- 20 Marks

FR – May 2015 – L2 – SB – Q3 – Statement of Cash Flows (IAS 7)

Calculate and analyze financial ratios and prepare cash flows from operating activities for Galadanci Plc.

Question

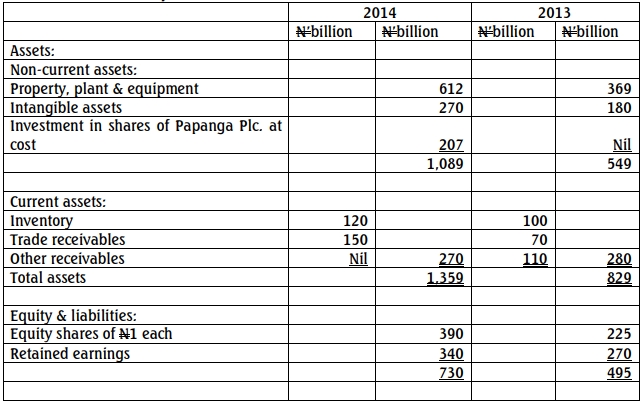

(a) Galadanci Plc, a telecommunications company, has the following financial statements for the years ending 31 December 2013 and 2014. Using the statements below, calculate specific ratios and analyze Galadanci Plc’s performance:

Statements of Profit or Loss and Other Comprehensive Income for the year ended

| 2014 (N’billion) | 2013 (N’billion) | |

|---|---|---|

| Revenue | 2,430 | 1,638 |

| Cost of Sales | (1,701) | (983) |

| Gross Profit | 729 | 655 |

| Administrative Costs | (311) | (180) |

| Distribution Costs | (207) | (117) |

| Finance Costs | (36) | (6) |

| Profit before Taxation | 175 | 352 |

| Income Tax Expense | (54) | (102) |

| Profit for the Year | 121 | 250 |

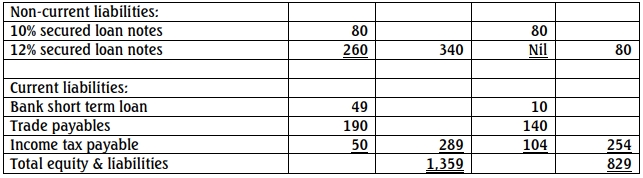

Statements of Financial Position as at 31 December

Additional Information for 2014

- Galadanci Plc acquired 60% of Papanga Plc’s shares to diversify into agriculture.

- The company increased its mobile subscriber base, raising the average revenue per user.

- No dividends were received from Papanga Plc, and the share value remained constant.

Required:

- Calculate the following ratios for the year ended 31 December 2014, analyze Galadanci Plc’s performance, and comment on qualitative factors impacting the company:

- Gross Profit Percentage

- Return on Capital Employed (where capital employed = Total Assets – Current Liabilities)

- Net Profit (PBIT) Percentage

- Asset Turnover

- Gearing Ratio

- Debt/Equity Ratio (16 Marks)

- Prepare Galadanci Plc’s Cash Flows from Operating Activities using the indirect method according to IAS 7. (4 Marks)

Find Related Questions by Tags, levels, etc.