- 30 Marks

PSAF – May 2019 – L2 – Q1 – Public Sector Financial Statements

Analyze financial ratios for a hotel transitioning to a public-private partnership.

Question

National Hotel, an investment unit of the Ministry of Tourism and Environment, is fifty (50) years old. It has recently been restructured from a wholly-owned government hotel to a private/government partnership. However, being the largest hotel in the country and for security reasons, the government still retains 55% of its equity.

The board of directors has decided to reposition the hotel for better performance, needing external finances amounting to N180 million, consisting of a N100 million loan over ten years and an N80 million bank overdraft. All necessary supports have been provided by the government and private equity holders.

The summarized results for the last two financial years are as follows:

Income Statement

| Year ended 30 September | 2013 (N’000) | 2014 (N’000) |

|---|---|---|

| Turnover | 200,000 | 240,000 |

| Cost of Sales | (150,000) | (184,000) |

| Gross Profit | 50,000 | 56,000 |

| Overhead Expenses | (10,000) | (12,000) |

| Profit before Tax | 40,000 | 44,000 |

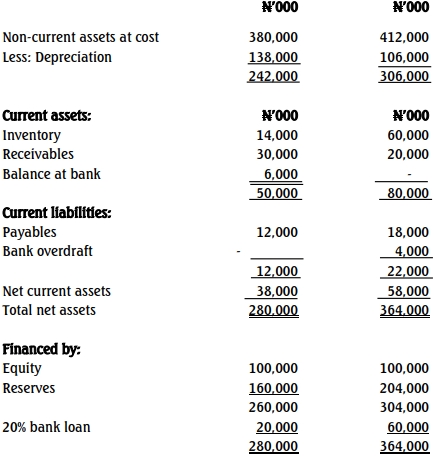

Statement of Financial Position

You have been engaged as a consultant to assist the hotel in preparing necessary documents and reports to achieve its objectives.

Required:

a. Calculate six relevant accounting ratios covering each of the two years: 2013 and 2014 in a tabular form. (12 Marks)

b. Interpret the result of the ratios calculated in (a) above to show the financial performance and position of the entity. (12 Marks)

c. Highlight four unfavorable factors about the hotel as revealed by your interpretation. (6 Marks)

Find Related Questions by Tags, levels, etc.