- 12 Marks

CR – Nov 2014 – L3 – SB – Q4a – Income Taxes (IAS 12)

Compute the impact of deferred tax on retained earnings and advise Lagos Plc on IAS 12 compliance.

Question

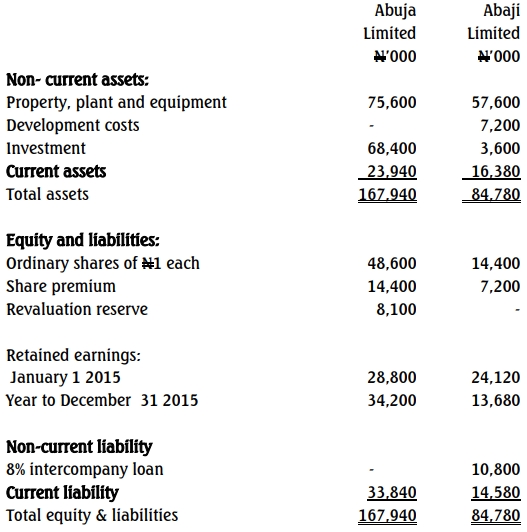

The following is the statement of financial position of Lagos Plc as at 31 December, 2013, with its immediate two comparative years.

The management of Lagos Plc is not sure of the impact of IAS 12 (Income Taxes) on its retained earnings as at 31 December, 2013, as well as what the new deferred tax balance will be on migrating to IFRS.

The following information was also available as at the year-end:

| Details | Value (N’000) |

|---|---|

| Tax written down value of PPE | 40,300 |

| Tax written down value of goodwill | 4,300 |

| Tax base of trade receivables | 29,800 |

| Tax base of trade payables | 13,000 |

Assume that current tax has been correctly computed in line with the applicable tax laws at 30%.

Required:

Using relevant computations, advise the management of Lagos Plc on the impact of deferred tax calculated on retained earnings in accordance with IAS 12.

Find Related Questions by Tags, levels, etc.

- Tags: Deferred Tax, Financial Reporting, Goodwill, IAS 12, Income Taxes, Plant & Equipment, Property, Retained Earnings, Tax Base

- Level: Level 3

- Topic: Income Taxes (IAS 12)

- Series: NOV 2014