial Statements provides a list of line items that, as a minimum, must be shown on the face of the statement of financial position.

Required:

i. Give FIVE examples of minimum line items to be shown on the face of the statement of financial position. (5 Marks)

ii. State FIVE items that should be accounted for in the statement of changes in equity. (5 Marks)

Find Related Questions by Tags, levels, etc.

- 30 Marks

FM – Nov 2017 – L3 – Q1 – Financial Planning and Forecasting

Prepare forecast financials for Lekki Plc and suggest divestment options for a poorly performing subsidiary.

Question

Despite the global recession, demand for the company’s products has recently increased and is expected to grow over the next two years.

As part of a recent strategic review, the directors made the following projections for the years ending March 31, 2018, and March 31, 2019:

- An anticipated annual revenue increase of 8% for each year.

- Operating costs (excluding depreciation) expected to rise by 4% per year.

- Tax rate to remain at 21%, payable in the year liability arises.

- The trade receivables/revenue and trade payables/operating costs ratios will stay the same.

- Inventory levels to increase by 10% in the year ending March 31, 2018, and then remain stable.

- Non-current assets, including Lekki Plc.’s headquarters and factory, are not depreciated, and capital allowances are negligible.

- Dividend growth rate to remain at 6% annually, with dividends declared at the year-end and paid the following year.

- Purchase of new machinery at N8 million, financed through existing overdraft facilities. Machinery to be depreciated straight-line over 8 years with a N1 million residual value; capital allowances will apply at 18% reducing balance.

- Finance costs are projected to increase by 50% in the year ending March 31, 2018, and remain stable thereafter.

Financial Statement Extracts (March 31, 2017):

- Income Statement:

- Revenue: N60,240,000

- Operating Costs: N49,500,000

- Operating Profit: N10,740,000

- Finance Costs: N800,000

- Profit before Tax: N9,940,000

- Tax: N2,286,000

- Profit after Tax: N7,654,000

- Statement of Financial Position:

- Assets:

- Non-current Assets: N28,850,000

- Current Assets:

- Inventories: N9,020,000

- Trade Receivables: N9,036,000

- Cash and Equivalents: N396,000

- Equity and Liabilities:

- Ordinary Share Capital: N16,700,000

- Retained Earnings: N12,482,000

- Non-current Liabilities: N8,000,000 (6% Debentures)

- Current Liabilities: N10,120,000 (Trade Payables, Dividends)

- Assets:

Assume today is April 1, 2017.

a. Prepare a Forecast Financial Statement (Income Statement, Statement of Financial Position, and Cash Flow Statement) for each of the years ending March 31, 2018, and March 31, 2019.

(24 Marks)

Note: All calculations should be rounded up to the nearest N’000.

b. Beyond March 31, 2019, the directors are considering the disposal of a smaller subsidiary due to poor performance. The Finance Director suggests avoiding liquidation to minimize industrial relations issues.

Required: Discuss three non-liquidation methods to divest the subsidiary.

(6 Marks)

Find Related Questions by Tags, levels, etc.

- 20 Marks

PSAF – Nov 2015 – L2 – Q4 – Public Sector Financial Statements

Prepare the financial statements of Egbin Electricity Board for 2014, including statement of financial performance and position.

Question

The following information has been extracted from the books of Egbin Electricity Board, a public sector-owned electricity generating company, for the year ended December 31, 2014:

| Item | N’000 |

|---|---|

| Accumulated Depreciation, January 1, 2014 | 45,224 |

| Sale of Electricity | 114,392 |

| Purchase of Electricity | 95,784 |

| Meter reading, billing, and collection | 1,624 |

| Non-Current Assets Expenditure | 84,102 |

| Debtors for electricity consumption | 12,006 |

| Training and welfare | 692 |

| Stock and work-in-progress | 1,234 |

| Rents, Rates, and Insurance | 2,126 |

| Electricity Estimated unread consumption | 7,222 |

| Administration and General Expenses | 1,476 |

| Electricity Council Grant | 21,556 |

| Preparation of Electricity Council’s Expenses | 362 |

| Bank Balance and Cash | 1,284 |

| Depreciation for the year | 3,634 |

| Hire purchase and deferred payment | 2,672 |

| Interest and Financing Expenses | 2,434 |

| Creditors and accrued liabilities | 13,926 |

| Profit on contracting and sale of appliance poles | 534 |

| Reserves | 23,116 |

| Rental of Meters Application | 556 |

| Distribution cost | 4,476 |

| Customer Service | 1,810 |

Required:

Prepare in vertical form the Statement of Financial Performance and Statement of Financial Position for Egbin Electricity Board for the year ended December 31, 2014.

