Question Tag: Rent

- 1 Marks

FA – May 2013 – L1 – SA – Q25 – Accruals and Prepayments

This question involves calculating the rent expense to be charged for the year.

Find Related Questions by Tags, levels, etc.

- Tags: Accruals, Financial Reporting, Rent

- Level: Level 1

- Topic: Accruals and prepayments

- Series: MAY 2013

- 1 Marks

FA – May 2021 – L1 – SA – Q20 – Accounting Treatment for Accruals and Prepayments

Determine the classification of rent received in advance.

Question

Rent received in advance is:

i. Credit balance in rent account

ii. Current asset in the statement of financial position

iii. Liability in the statement of financial position

iv. Debit balance in the rent account

A. I and II

B. I and III

C. II and III

D. II and IV

E. III and IV

Find Related Questions by Tags, levels, etc.

- Tags: Accruals, Financial Statements, Prepayments, Rent

- Level: Level 1

- Topic: Accruals and Prepayments

- Series: MAY 2021

- 1 Marks

FA – May 2017 – L1 – SA – Q18 – Bank Reconciliation

Identifies items involving movement in cash flows.

Find Related Questions by Tags, levels, etc.

- Tags: Amortization, Cash Flow, Depreciation, Gain and Loss, Rent

- Level: Level 1

- Topic: Bank reconciliations

- Series: MAY 2017

- 10 Marks

PT – July 2023 – L2 – Q5a – Withholding Tax Administration

Calculate taxes and determine whether each is final based on various transactions provided.

Question

The following information is available to you as a tax consultant:

| Description | Amount (GH¢) |

|---|---|

| Dividend paid to resident person | 100,000 |

| Dividend paid to non-resident person | 200,000 |

| Payment of goods to resident person | 300,000 |

| Payment of goods to non-resident person | 400,000 |

| Rent – residential property | 150,000 |

| Rent – commercial property | 300,000 |

| Natural Resource Payment | 1,000,000 |

| Management and Technical Service fees to non-resident | 400,000 |

| Interest paid to resident financial institution | 20,000,000 |

| Royalty paid to non-resident person | 400,000 |

Required: Compute taxes from the above information and indicate whether the tax is final or not final.

Find Related Questions by Tags, levels, etc.

- Tags: Dividend, Final Tax, Goods payment, Non-resident, Rent, Withholding Tax

- Level: Level 2

- Topic: Withholding Tax Administration

- Series: JULY 2023

- 20 Marks

FA – Nov 2021 – L1 – Q2 – Accruals and prepayments | Preparation of Partnership accounts

Recording rent transactions and preparing financial statements related to the retirement of a partner, including revaluation and goodwill adjustments.

Question

a) Ansong is a sole proprietor whose accounting year is 1 November to 31 October. Ansong rents factory space at the cost of GHȼ10,000 per quarter, payable in advance. Payments for rent were made on 1 January, 1 April, 1 July, and 1 October during the year 2020.

Required:

i) Show the ledger entries to record the above transactions for the year ended 31 October 2020.

(4 marks)

ii) Prepare an extract for the Statement of Profit or Loss and Statement of Financial Position.

(1 mark)

b) Agyei, Bobo, and Dago have been in partnership for some years, sharing profits and losses in the ratio 3:2:1, respectively. The partnership statement of financial position as at 30 June 2020 was as follows:

| Assets | GHȼ | GHȼ |

|---|---|---|

| Non-current assets | ||

| Premises | 80,000 | |

| Office equipment | 58,400 | |

| Motor vehicles | 45,000 | |

| Total Non-current assets | 183,400 | |

| Current assets | ||

| Inventory | 28,600 | |

| Trade receivables | 25,800 | |

| Bank | 5,650 | |

| Total Current assets | 60,050 | |

| Total assets | 243,450 | |

| Capital and Liabilities | ||

| Capital accounts | ||

| Agyei | 95,000 | |

| Bobo | 60,000 | |

| Dago | 50,000 | |

| Total Capital | 205,000 | |

| Current accounts | ||

| Agyei | 15,200 | |

| Bobo | 7,040 | |

| Dago (debit balance) | (10,200) | |

| Total Current accounts | 12,040 | |

| Current liabilities | ||

| Trade payables | 26,410 | |

| Total Capital and Liabilities | 243,450 |

The partners have agreed that the following should take effect on 1 July 2020 upon the retirement of Dago:

- Goodwill is to be valued at GHȼ60,000 and will not remain in the books of account.

