- 20 Marks

CR – Nov 2014 – L3 – SB – Q3 – Presentation of Financial Statements (IAS 1)

Analyze Prochain Plc’s financial performance and calculate key ratios for loan covenants.

Question

Prochain Plc

The Directors of Prochain Plc have pursued an aggressive policy of expansion in the last two years. They have developed several new products and market share has increased.

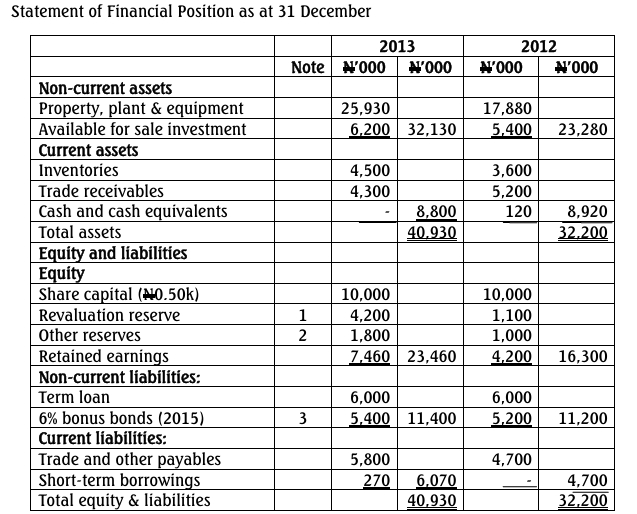

The financial statements for the year ended 31 December 2013, which will be presented to the Board of Directors at its next meeting, are being finalised. The financial statements at the year-end are presented below:

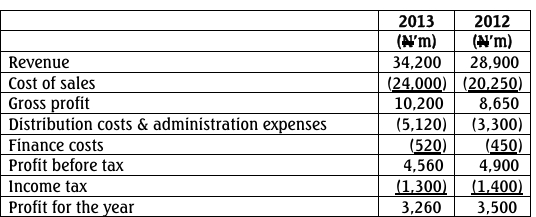

Statement of profit or loss and other comprehensive income for the year ended 31 December

![]()

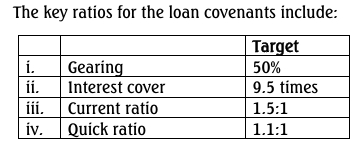

The results of the company as well as certain key ratios that will form part of the covenants in respect of the loan facilities will be discussed at the Board of Directors meeting.

Notes:

- The movement on the revaluation reserve relates to property, plant, and equipment revalued in the year.

- The movement on other reserves relates to the gains on the investments available for sale.

- The bonds are repayable on 1 July 2015.

Required:

(a) Based on the results of Prochain Plc for the year ended 31 December 2013, calculate the key ratios for the loan.

(8 Marks)

(b) Prepare a report commenting on the financial performance for the year in relation to the key ratios for the loan.

(12 Marks)

(Total 20 Marks)

Find Related Questions by Tags, levels, etc.