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – May 2024 – L2 – SA – Q2 – Conceptual Framework for Financial Reporting

Discusses the information needs of financial statement users, CAMA director report requirements, and deferred tax calculations.

Question

a. The Conceptual Framework for Financial Reporting sets out the concepts that underlie the preparation and presentation of financial statements and considers the various users of these financial statements.

Required:

Identify and discuss the information needs of the different users of financial statements. (10 Marks)

b. The Companies and Allied Matters Act (CAMA) 2020 is the primary source of company law that establishes the requirements for financial reporting by all companies in Nigeria.

Required:

Briefly explain FIVE issues that must be contained in a directors’ report in accordance with CAMA 2020. (5 Marks)

c. Babanriga Nigeria Limited acquired a factory machine for N10 million on January 1, 2019. The machine had an estimated life and residual value of 10 years and N2 million, respectively, and is depreciated on a straight-line basis. In lieu of depreciation, the tax authority allows a tax expense of 40% of the cost of this type of machine to be claimed against income tax in the year of purchase, with 25% per annum of its tax base subsequently on a reducing balance basis. The prevailing company income tax rate is 30%.

Required:

Calculate the deferred tax charge or credit which will be recorded in Babanriga Nigeria Limited’s Statement of Profit or Loss and Other Comprehensive Income for the year ended December 31, 2021, and the deferred tax balance in the Statement of Financial Position at that date. (5 Marks)

Find Related Questions by Tags, levels, etc.

- 30 Marks

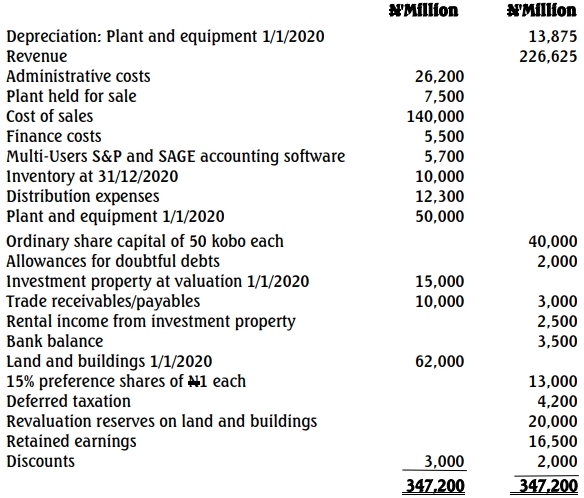

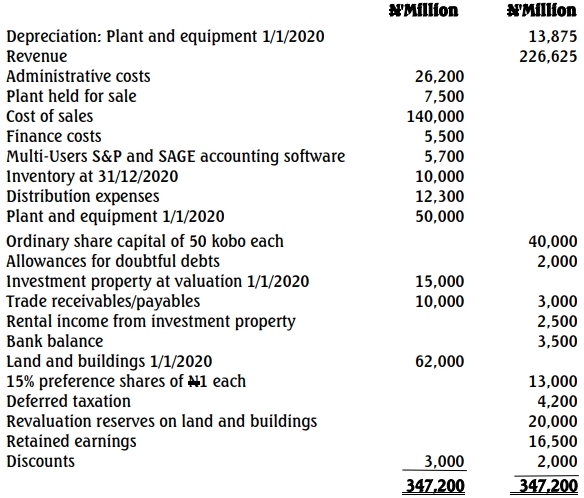

FR – May 2022 – L2 – SA – Q1 – Preparation of Financial Statements

Prepare a statement of profit or loss, comprehensive income, changes in equity, and financial position for Endtime PLC.