- Premises are to be revalued to GHȼ116,325.

- Dago is to take inventory costing GHȼ8,400 and a Motor Vehicle with a net book value of GHȼ20,500 as part settlement of his capital.

- A specific allowance for receivables is to be made for GHȼ5,300 owed by an individual customer. In addition, a general allowance for receivables is to be made at 5% of the remaining trade receivables.

- Agyei and Bobo will continue in partnership, sharing profits and losses in the ratio 3:2.

- Dago will transfer GHȼ12,000 to a loan account to be repaid in full in 2025. No loan interest will be charged on this amount.

- The remaining balance from combining both Dago’s capital account and current account will be paid from the business bank account.

Required:

i) Prepare the partners’ capital accounts on 1 July 2020 to show the retirement of Dago.

(7 marks)

ii) Prepare the partnership statement of financial position as at 1 July 2020.

(8 marks)

Find Related Questions by Tags, levels, etc.

- 20 Marks

FA – May 2021 – L1 – Q2 – Accruals and prepayments | Bad and doubtful debt | Preparation of Partnership accounts

Preparation of ledger accounts for accruals and prepayments and accounts on the dissolution of a partnership.

Question

a) The following information is available from the books of Twibom Ltd.

| Item | 1 January 2020 (GH¢) | 31 December 2020 (GH¢) |

|---|---|---|

| Interest received | 680 Accrued | 750 Accrued |

| General expenses | 5,200 Prepaid | 3,180 Accrued |

| Allowance for receivables | 1,350 | – |

| Receivables | 45,000 | 56,000 |

During the year ended 31 December 2020, the following amounts were received or paid (all transactions were through the bank account).

| Date | Transaction | Amount (GH¢) |

|---|---|---|

| 31 March | Interest received | 1,280 |

| 4 August | General expenses paid | 4,500 |

| 5 December | Rent paid | 27,000 |

The rent is due in equal monthly installments. The payment for rent covered the period from 1 January 2020 to 31 March 2021.

The allowance for receivables is to be set using the same percentage of receivables as in the previous year.

Required:

Prepare the following ledger accounts for the year ended 31 December 2020.

i) Interest Received (1 mark)

ii) General Expenses (1 mark)

iii) Rent (1 mark)

iv) Allowance for Receivables (2 marks)

