- 14 Marks

CR – May 2021 – L3 – Q3a – Presentation of Financial Statements (IAS 1)

Analyze Somolu Limited's financial performance and recommend whether Agege Plc should invest; discuss reporting quality improvements.

Question

The Chief Executive Officer (CEO) of Agege Plc. has forwarded the draft financial statements of Somolu Limited through an e-mail to you as the company’s financial consultants.

In the e-mail, the CEO informed you that Agege Plc. is planning to acquire Somolu Limited. Somolu Limited is a private limited company that has recently applied for additional funds which was rejected from its current bankers on the basis that the company has insufficient assets to offer as security.

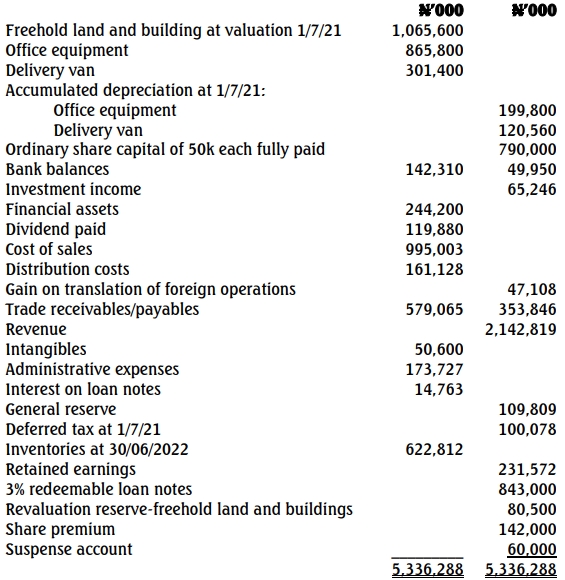

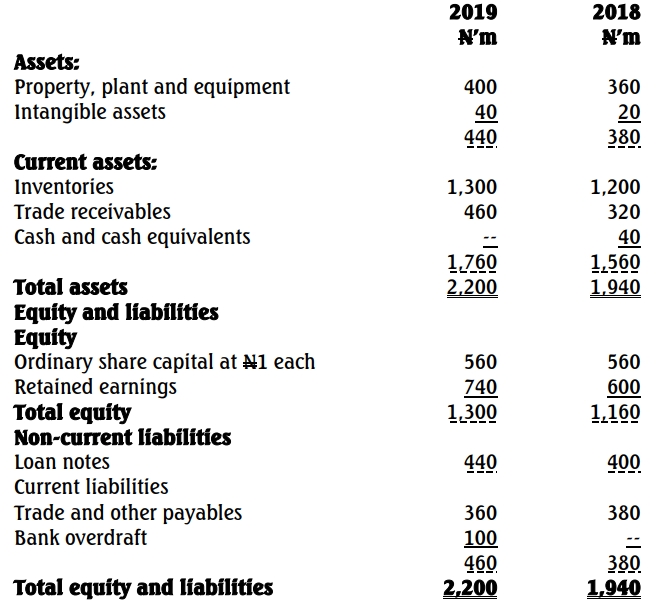

The draft financial statements of Somolu Limited as at December 31, 2019, are as follows:

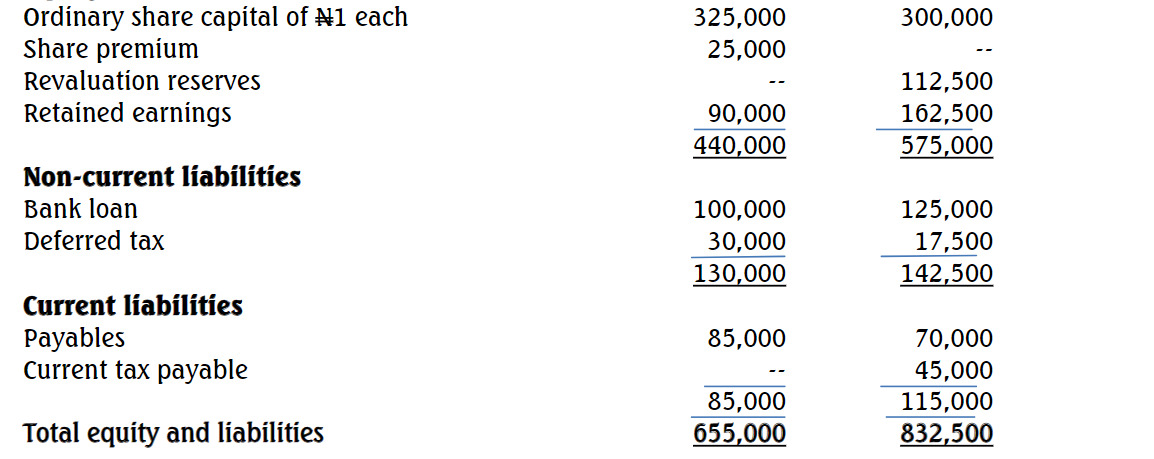

Somolu Limited

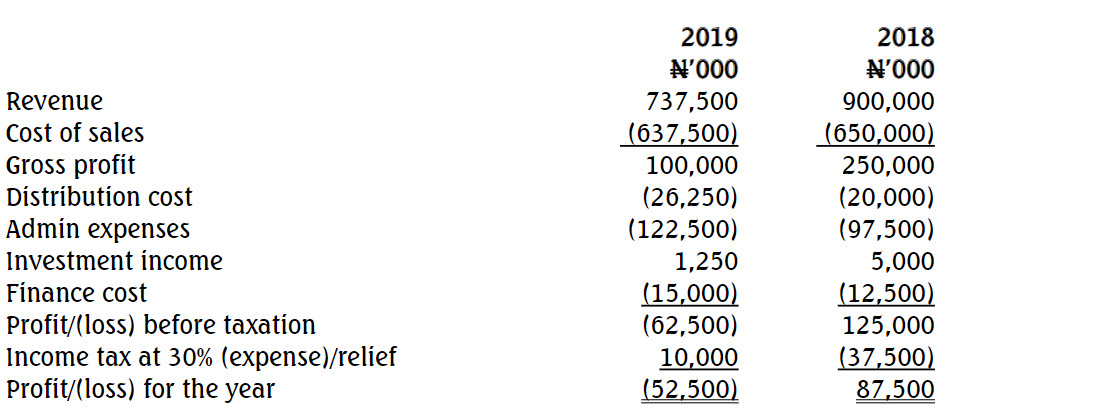

Statement of profit or loss and other comprehensive income for the year ended December 31, 2019

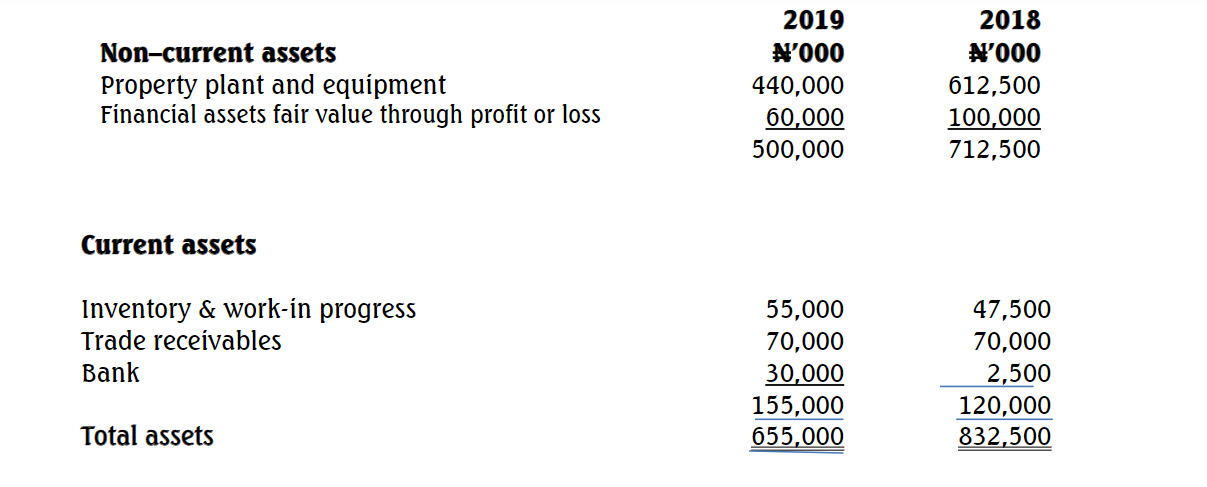

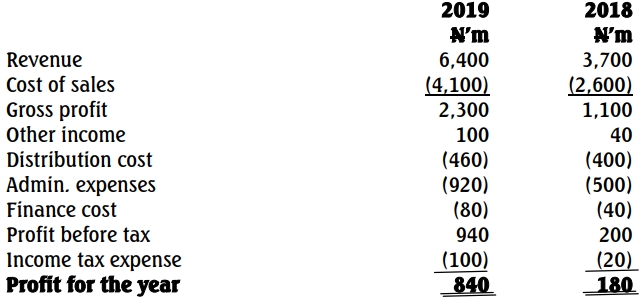

Somolu Limited

Statement of financial position as at December 31, 2019

Required:

a. Carry out a critical analysis of the financial performance and position of Somolu

Limited together with recommendations as to whether Agege Limited should

consider the investment in Somolu Limited. (14 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Financial Analysis, IFRS, Ratios, Reporting Standards

- Level: Level 3