Question

Endtime PLC is a company based in Benin with the following trial balance for the year ended December 31, 2020:

Additional Information:

(i) Finance costs include full year dividends on preference shares and ordinary share dividends of 2½ kobo paid at the end of the year. Allowances for 4 doubtful debts are no longer necessary as customers paid as at when due from time to time in the past 2 years.

(ii) Severely damaged inventories, which cost N790,000,000 were included in the inventories in the trial balance. This will need to be repaired at a cost of N440,000,000 before a knowledgeable buyer will be interested to pay N940,000,000 at arm’s length transaction.

(iii) As at December 31, 2020, a valuer based in Victoria Island in Lagos was contacted by the company to review its land and buildings. The land and buildings was revalued upward by N13,000,000,000 and a certificate was issued to this effect. The board of directors approved the valuation but it has

not yet been accounted for in the trial balance. The valuer advised that the remaining useful life of the asset is reasonably and reliably estimated to be 20 years. Depreciation is on straight-line basis.

(iv) Depreciation on plant and equipment is charged at 15% on reducing balance basis. The multi-users S&P and Sage was bought on September 30, 2020. The amortisation is at the rate of 12.5% annually. The amortisation is evenly distributed over the year. Besides, software installation, customisation and

handling cost of N800,000,000, training costs of N900,000,000, consultancy fee of N600,000,000 and other general overheads of N850,000,000 on the new software were included in administrative expenses. All depreciations are treated as administrative costs.

(v) On December 30, 2020, a chartered surveyor valued investment property at N14,000,000,000 and the company uses fair value model in IAS 40 – Investment Property.

(vi) Current income tax has been estimated for the year ended December 31, 2020 at N9,000,000,000 and deferred tax provision as at December 31, 2020 is to be adjusted in the income statement to reflect the tax base of the company’s net assets of N12,000,000,000 less than the carrying amounts. The current

company income tax rate is 30%.

vii) The plant held for sale is valued in the trial balance at its carrying amount. A broker is readily available to buy the plant for N6,000,000,000 at a fee of 6% of sales proceed. The sale would take place in January, 2021. Any necessary adjustment is to be treated as cost of sales.

You are required to prepare:

a. Statement of profit or loss and other comprehensive income for the year ended December 31, 2020. (13 Marks)

b. Statement of changes in equity for the year ended December 31, 2020. (4 Marks)

c. Statement of financial position as at December 31, 2020. (13 Marks)

Find Related Questions by Tags, levels, etc.

- 16 Marks

FR – Nov 2019 – L2 – Q1b – Presentation of Financial Statements (IAS 1)

Prepare financial statements for Uchena Nigeria Plc, including profit or loss, changes in equity, and financial position.

Question

The Chief Accountant of Uchena Nigeria plc has just forwarded the trial balance of the company to you for review before the preparation of draft financial statements for the year ended December 31, 2018.

The trial balance is as follows:

| Description | Debit (N’m) | Credit (N’m) |

|---|---|---|

| Ordinary share capital | 43,200 | |

| Revenue | 125,280 | |

| Staff cost | 18,720 | |

| Leasehold building | 21,600 | |

| Patent rights | 4,320 | |

| Work-in-progress (Jan 1, 2018) | 9,000 | |

| Accum. Depreciation on building (Jan 1, 2018) | 4,320 | |

| Inventories of finished goods (Jan 1, 2018) | 11,160 | |

| Consultancy fee | 3,168 | |

| Directors’ salaries | 25,920 | |

| Computer at cost (Hardware) | 3,600 | |

| Accum. Depreciation on computer (Jan 1, 2018) | 1,440 | |

| Retained earnings (Jan 1, 2018) | 8,712 | |

| Dividend paid | 9,000 | |

| Cash and bank | 31,680 | |

| Trade receivables | 30,240 | |

| Trade payables | 6,624 | |

| Sundry expenses | 21,168 | |

| Totals | 189,576 | 189,576 |

Additional information:

- On January 1, 2018, buildings were revalued to N25,920 million. This has not been reflected in the accounts.

