- 30 Marks

FM – Nov 2016 – L3 – Q1 – Investment Appraisal Techniques

Evaluate TP’s project considering current market values and assess the risk-adjusted cost of capital.

Question

Tinko Plc (TP) repairs and maintains heavy-duty trucks, with workshops in Nigeria and several other African countries. TP is considering an expansion project in response to the government’s recent policy aimed at encouraging mechanized farming through the “Graduates Back To Land (GBTL)” program, which will likely increase demand for heavy-duty machinery.

Below are extracts from the most recent Statement of Financial Position of TP:

| Item | ₦’million |

|---|---|

| Share capital | 200 |

| Reserves | 320 |

| Non-current liabilities | 760 |

| Current liabilities | 60 |

| Total | 1,340 |

TP’s Free Cash Flows to Equity (FCFE) is currently estimated at ₦153 million, and it is expected to grow at 2.5% per annum indefinitely. The equity shareholders require a return of 11%.

The non-current liabilities consist entirely of bonds redeemable in four years at par with a coupon rate of 5.4%. The debt is rated BB, and the credit spread on BB-rated debt is 80 basis points above the risk-free rate.

In light of the GBTL program, TP is contemplating entry into the mechanized farming support industry through a four-year project, recognizing that after four years, competition may intensify significantly.

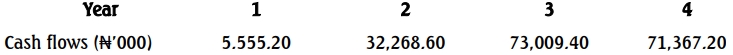

The project requires an initial investment of ₦84 million and is expected to generate the following after-tax cash flows:

Additional Information:

- Scenario Adjustments:

- There is a 25% probability that the GBTL program will not grow as expected in the first year. If this occurs, the present value of the project’s cash flows over its four-year life will be 50% of the original estimates.

- If the GBTL program grows as expected in the first year, there is still a 20% probability that growth will slow in subsequent years, reducing the present value of cash flows to 40% of the original estimates for those years.

- Sale Option: Feedwell Limited (FL) has offered ₦100 million to buy the project from TP at the start of the second year. TP is evaluating if this option adds strategic value to the project.

- Abako Plc, a comparable company, operates primarily in non-agricultural services, similar to TP, and has an equity beta of 1.6. Abako derives approximately 80% of its revenues from services outside agriculture, with an asset beta of 0.80. Abako’s capital structure consists of 80 million shares trading at ₦4.50 per share and debt of ₦340 million.

- The debt is trading at ₦1,050 per ₦1,000 with a zero debt beta.

- Risk-free rate: 4%; Market risk premium: 6%; Corporate tax rate: 20%.

Requirements: a. Calculate TP’s current total market value of:

- i. Equity (3 Marks)

- ii. Bonds (4 Marks) b. Determine the risk-adjusted cost of capital for the new project (to the nearest percent) (10 Marks) c. Estimate the value of the project:

- i. Without factoring in the potential strategic value or synergy from the project (5 Marks)

- ii. With FL’s offer, assuming it reflects the market’s view of the project’s value (5 Marks) d. Clearly state the assumptions made in your calculations (3 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cost of Capital, Debt Valuation, Equity Valuation, Market Value, Project Valuation, Risk Adjustment

- Level: Level 3