- 16 Marks

FR – Nov 2019 – L2 – Q1b – Presentation of Financial Statements (IAS 1)

Prepare financial statements for Uchena Nigeria Plc, including profit or loss, changes in equity, and financial position.

Question

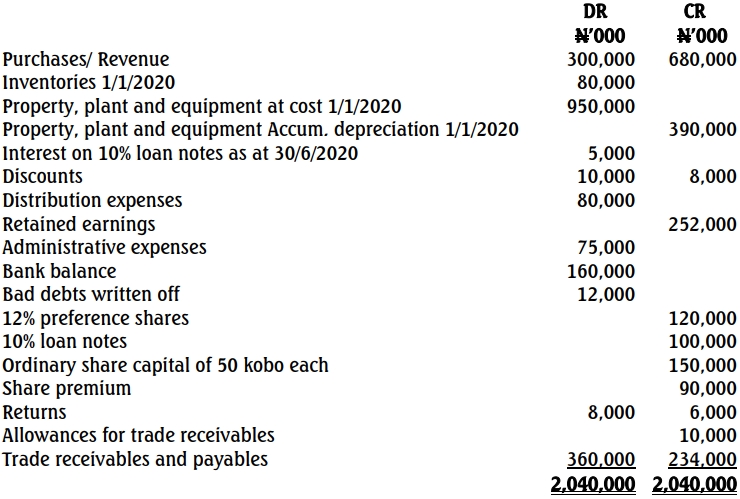

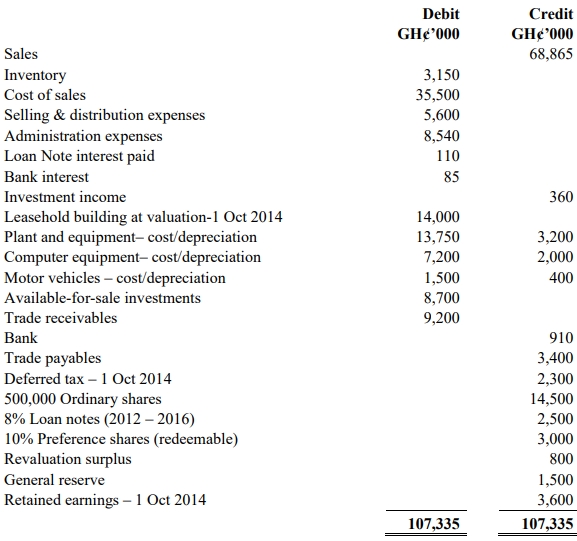

The Chief Accountant of Uchena Nigeria plc has just forwarded the trial balance of the company to you for review before the preparation of draft financial statements for the year ended December 31, 2018.

The trial balance is as follows:

| Description | Debit (N’m) | Credit (N’m) |

|---|---|---|

| Ordinary share capital | 43,200 | |

| Revenue | 125,280 | |

| Staff cost | 18,720 | |

| Leasehold building | 21,600 | |

| Patent rights | 4,320 | |

| Work-in-progress (Jan 1, 2018) | 9,000 | |

| Accum. Depreciation on building (Jan 1, 2018) | 4,320 | |

| Inventories of finished goods (Jan 1, 2018) | 11,160 | |

| Consultancy fee | 3,168 | |

| Directors’ salaries | 25,920 | |

| Computer at cost (Hardware) | 3,600 | |

| Accum. Depreciation on computer (Jan 1, 2018) | 1,440 | |

| Retained earnings (Jan 1, 2018) | 8,712 | |

| Dividend paid | 9,000 | |

| Cash and bank | 31,680 | |

| Trade receivables | 30,240 | |

| Trade payables | 6,624 | |

| Sundry expenses | 21,168 | |

| Totals | 189,576 | 189,576 |

Additional information:

- On January 1, 2018, buildings were revalued to N25,920 million. This has not been reflected in the accounts.

- Computer (hardware) is depreciated over five years. Buildings are now to be depreciated over 30 years.

- The patent rights relate to a computer software with a 3-year life span.

- An allowance for bad debts of 5% is to be created.

- Closing inventories of finished goods are valued at N12,960 million. Work-in-progress has increased to N10,080 million.

- There is an estimated liability for current tax of N8,640 million, which has not been recognized.