- Computer (hardware) is depreciated over five years. Buildings are now to be depreciated over 30 years.

- The patent rights relate to a computer software with a 3-year life span.

- An allowance for bad debts of 5% is to be created.

- Closing inventories of finished goods are valued at N12,960 million. Work-in-progress has increased to N10,080 million.

- There is an estimated liability for current tax of N8,640 million, which has not been recognized.

Required:

- Prepare a draft statement of profit or loss (analyzing expenses by nature) for the year ended December 31, 2018. (6 Marks)

- Prepare a statement of changes in equity for the year ended December 31, 2018. (4 Marks)

- Prepare a statement of financial position as at December 31, 2018. (6 Marks)

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – Nov 2024 – L2 – Q3 – Financial Statements Preparation

Preparation of Fahnbulleh LTD’s Statement of Comprehensive Income and Statement of Financial Position using IFRS.

Question

Fahnbulleh LTD (Fahnbulleh) is a well-known company manufacturing thrill rides. During the current economic climate, Fahnbulleh has experienced some difficulties and has had to close down its Merry Go Round division.

The company’s trial balance as at 31 October 2023 is as follows:

| Account Description | Dr (GH¢’000) | Cr (GH¢’000) |

|---|---|---|

| Revenue | 1,296,000 | |

| Cost of Sales | 546,480 | |

| Distribution Costs | 127,080 | |

| Administrative Expenses | 142,560 | |

| Investment Income | 28,080 | |

| Investment Property | 270,000 | |

| Interest Paid | 17,280 | |

| Income Tax | 10,800 | |

| Property, Plant & Equipment (PPE) – Carrying Value at 1 Nov 2022 | 1,620,000 | |

| Inventories (31 October 2023) | 108,000 | |

| Trade Receivables | 135,000 | |

| Bank | 64,800 | |

| Payables | 43,200 | |

| Deferred Tax (1 Nov 2022) | 75,600 | |

| 8% Loan Note | 432,000 | |

| Ordinary Share Capital (GH¢1 per share) | 540,000 | |

| Retained Earnings (1 Nov 2022) | 605,520 | |

| Totals | 3,031,200 | 3,031,200 |

Additional Information:

-

Revenue Adjustments:

- Revenue includes VAT of GH¢72 million.

-

Property, Plant & Equipment (PPE):

- A building with a carrying value of GH¢54 million was revalued on 1 November 2022 to GH¢72 million.

- The building had an estimated useful life of 25 years when purchased, and this has not changed after the revaluation.

- All other PPE should be depreciated at 20% per annum (reducing balance method).

- All depreciation should be charged to cost of sales.

-

Closure of the Merry Go Round Division (Discontinued Operations):

- Closure Date: 1 October 2023

- Division’s Results (1 Nov 2022 – 1 Oct 2023):

Item GH¢’000 Revenue 58,800 Cost of Sales 38,700 Distribution Costs 12,240 Administrative Expenses 11,880 - The division’s net assets were sold at a loss of GH¢19.2 million, recorded in cost of sales.

-

Investment Property Revaluation (IAS 40):

- Investment property value increased by 5%, which should be incorporated into the financial statements.

-

Income Tax and Deferred Tax (IAS 12):

- The estimated income tax provision for the year: GH¢140.4 million.

- Deferred tax liability should be adjusted for temporary differences (GH¢129.6 million) at a 25% tax rate.

-

Damaged Inventory (IAS 2):

- Inventory worth GH¢46 million was damaged.

- It can be reconditioned at a cost of GH¢12 million and sold for GH¢52 million.

- Appropriate adjustments should be made.

Required:

Prepare and present the Statement of Comprehensive Income for the year ended 31 October 2023 and the Statement of Financial Position as at 31 October 2023 for Fahnbulleh LTD.

Find Related Questions by Tags, levels, etc.

- 20 Marks

FA – Nov 2024 – L1 – Q4- Preparation of Financial Statements for a Sole Trader

Prepare the Statement of Profit or Loss and Statement of Financial Position for a sole trader from given financial data and adjustments.

