- 20 Marks

PM – May 2021 – L2 – Q3 – Cost-Volume-Profit (CVP) Analysis

Forecast future sales using historical data and analyze which data period provides a better basis for forecasting.

Question

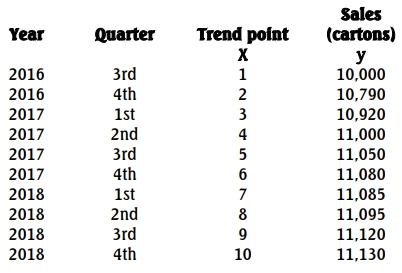

Some time ago, Robert launched a new product. Initially, sales were strong, but recent figures have raised concerns. Robert seeks a more accurate sales forecast to create detailed cash projections. The sales data below illustrates an underlying trend derived from an averaging method:

| Year | Quarter | Trend Point (x) | Sales (Cartons) (y) |

|---|---|---|---|

| 2016 | 3rd | 1 | 10,000 |

| 2016 | 4th | 2 | 10,760 |

| 2017 | 1st | 3 | 10,920 |

| 2017 | 2nd | 4 | 11,000 |

| 2017 | 3rd | 5 | 11,050 |

| 2017 | 4th | 6 | 11,080 |

| 2018 | 1st | 7 | 11,085 |

| 2018 | 2nd | 8 | 11,095 |

| 2018 | 3rd | 9 | 11,120 |

| 2018 | 4th | 10 | 11,130 |

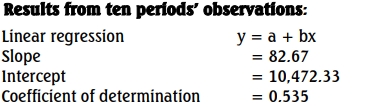

On average, quarters 1 and 3 are 5% and 6% above the trend, respectively, while quarters 2 and 4 are 2% and 9% below it. Preliminary calculations for the 10 periods yield:

- Linear Regression: y = a + bx

- Slope: 82.67

- Intercept: 10,472.33

- Coefficient of determination: 0.535

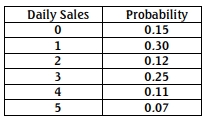

Forecasting is needed for quarters 3 and 4 in 2019 and quarters 1 and 2 in 2020. There is a debate about using data from all 10 periods versus only the last 5. Analysis for the last five periods includes:

Results of last five periods‟ observations

(Note: y values are scaled down by 100 for ease of calculation.)

Required:

a. Forecast sales for the four quarters using the 10-period data. (8 Marks)

b. Prepare similar forecasts using the last five periods of data. (8 Marks)

c. Evaluate which data set provides the better forecast. (4 Marks)

Find Related Questions by Tags, levels, etc.