Required:

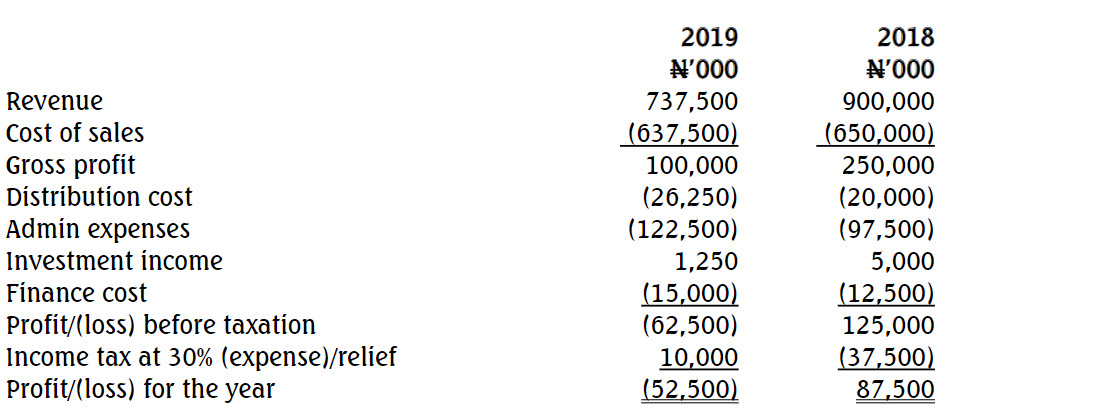

- Prepare a draft statement of profit or loss (analyzing expenses by nature) for the year ended December 31, 2018. (6 Marks)

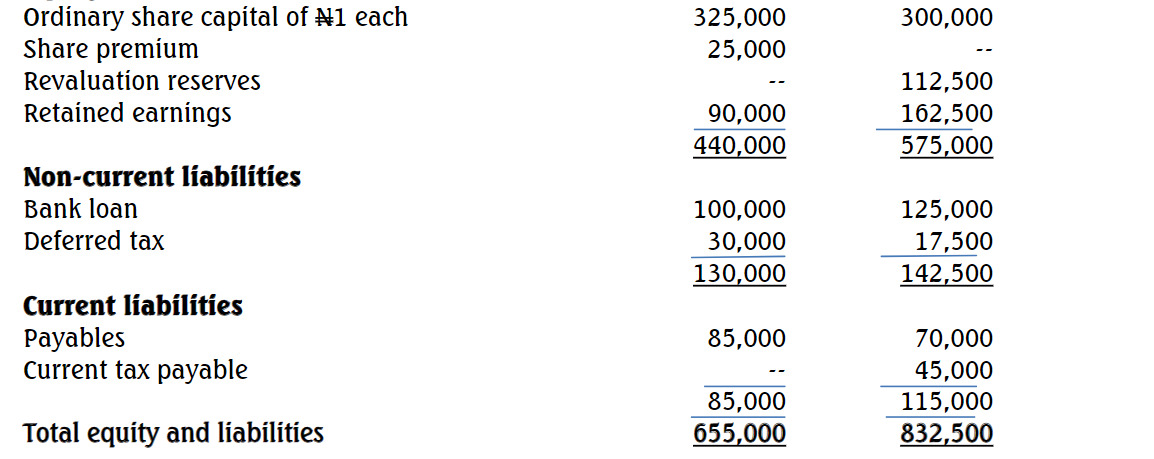

- Prepare a statement of changes in equity for the year ended December 31, 2018. (4 Marks)

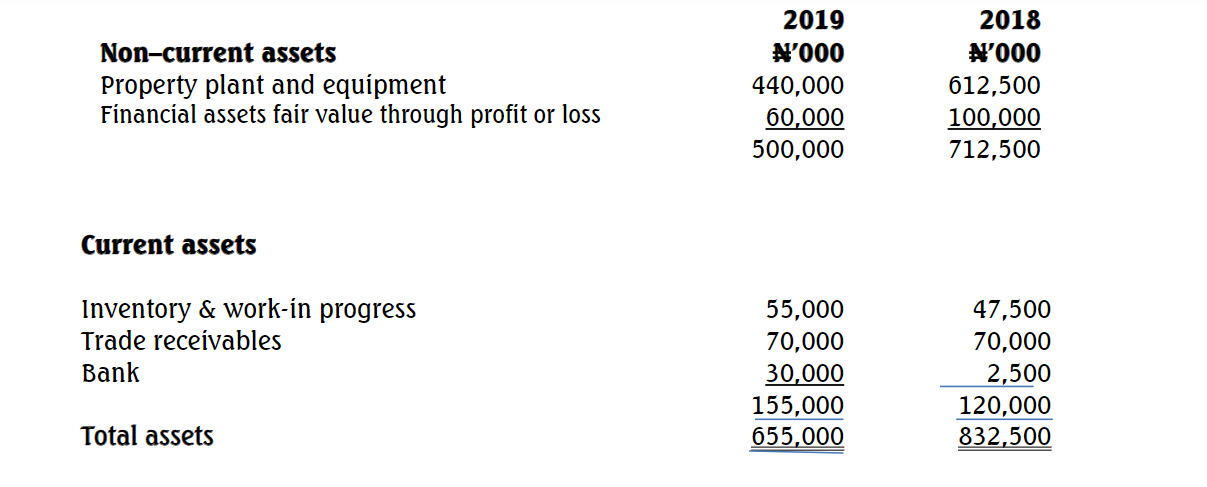

- Prepare a statement of financial position as at December 31, 2018. (6 Marks)

Find Related Questions by Tags, levels, etc.