- 20 Marks

FA – Nov 2023 – L1 – Q5 – Interpretation of financial statements (Financial Ratios)

Calculate and interpret financial performance ratios for Edumfa Ltd in comparison to a competitor.

Question

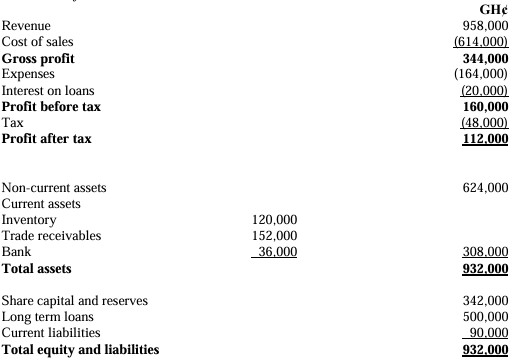

The following summarised information is available in respect of Edumfa Ltd for the year ended 31 July 2022:

The performance ratios for a competitor company for the same period are as follows:

| Description | Ratio |

|---|---|

| Return On Capital Employed (ROCE) | 25.2% |

| Asset turnover rate | 1.06 |

| Acid test ratio | 0.9:1 |

| Return on equity | 31.5% |

| Receivables collection period | 38 days |

Required:

a) Calculate the performance indicators for Edumfa Ltd as shown for the comparable company. (10 marks)

b) Comment on the performance of Edumfa Ltd for the year ended 31 July 2022 using the information you calculated in (a) above. (10 marks)

Find Related Questions by Tags, levels, etc.