- 20 Marks

CR – Nov 2023 – L3 – SB – Q4 – Financial Instruments (IFRS 9)

Discuss IFRS 9 derecognition rules, trade receivables factoring, and FVTOCI investment strategy for Pelumi Limited.

Question

a. Derecognition of financial instruments is the removal of a previously recognised financial asset or liability from an entity’s statement of financial position.

Required:

Discuss the rules of IFRS 9 – Financial Instruments relating to the derecognition of a financial asset. (10 Marks)

b. Royal Business Limited (RBL) held a portfolio of trade receivables with a carrying amount of N40 million as of May 31, 2022. At that date, the entity entered into a factoring agreement with Hexlinks Bank Limited (HBL), whereby it transfers the receivables in exchange for N36 million in cash. Royal Business Limited has agreed to reimburse the factor (HBL) for any shortfall between the amount collected and N36 million. Once the receivables have been collected, any amount above N36 million, less interest on this amount, will be repaid to Royal Business Limited. Royal Business Limited has derecognised the receivables and charged N4 million as a loss to profit or loss.

Required:

Explain how the rules of derecognition of the financial assets will affect the portfolio of trade receivables in Royal Business Limited’s financial statements. (3 Marks)

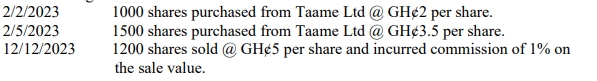

c. During the year 2021, Pelumi Limited invested in 800,000 shares in an NGX quoted company. The shares were purchased at N4.54 per share. The broker collected a commission of 1% on the transaction. Pelumi Limited elected to measure their shares at fair value through other comprehensive income (FVTOCI). The quoted share price as of December 31, 2021, was N4.22 to N4.26. Pelumi Limited decided to adopt a ‘sale and buy back’ strategy for the shares to realise a tax loss and therefore sold the shares at the market price on December 31, 2021, and bought the same quantity back the following day. The market price did not change on January 1, 2022. The broker collected a 1% commission on both transactions.

Required:

Explain the IFRS 9 accounting treatment of the above shares in the financial statement of Pelumi Limited for the year ended December 31, 2021.

Note: Show relevant calculations. (7 Marks)

Find Related Questions by Tags, levels, etc.