- 20 Marks

PM – May 2017 – L2 – SA – Q3 – Cost Management Strategies

Calculate relevant cost for engine production for Tadex and factors influencing component opportunity cost.

Question

- Tadex Nigeria Limited is an engineering company specializing in building engines for grinding machines. One of the components for building these engines is sourced from Toka Nigeria Limited, a company in the same group as Tadex Nigeria Limited. Each component is transferred to Tadex, taking into account Toka’s opportunity cost of the component. The variable cost for Toka is N280 per component.

A prospective customer has approached Tadex to submit a quotation for a contract to build a new engine. This is a new customer for Tadex, but the directors of Tadex are keen on winning this contract, as they believe it may lead to more contracts in the future. As a result, they intend to price the contract using relevant costs.

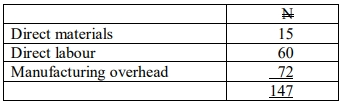

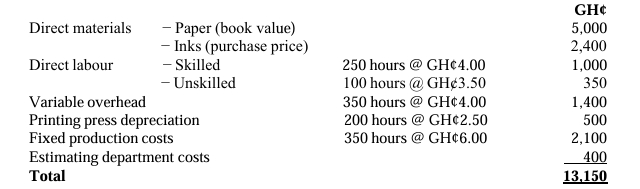

The following cost data is provided for the contract:

(i) Production Director’s Salary: Annual salary equivalent to N15,000 per 8-hour day.

(ii) Materials for the Contract:

- Material A: 110 square meters needed, with 200 square meters in stock, bought at N120 per square meter. Resale value: N105 per square meter; Replacement cost: N125 per square meter.

- Material B: 30 liters needed, must purchase a minimum of 40 liters at N90 per liter, with no future use after the contract.

- Components from Toka: 60 units at N500 per unit.

(iii) Direct Labor Hours: 240 hours required; 75 hours available as spare capacity. Additional hours are sourced at overtime cost of N140/hour or temporary staff at N120/hour (10 hours supervision by an existing supervisor at N180/hour).

(iv) Machine Hours: 25 hours needed, with the machine leased weekly at N6,000 and sufficient spare capacity. Running cost: N70 per hour.

(v) Fixed Overhead Absorption Rate: N200 per direct labor hour.

Requirements:

a. Calculate the relevant cost of building the new engine and explain why you have included or excluded any costs in your calculations.

(15 marks)

b. Discuss the factors that would be considered by Toka to determine the opportunity cost of the component.

(5 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cost Analysis, Opportunity Cost, Project Quotation, Relevant Costing

- Level: Level 2

- Topic: Cost Management Strategies

- Series: MAY 2017