Question

The following list of assets, liabilities, and equity as at 30 June 2023 was extracted from the books of Akuorkor, a sole trader:

Trial Balance as at 30 June 2023

| Item | GH¢ |

|---|---|

| Plant and equipment – cost | 100,000 |

| Accumulated depreciation – Plant & Equipment | 36,000 |

| Office fixtures – cost | 25,000 |

| Accumulated depreciation – Office Fixtures | 2,500 |

| Inventory | 15,250 |

| Trade receivables and prepayments | 17,500 |

| Trade payables and accrued expenses | 8,800 |

| Bank overdraft | 4,425 |

| Loan (10% interest per annum) | 47,500 |

| Capital | 58,525 |

Summary of Receipts and Payments for the Year Ended 30 June 2024

| Receipts | GH¢ |

|---|---|

| Capital introduced | 11,000 |

| Cash from customers | 213,750 |

| Total Receipts | 224,750 |

| Payments | GH¢ |

|---|---|

| Cash drawings (Note 5) | 11,225 |

| Loan repayments (Note 7) | 10,000 |

| Payment to suppliers | 87,800 |

| Rent | 11,000 |

| Wages | 45,000 |

| Office expenses | 6,250 |

| Total Payments | 171,275 |

Additional Information:

- Closing inventory on 30 June 2024 was GH¢13,925.

- Depreciation policies:

- Plant & Equipment: 20% per annum reducing balance.

- Office Equipment: 10% per annum on cost.

- Fixtures & Fittings: Straight-line method over 4 years with a full year’s charge in the year of acquisition.

- GH¢2,500 worth of fixtures & fittings was introduced into the business.

- Prepayments and accrued expenses as at 30 June 2023:

- Rent paid in advance: GH¢1,250

- Accrued wages: GH¢2,150

- Cash drawings included:

- Wages: GH¢3,375

- Payments to suppliers: GH¢2,100

- Advertising leaflets: GH¢1,300 (Half not yet distributed).

- Bank balance per statement: GH¢53,350 after adjusting for unpresented cheques.

- Loan repayments include GH¢4,750 in interest payments.

- Assets and liabilities as at 30 June 2024:

- Rent paid in advance: GH¢1,350

- Accrued wages: GH¢2,625

- Amounts due to suppliers: GH¢6,100

- Amounts due from customers: GH¢11,150

- Major customer went into liquidation owing GH¢8,000; only 20% recoverable.

Required:

Prepare:

i) Statement of Profit or Loss for Akuorkor for the year ended 30 June 2024.

ii) Statement of Financial Position as at 30 June 2024.

Find Related Questions by Tags, levels, etc.

- 20 Marks

AAA – Nov 2018 – L3 – Q2 – Regulatory Investigations and Disciplinary Actions

Assessment of joint audit advantages, agenda setup, and addressing regulatory issues in audit planning

Question

Yusuf Olatunji & Co., (Chartered Accountants) have been auditors to XBC Bank Limited. There has been some regulatory and compliance issues for which the bank was sanctioned and paid penalties to both the Central Bank of Nigeria and the Financial Reporting Council of Nigeria. At the board of directors meeting to consider the last annual report audited by the firm, some of the problems caused by the auditors were raised. Following the reoccurrence of such issues, it was proposed that another audit firm be engaged in addition to the present firm. To achieve their objective, a bigger firm that has international affiliation was considered to take a leading position in a joint audit arrangement and to ensure appropriate compliance.

Your firm has been approached for the appointment. A meeting was scheduled between your firm, Yusuf Olatunji & Co., and the executive management of the bank. In preparation for the meeting, you are informed that you will address the meeting on the advantages and disadvantages of joint audit, being an area some members of the management team have expressed concerns.

After the meeting, your firm was subsequently appointed, and the necessary formalities were properly followed. Your partner has directed that you liaise with Yusuf Olatunji & Co. to obtain the necessary materials for the preparation of the audit and that you review your firm’s audit manual with respect to the concerns of management on joint audit.

