- 20 Marks

FR – Aug 2022 – L2 – Q4 – Financial Statement Analysis

Calculate various financial ratios for Pat Plc and compare them to industry averages and Write a report to assess the financial performance and position of Pat Plc relative to industry standards based on the calculated ratios.

Question

Pat Plc is a listed Ghanaian company that produces textile prints for local and African markets. During the year ended 31 March 2022, the following financial information was available:

Gross profit: GH¢12,150

Cost of sales: GH¢77,850

Operating profit before interest and tax: GH¢7,130

Finance cost: GH¢920

Tax charged to profit or loss: GH¢1,400

Inventory turnover: 3.6 times

Dividend per share: GH¢0.36

Dividend yield: 6%

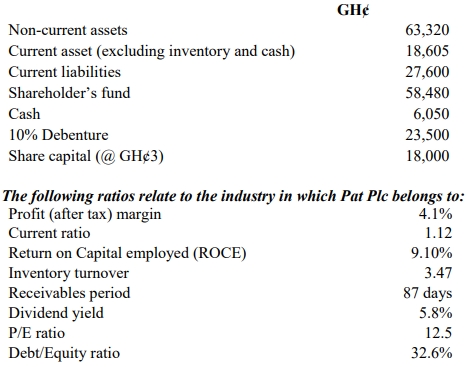

Extracts from the Statement of Financial Position as at 31 March 2022:

Required:

a. Based on the information provided, compute the following ratios for Pat Plc:

i) Profit (after tax) margin

ii) Current ratio

iii) Return on Capital Employed (ROCE)

iv) Receivables period

v) Price/Earnings ratio

vi) Debt/Equity ratio

b. Using the ratios computed in Question 4a, write a report to the Board of Directors of Pat Plc assessing the financial performance and financial position of the entity, relative to its industry.

Find Related Questions by Tags, levels, etc.