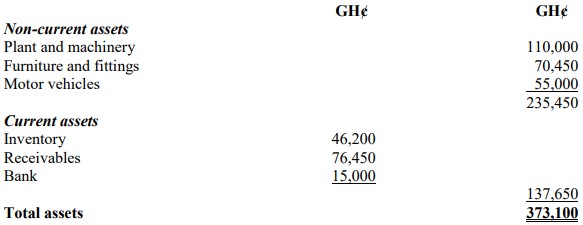

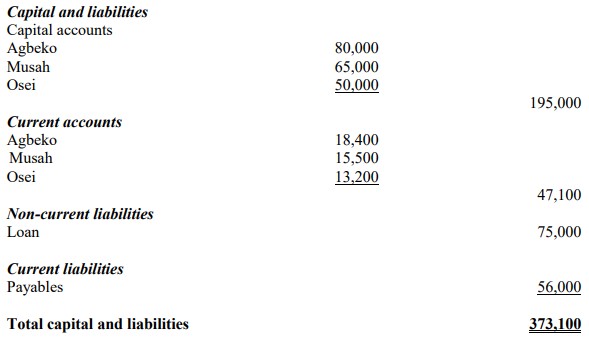

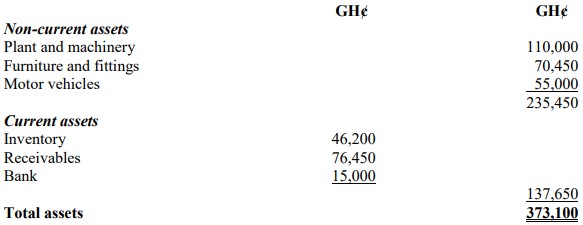

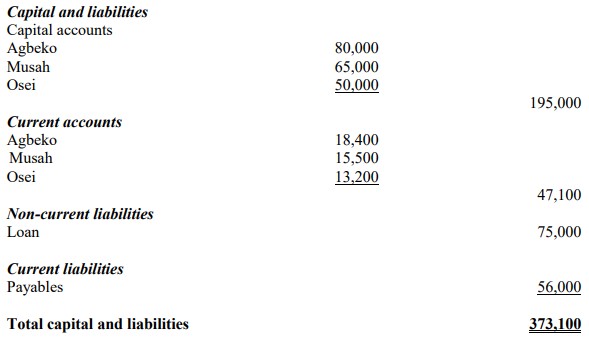

b) Agbeko, Musah, and Osei had been in partnership for several years sharing profits and losses in the ratio 5:3:2. On 1 January 2021, they decided to dissolve their partnership after a disagreement. The Statement of Financial Position of the partnership as at 31 December 2020, was as follows:

Additional Information

- The plant and machinery were sold for GH¢98,200.

- The inventory was sold for GH¢40,500.

- The Receivables realized GH¢62,000.

- The motor vehicles were taken over by Agbeko at an agreed value of GH¢40,800.

- The furniture and fittings were sold for GH¢50,400.

- A discount of GH¢4,320 was received when payables were paid off.

- The loan was repaid in full on 1 January 2021.

- There were no outstanding interest payments on the loan.

- Dissolution expenses amounted to GH¢3,000.

Required:

Prepare the following accounts on dissolution:

i) Partners’ capital accounts (3 marks)

ii) Realization account (7 marks)

iii) Bank account (5 marks)

Find Related Questions by Tags, levels, etc.

- 20 Marks

FA – Nov 2020 – L1 – Q1 – Accruals and prepayments | Bad and doubtful debt | The IASB’s Conceptual Framework

Question on various accounting principles and preparation of specific accounts related to rent, rates, bad debts, and doubtful debts.

Question

a) Accounting principles and concepts are of fundamental importance in the preparation of financial statements.

Required:

With the aid of relevant examples, outline your understanding on any FOUR (4) of the following concepts/principles: i) Accruals

ii) Going Concern

iii) Historical Cost

iv) Materiality

v) Break up basis

(10 marks)

b) Patricia Ltd prepares accounts to 31 December each year. The following transactions relate to Rent and Rates: i) 31 December 2018 three months’ rent owing amounted to GH¢6,000.

ii) 31 December 2018 two months rates prepaid amounted to GH¢5,250.

iii) During the year 2019, cash paid for rent and rates amounted to GH¢90,000

iv) Rent owing as at 31 December 2019 amounts to GH¢9,000

v) Rates prepaid as at 31 December 2019 amounts to GH¢2,250

Required:

Prepare a combined rent and rates account to disclose the amount that is chargeable to the profit or loss account for the year ended 31 December, 2019.

(4 marks)

c) The following information was extracted from the books of Maanaa and Co.:

| Year | Bad debts written off (GH¢) | Trade Receivables (GH¢) | Allowance for doubtful debt (%) |

|---|---|---|---|

| 1 | 200,000 | 1,200,000 | 10 |

| 2 | 300,000 | 1,800,000 | 5 |

| 3 | 100,000 | 3,000,000 | 5 |

Required:

Prepare the following accounts for the 3 years to determine the amount chargeable to the Profit or Loss account:

i) Bad debts written off account (2 marks)

ii) Allowance for doubtful debt account (4 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Accruals, Allowance for Doubtful Debt, Bad Debts, Break-up Basis, Going Concern, Historical Cost, Materiality, Rates, Rent

- Level: Level 1

- 1 Marks

FA – May 2013 – L1 – SA – Q25 – Accruals and Prepayments

This question involves calculating the rent expense to be charged for the year.

Find Related Questions by Tags, levels, etc.

- Tags: Accruals, Financial Reporting, Rent

- Level: Level 1

- Topic: Accruals and prepayments

- Series: MAY 2013

- 1 Marks

FA – May 2021 – L1 – SA – Q20 – Accounting Treatment for Accruals and Prepayments

Determine the classification of rent received in advance.

Question

Rent received in advance is:

i. Credit balance in rent account

ii. Current asset in the statement of financial position

iii. Liability in the statement of financial position

iv. Debit balance in the rent account

A. I and II

B. I and III

C. II and III

D. II and IV

E. III and IV

Find Related Questions by Tags, levels, etc.