Your assessment of the documents obtained from the other auditor revealed the following, amongst others:

- Part of the penalty was on improper disclosure relating to a material property, plant, and equipment (PPE) acquired during the previous year and a substantial loan above the limit authorised for a sector of the economy;

- The classification of unresolved transactions as debit balances in the statement of financial position, resulting in an increase in operating profit and the payment of higher taxes than projected;

- The IT operations of the bank had weak controls such that it was possible for some staff to over-ride some of them;

- The net current assets have continued to fall and, in the preceding year, have fallen below industry average despite an increase in gross earnings.

Required:

a. Evaluate the advantages and disadvantages of joint audit. (8 Marks)

b. Prepare an agenda for the scheduled meeting between the two audit firms. (4 Marks)

c. Develop the appropriate audit approach to address each of the issues identified from the review of the documents obtained from Yusuf Olatunji & Co. (8 Marks)

Find Related Questions by Tags, levels, etc.

- 10 Marks

FR – Nov 2023 – L2 – Q7b – Presentation of Financial Statements (IAS 1)

Lists minimum line items for the statement of financial position and changes in equity as per IAS 1

Question

IAS 1- Presentation of Financial Statements provides a list of line items that, as a minimum, must be shown on the face of the statement of financial position.

Required:

i. Give FIVE examples of minimum line items to be shown on the face of the statement of financial position. (5 Marks)

ii. State FIVE items that should be accounted for in the statement of changes in equity. (5 Marks)

Find Related Questions by Tags, levels, etc.

- 30 Marks

FM – Nov 2017 – L3 – Q1 – Financial Planning and Forecasting

Prepare forecast financials for Lekki Plc and suggest divestment options for a poorly performing subsidiary.

Question

Despite the global recession, demand for the company’s products has recently increased and is expected to grow over the next two years.

As part of a recent strategic review, the directors made the following projections for the years ending March 31, 2018, and March 31, 2019:

- An anticipated annual revenue increase of 8% for each year.

- Operating costs (excluding depreciation) expected to rise by 4% per year.

- Tax rate to remain at 21%, payable in the year liability arises.

- The trade receivables/revenue and trade payables/operating costs ratios will stay the same.

- Inventory levels to increase by 10% in the year ending March 31, 2018, and then remain stable.

- Non-current assets, including Lekki Plc.’s headquarters and factory, are not depreciated, and capital allowances are negligible.

- Dividend growth rate to remain at 6% annually, with dividends declared at the year-end and paid the following year.

- Purchase of new machinery at N8 million, financed through existing overdraft facilities. Machinery to be depreciated straight-line over 8 years with a N1 million residual value; capital allowances will apply at 18% reducing balance.

- Finance costs are projected to increase by 50% in the year ending March 31, 2018, and remain stable thereafter.

Financial Statement Extracts (March 31, 2017):

- Income Statement:

- Revenue: N60,240,000

- Operating Costs: N49,500,000

- Operating Profit: N10,740,000

- Finance Costs: N800,000

- Profit before Tax: N9,940,000

- Tax: N2,286,000

- Profit after Tax: N7,654,000

- Statement of Financial Position:

- Assets:

- Non-current Assets: N28,850,000

- Current Assets:

- Inventories: N9,020,000

- Trade Receivables: N9,036,000

- Cash and Equivalents: N396,000

- Equity and Liabilities:

- Ordinary Share Capital: N16,700,000

- Retained Earnings: N12,482,000

- Non-current Liabilities: N8,000,000 (6% Debentures)

- Current Liabilities: N10,120,000 (Trade Payables, Dividends)

- Assets:

Assume today is April 1, 2017.

a. Prepare a Forecast Financial Statement (Income Statement, Statement of Financial Position, and Cash Flow Statement) for each of the years ending March 31, 2018, and March 31, 2019.

(24 Marks)

Note: All calculations should be rounded up to the nearest N’000.

b. Beyond March 31, 2019, the directors are considering the disposal of a smaller subsidiary due to poor performance. The Finance Director suggests avoiding liquidation to minimize industrial relations issues.

Required: Discuss three non-liquidation methods to divest the subsidiary.

(6 Marks)

Find Related Questions by Tags, levels, etc.

