- 20 Marks

AAA – Nov 2020 – L3 – Q3 – Audit of Specialized Industries

Audit planning, risk assessment, internal control, audit evidence, and reporting in a not-for-profit organization.

Question

Question:

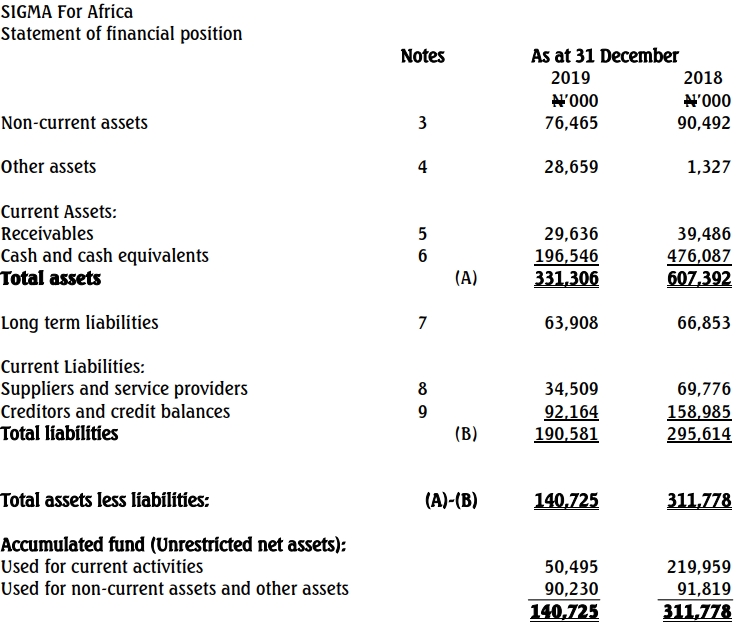

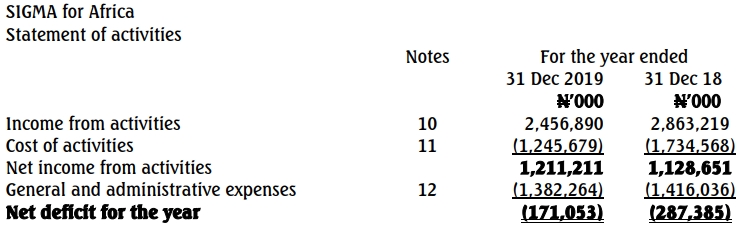

You are the Audit Manager at HWO, an audit firm. HWO has secured the audit of SIGMA For Africa, a not-for-profit organization. You have been assigned the audit of SIGMA For Africa. An extract of the unaudited financial statements is as follows:

SIGMA For Africa Statement of Financial Position

As at 31 December

Furthermore, you were assigned an audit senior. Based on preliminary discussions with your audit senior, you noted that the senior had no prior experience with audits of not-for-profit entities.

Required:

To help your audit senior understand how to audit a not-for-profit organization, prepare a presentation note summarizing the key considerations in the audit for the following areas:

a. Planning (4 Marks)

b. Risk analysis (4 Marks)

c. Internal control (4 Marks)

d. Audit evidence (4 Marks)

e. Reporting (4 Marks)

Find Related Questions by Tags, levels, etc.