- Tags: Accruals, Financial Statements, Prepayments, Rent

- Level: Level 1

- Topic: Accruals and Prepayments

- Series: MAY 2021

- 1 Marks

FA – May 2017 – L1 – SA – Q18 – Bank Reconciliation

Identifies items involving movement in cash flows.

Find Related Questions by Tags, levels, etc.

- Tags: Amortization, Cash Flow, Depreciation, Gain and Loss, Rent

- Level: Level 1

- Topic: Bank reconciliations

- Series: MAY 2017

- 10 Marks

PT – July 2023 – L2 – Q5a – Withholding Tax Administration

Calculate taxes and determine whether each is final based on various transactions provided.

Question

The following information is available to you as a tax consultant:

| Description | Amount (GH¢) |

|---|---|

| Dividend paid to resident person | 100,000 |

| Dividend paid to non-resident person | 200,000 |

| Payment of goods to resident person | 300,000 |

| Payment of goods to non-resident person | 400,000 |

| Rent – residential property | 150,000 |

| Rent – commercial property | 300,000 |

| Natural Resource Payment | 1,000,000 |

| Management and Technical Service fees to non-resident | 400,000 |

| Interest paid to resident financial institution | 20,000,000 |

| Royalty paid to non-resident person | 400,000 |

Required: Compute taxes from the above information and indicate whether the tax is final or not final.

Find Related Questions by Tags, levels, etc.

- Tags: Dividend, Final Tax, Goods payment, Non-resident, Rent, Withholding Tax

- Level: Level 2

- Topic: Withholding Tax Administration

- Series: JULY 2023

- 20 Marks

FA – Nov 2021 – L1 – Q2 – Accruals and prepayments | Preparation of Partnership accounts

Recording rent transactions and preparing financial statements related to the retirement of a partner, including revaluation and goodwill adjustments.

Question

a) Ansong is a sole proprietor whose accounting year is 1 November to 31 October. Ansong rents factory space at the cost of GHȼ10,000 per quarter, payable in advance. Payments for rent were made on 1 January, 1 April, 1 July, and 1 October during the year 2020.

Required:

i) Show the ledger entries to record the above transactions for the year ended 31 October 2020.

(4 marks)

ii) Prepare an extract for the Statement of Profit or Loss and Statement of Financial Position.

(1 mark)

b) Agyei, Bobo, and Dago have been in partnership for some years, sharing profits and losses in the ratio 3:2:1, respectively. The partnership statement of financial position as at 30 June 2020 was as follows:

| Assets | GHȼ | GHȼ |

|---|---|---|

| Non-current assets | ||

| Premises | 80,000 | |

| Office equipment | 58,400 | |

| Motor vehicles | 45,000 | |

| Total Non-current assets | 183,400 | |

| Current assets | ||

| Inventory | 28,600 | |

| Trade receivables | 25,800 | |

| Bank | 5,650 | |

| Total Current assets | 60,050 | |

| Total assets | 243,450 | |

| Capital and Liabilities | ||

| Capital accounts | ||

| Agyei | 95,000 | |

| Bobo | 60,000 | |

| Dago | 50,000 | |

| Total Capital | 205,000 | |

| Current accounts | ||

| Agyei | 15,200 | |

| Bobo | 7,040 | |

| Dago (debit balance) | (10,200) | |

| Total Current accounts | 12,040 | |

| Current liabilities | ||

| Trade payables | 26,410 | |

| Total Capital and Liabilities | 243,450 |

The partners have agreed that the following should take effect on 1 July 2020 upon the retirement of Dago:

- Goodwill is to be valued at GHȼ60,000 and will not remain in the books of account.

- Premises are to be revalued to GHȼ116,325.

- Dago is to take inventory costing GHȼ8,400 and a Motor Vehicle with a net book value of GHȼ20,500 as part settlement of his capital.

- A specific allowance for receivables is to be made for GHȼ5,300 owed by an individual customer. In addition, a general allowance for receivables is to be made at 5% of the remaining trade receivables.

- Agyei and Bobo will continue in partnership, sharing profits and losses in the ratio 3:2.

- Dago will transfer GHȼ12,000 to a loan account to be repaid in full in 2025. No loan interest will be charged on this amount.

- The remaining balance from combining both Dago’s capital account and current account will be paid from the business bank account.

Required:

i) Prepare the partners’ capital accounts on 1 July 2020 to show the retirement of Dago.

(7 marks)

ii) Prepare the partnership statement of financial position as at 1 July 2020.