- 20 Marks

PSAF – Nov 2015 – L2 – Q4 – Public Sector Financial Statements

Prepare the financial statements of Egbin Electricity Board for 2014, including statement of financial performance and position.

Question

The following information has been extracted from the books of Egbin Electricity Board, a public sector-owned electricity generating company, for the year ended December 31, 2014:

| Item | N’000 |

|---|---|

| Accumulated Depreciation, January 1, 2014 | 45,224 |

| Sale of Electricity | 114,392 |

| Purchase of Electricity | 95,784 |

| Meter reading, billing, and collection | 1,624 |

| Non-Current Assets Expenditure | 84,102 |

| Debtors for electricity consumption | 12,006 |

| Training and welfare | 692 |

| Stock and work-in-progress | 1,234 |

| Rents, Rates, and Insurance | 2,126 |

| Electricity Estimated unread consumption | 7,222 |

| Administration and General Expenses | 1,476 |

| Electricity Council Grant | 21,556 |

| Preparation of Electricity Council’s Expenses | 362 |

| Bank Balance and Cash | 1,284 |

| Depreciation for the year | 3,634 |

| Hire purchase and deferred payment | 2,672 |

| Interest and Financing Expenses | 2,434 |

| Creditors and accrued liabilities | 13,926 |

| Profit on contracting and sale of appliance poles | 534 |

| Reserves | 23,116 |

| Rental of Meters Application | 556 |

| Distribution cost | 4,476 |

| Customer Service | 1,810 |

Required:

Prepare in vertical form the Statement of Financial Performance and Statement of Financial Position for Egbin Electricity Board for the year ended December 31, 2014.

Find Related Questions by Tags, levels, etc.

- 20 Marks

FR – May 2024 – L2 – SA – Q2 – Conceptual Framework for Financial Reporting

Discusses the information needs of financial statement users, CAMA director report requirements, and deferred tax calculations.

Question

a. The Conceptual Framework for Financial Reporting sets out the concepts that underlie the preparation and presentation of financial statements and considers the various users of these financial statements.

Required:

Identify and discuss the information needs of the different users of financial statements. (10 Marks)

b. The Companies and Allied Matters Act (CAMA) 2020 is the primary source of company law that establishes the requirements for financial reporting by all companies in Nigeria.

Required:

Briefly explain FIVE issues that must be contained in a directors’ report in accordance with CAMA 2020. (5 Marks)

c. Babanriga Nigeria Limited acquired a factory machine for N10 million on January 1, 2019. The machine had an estimated life and residual value of 10 years and N2 million, respectively, and is depreciated on a straight-line basis. In lieu of depreciation, the tax authority allows a tax expense of 40% of the cost of this type of machine to be claimed against income tax in the year of purchase, with 25% per annum of its tax base subsequently on a reducing balance basis. The prevailing company income tax rate is 30%.

Required:

Calculate the deferred tax charge or credit which will be recorded in Babanriga Nigeria Limited’s Statement of Profit or Loss and Other Comprehensive Income for the year ended December 31, 2021, and the deferred tax balance in the Statement of Financial Position at that date. (5 Marks)

Find Related Questions by Tags, levels, etc.

- 30 Marks

FR – May 2022 – L2 – SA – Q1 – Preparation of Financial Statements

Prepare a statement of profit or loss, comprehensive income, changes in equity, and financial position for Endtime PLC.

Question

Endtime PLC is a company based in Benin with the following trial balance for the year ended December 31, 2020:

Additional Information:

(i) Finance costs include full year dividends on preference shares and ordinary share dividends of 2½ kobo paid at the end of the year. Allowances for 4 doubtful debts are no longer necessary as customers paid as at when due from time to time in the past 2 years.

(ii) Severely damaged inventories, which cost N790,000,000 were included in the inventories in the trial balance. This will need to be repaired at a cost of N440,000,000 before a knowledgeable buyer will be interested to pay N940,000,000 at arm’s length transaction.

