- 20 Marks

PM – May 2023 – L2 – SA – Q4 – Decision-Making Techniques

Evaluate the costs and desirability of mutually exclusive contracts for Tayo Limited, considering penalties and other relevant factors.

Question

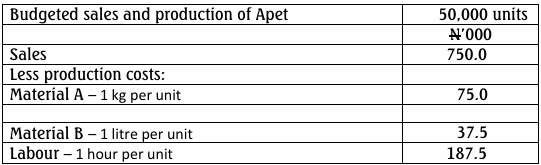

Tayo Limited is a civil engineering company based in Benin. Contracts are carried out under the supervision of project managers who are sent out from Head Office and remain on-site for the duration of the contract. The project manager recruits local labour and arranges for plant and materials to be provided by Head Office.

Some time ago, the company successfully tendered for two contracts that have now become mutually exclusive. It is currently considering which of these to accept. Both jobs would last for 12 months.

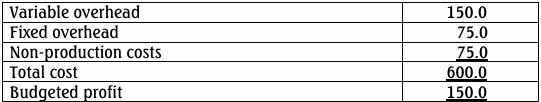

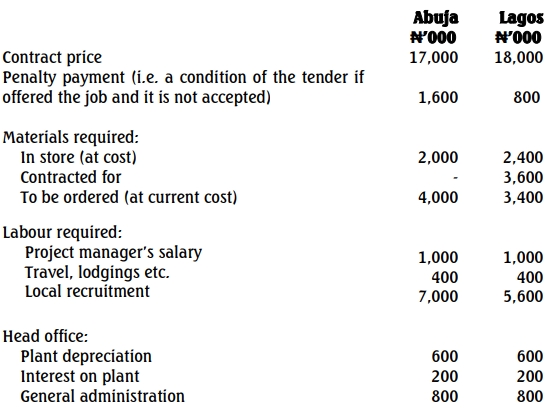

The following information about each contract is available:

Notes:

(i) The materials which would be used on the Abuja job have increased in money value by 60% over their purchase cost. Tayo Limited has no other use for these materials on any other contract apart from the Abuja one, but they could be re-sold to other companies in the industry at 90% of their value. Transportation and other selling costs would further decrease the cash inflow from the sale by 16.67% of the sales price.

(ii) The materials for the Lagos job have no other obvious use, but could be sold for scrap if the contract were cancelled. The scrap value would be 10% of cost, and costs of transport, etc., would be paid by the scrap merchant. It is likely, however, that the materials could be used next year on another contract in substitution for a different material normally costing 20% less than the cost of the materials to be used on the Lagos contract.

(iii) Local labour can be hired as and when required.

(iv) Plant is depreciated on a straight-line basis, and the interest on plant charge is a nominal cost added for accounting purposes.

(v) The two contracts would require similar plant, although more plant would be required for the Lagos than for the Abuja job. The plant not required on the Abuja job would be sub-contracted out by Head Office for ₦200,000 per annum.

(vi) Head Office administration costs are fixed at ₦2,500,000 for the coming year. This excludes project managers’ salaries.

Required:

a. Present the data to management in a form which will assist in making the decision as to which job to undertake. Provide notes to explain the principles which have been used in selecting the data and to support any calculations made. (12 Marks)

b. Comment on the appropriateness of the approach used in your analysis. (4 Marks)

c. List briefly any other factors which ought to be considered before finally making the decision in this case. (4 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Contract Profitability, Labour Costs, Material Costs, Penalty Payments, Relevant Costs

- Level: Level 2

- Topic: Decision-making techniques

- Series: MAY 2023