(8 marks)

Find Related Questions by Tags, levels, etc.

- 20 Marks

FA – May 2021 – L1 – Q2 – Accruals and prepayments | Bad and doubtful debt | Preparation of Partnership accounts

Preparation of ledger accounts for accruals and prepayments and accounts on the dissolution of a partnership.

Question

a) The following information is available from the books of Twibom Ltd.

| Item | 1 January 2020 (GH¢) | 31 December 2020 (GH¢) |

|---|---|---|

| Interest received | 680 Accrued | 750 Accrued |

| General expenses | 5,200 Prepaid | 3,180 Accrued |

| Allowance for receivables | 1,350 | – |

| Receivables | 45,000 | 56,000 |

During the year ended 31 December 2020, the following amounts were received or paid (all transactions were through the bank account).

| Date | Transaction | Amount (GH¢) |

|---|---|---|

| 31 March | Interest received | 1,280 |

| 4 August | General expenses paid | 4,500 |

| 5 December | Rent paid | 27,000 |

The rent is due in equal monthly installments. The payment for rent covered the period from 1 January 2020 to 31 March 2021.

The allowance for receivables is to be set using the same percentage of receivables as in the previous year.

Required:

Prepare the following ledger accounts for the year ended 31 December 2020.

i) Interest Received (1 mark)

ii) General Expenses (1 mark)

iii) Rent (1 mark)

iv) Allowance for Receivables (2 marks)

b) Agbeko, Musah, and Osei had been in partnership for several years sharing profits and losses in the ratio 5:3:2. On 1 January 2021, they decided to dissolve their partnership after a disagreement. The Statement of Financial Position of the partnership as at 31 December 2020, was as follows:

Additional Information

- The plant and machinery were sold for GH¢98,200.

- The inventory was sold for GH¢40,500.

- The Receivables realized GH¢62,000.

- The motor vehicles were taken over by Agbeko at an agreed value of GH¢40,800.

- The furniture and fittings were sold for GH¢50,400.

- A discount of GH¢4,320 was received when payables were paid off.

- The loan was repaid in full on 1 January 2021.

- There were no outstanding interest payments on the loan.

- Dissolution expenses amounted to GH¢3,000.

Required:

Prepare the following accounts on dissolution:

i) Partners’ capital accounts (3 marks)

ii) Realization account (7 marks)

iii) Bank account (5 marks)

Find Related Questions by Tags, levels, etc.

- 20 Marks

FA – Nov 2020 – L1 – Q1 – Accruals and prepayments | Bad and doubtful debt | The IASB’s Conceptual Framework

Question on various accounting principles and preparation of specific accounts related to rent, rates, bad debts, and doubtful debts.

Question

a) Accounting principles and concepts are of fundamental importance in the preparation of financial statements.

Required:

With the aid of relevant examples, outline your understanding on any FOUR (4) of the following concepts/principles: i) Accruals

ii) Going Concern

iii) Historical Cost

iv) Materiality

v) Break up basis

(10 marks)

b) Patricia Ltd prepares accounts to 31 December each year. The following transactions relate to Rent and Rates: i) 31 December 2018 three months’ rent owing amounted to GH¢6,000.

ii) 31 December 2018 two months rates prepaid amounted to GH¢5,250.

iii) During the year 2019, cash paid for rent and rates amounted to GH¢90,000

iv) Rent owing as at 31 December 2019 amounts to GH¢9,000

v) Rates prepaid as at 31 December 2019 amounts to GH¢2,250

Required:

Prepare a combined rent and rates account to disclose the amount that is chargeable to the profit or loss account for the year ended 31 December, 2019.

(4 marks)

c) The following information was extracted from the books of Maanaa and Co.:

| Year | Bad debts written off (GH¢) | Trade Receivables (GH¢) | Allowance for doubtful debt (%) |

|---|---|---|---|

| 1 | 200,000 | 1,200,000 | 10 |

| 2 | 300,000 | 1,800,000 | 5 |

| 3 | 100,000 | 3,000,000 | 5 |

Required:

Prepare the following accounts for the 3 years to determine the amount chargeable to the Profit or Loss account:

i) Bad debts written off account (2 marks)

ii) Allowance for doubtful debt account (4 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Accruals, Allowance for Doubtful Debt, Bad Debts, Break-up Basis, Going Concern, Historical Cost, Materiality, Rates, Rent

- Level: Level 1