(iii) As at December 31, 2020, a valuer based in Victoria Island in Lagos was contacted by the company to review its land and buildings. The land and buildings was revalued upward by N13,000,000,000 and a certificate was issued to this effect. The board of directors approved the valuation but it has

not yet been accounted for in the trial balance. The valuer advised that the remaining useful life of the asset is reasonably and reliably estimated to be 20 years. Depreciation is on straight-line basis.

(iv) Depreciation on plant and equipment is charged at 15% on reducing balance basis. The multi-users S&P and Sage was bought on September 30, 2020. The amortisation is at the rate of 12.5% annually. The amortisation is evenly distributed over the year. Besides, software installation, customisation and

handling cost of N800,000,000, training costs of N900,000,000, consultancy fee of N600,000,000 and other general overheads of N850,000,000 on the new software were included in administrative expenses. All depreciations are treated as administrative costs.

(v) On December 30, 2020, a chartered surveyor valued investment property at N14,000,000,000 and the company uses fair value model in IAS 40 – Investment Property.

(vi) Current income tax has been estimated for the year ended December 31, 2020 at N9,000,000,000 and deferred tax provision as at December 31, 2020 is to be adjusted in the income statement to reflect the tax base of the company’s net assets of N12,000,000,000 less than the carrying amounts. The current

company income tax rate is 30%.

vii) The plant held for sale is valued in the trial balance at its carrying amount. A broker is readily available to buy the plant for N6,000,000,000 at a fee of 6% of sales proceed. The sale would take place in January, 2021. Any necessary adjustment is to be treated as cost of sales.

You are required to prepare:

a. Statement of profit or loss and other comprehensive income for the year ended December 31, 2020. (13 Marks)

b. Statement of changes in equity for the year ended December 31, 2020. (4 Marks)

c. Statement of financial position as at December 31, 2020. (13 Marks)

Find Related Questions by Tags, levels, etc.

- 16 Marks

FR – Nov 2019 – L2 – Q1b – Presentation of Financial Statements (IAS 1)

Prepare financial statements for Uchena Nigeria Plc, including profit or loss, changes in equity, and financial position.

Question

The Chief Accountant of Uchena Nigeria plc has just forwarded the trial balance of the company to you for review before the preparation of draft financial statements for the year ended December 31, 2018.

The trial balance is as follows:

| Description | Debit (N’m) | Credit (N’m) |

|---|---|---|

| Ordinary share capital | 43,200 | |

| Revenue | 125,280 | |

| Staff cost | 18,720 | |

| Leasehold building | 21,600 | |

| Patent rights | 4,320 | |

| Work-in-progress (Jan 1, 2018) | 9,000 | |

| Accum. Depreciation on building (Jan 1, 2018) | 4,320 | |

| Inventories of finished goods (Jan 1, 2018) | 11,160 | |

| Consultancy fee | 3,168 | |

| Directors’ salaries | 25,920 | |

| Computer at cost (Hardware) | 3,600 | |

| Accum. Depreciation on computer (Jan 1, 2018) | 1,440 | |

| Retained earnings (Jan 1, 2018) | 8,712 | |

| Dividend paid | 9,000 | |

| Cash and bank | 31,680 | |

| Trade receivables | 30,240 | |

| Trade payables | 6,624 | |

| Sundry expenses | 21,168 | |

| Totals | 189,576 | 189,576 |

Additional information:

- On January 1, 2018, buildings were revalued to N25,920 million. This has not been reflected in the accounts.

- Computer (hardware) is depreciated over five years. Buildings are now to be depreciated over 30 years.

- The patent rights relate to a computer software with a 3-year life span.

- An allowance for bad debts of 5% is to be created.

- Closing inventories of finished goods are valued at N12,960 million. Work-in-progress has increased to N10,080 million.

- There is an estimated liability for current tax of N8,640 million, which has not been recognized.

Required:

- Prepare a draft statement of profit or loss (analyzing expenses by nature) for the year ended December 31, 2018. (6 Marks)

- Prepare a statement of changes in equity for the year ended December 31, 2018. (4 Marks)

- Prepare a statement of financial position as at December 31, 2018. (6 Marks)

Find Related Questions by Tags, levels, etc.