- 20 Marks

PM – May 2018 – L2 – Q2 – Standard Costing and Variance Analysis

Calculate sales variances and discuss their significance in standard costing.

Question

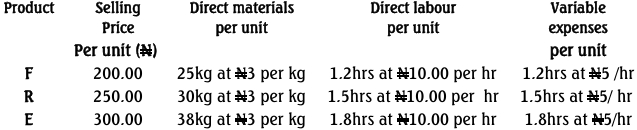

Nwokocha and Sons Bakery Limited uses absorption costing technique in its

accounting system. The company produces and sells three bakery products, namely

four corner loaf (F), round corner loaf (R) and executive loaf (E) which are

substitutes for each other. The following standard selling prices and cost data

relate to these three products:

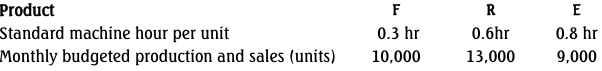

Annual budgeted fixed production overhead was N3,840,000. The company policy

is that overhead will be absorbed on a machine hour basis. The standard machine

hour for each product and the monthly budgeted level of production and sales for

each product are as follows;

Actual volumes and selling prices for the three products in a particular month are

as follows:

a. Calculate the following variances for overall sales for the particular month:

i. Sales price variance; (2 Marks)

ii. Sales volume profit variance; (2 Marks)

iii. Sales mix profit variance; and (3 Marks)

iv. Sales quantity profit variance. (3 Marks)

b. Determine the monthly budgeted profit for the company. (6 Marks)

c. Discuss the significance of mix variances in a standard costing system?

(4 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Absorption Costing, Bakery, Performance Evaluation, Sales Variances

- Level: Level 2

- Topic: Variance Analysis

- Series: MAY 2018