- 20 Marks

AT – Aug 2022 – L3 – Q4 – Capital Allowance

Calculation of capital allowances, provisional tax, chargeable income, company tax, and additional tax liability for Zimbo Ltd for the year ended 31 December 2021.

Question

Zimbo Ltd (Zimbo) specialises in the manufacture of personal hygiene soaps and related

products at their factory in the industrial area of Accra. Zimbo commenced business operations

on 1 April 2020 and had an assessed loss of GH¢112,000 for the period ended 31 December

2020 attributable to large start-up costs in the first period of trading.

Turnover for the year ended 31 December 2021 amounted to GH¢1,980,000 of which

GH¢700,000 relates to export sales. Zimbo is trying to increase its turnover from export sales

through participation in foreign market trade fairs as well as other marketing campaigns. The

gross profit margin for the year ended 31 December 2021 was 60%.

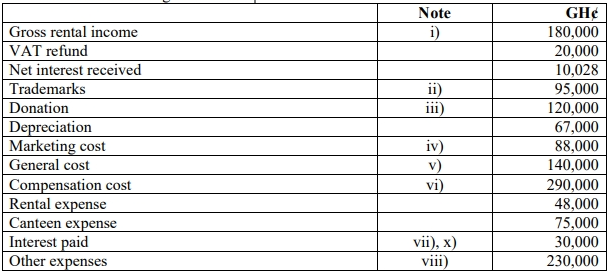

Zimbo recorded a net profit of GH¢315,000 for the year ended 31 December 2021 after taking

into account the following transactions:

Additional information:

i) The gross rental income earned was from leasing one wing of the head office building. The

wing constitutes 10% of the entire building.

ii) The registration of three trademarks, ‘Cleanex’, ‘Perfect’ and ‘Alfresh’ at a total cost of

GH¢30,000 in respect of Zimbo’s personal hygiene soaps that is to last for fifteen years. The

market research expenses incurred in connection with the development of these soaps

amounted to GH¢65,000.

iii) The donation was made to a local government assisted school as part of Zimbo’s corporate

social responsibility programme.

iv) GH¢25,000 of the marketing cost was incurred when the export market Development Manager

attended two trade conventions and one trade mission as part of Zimbo’s efforts to increase its

export sales. The trade mission was duly approved. The remaining GH¢63,000 of costs were

incurred in marketing Zimbo’s soaps to foreign markets.

v) GH¢28,000 of the general costs was incurred in underpinning the office building to strengthen

its foundations against sinking.

vi) The compensation cost was as a result of the production manager incurring an injury while

working on one of the production lines in the factory. The Production Manager was rendered

incapacitated as a result of the incident. Zimbo settled out of court. GH¢250 000 of the costs

relate to a payment made to the Production Manager in full settlement of the case. GH¢50,000

of the GH¢250,000 out-of-court settlement was paid in order to prevent the Production

Manager from setting up a similar business in competition with Zimbo. The remaining

GH¢40,000 of costs represent fines imposed by the Factory Inspectorate Division following

the incident. The production line was also condemned as a result.

vii)The interest paid was incurred in respect of Zimbo’s GH¢200,000 overdraft facility.

GH¢100,000 of the facility was applied towards recurrent expenditure while the other

GH¢100,000 of the facility was applied towards the cost of a new showroom.

viii) Ghana Revenue Authority considers 40% of other expenses to be prohibited for tax purposes.

ix) Zimbo’s projected taxable income for the year ended 31 December 2021 was GH¢360,000.

The Accountant remitted the provisional tax for the three quarterly payment dates (QPDs) on

time but, due to the pressures of year-end work, forgot to submit the return for the final QPD.

The Accountant also omitted the brought forward assessed loss from his computations of the

provisional tax.

x) During the year, a showroom was constructed in close proximity to Zimbo’s factory building.

The showroom is used to display the soaps from the factory as well as for storage purposes

pending shipment to various destinations. The showroom was constructed at a total cost of

GH¢100,000 and was wholly funded by Zimbo’s overdraft facility. The showroom was

brought into use on 1 August 2021. Zimbo has made all tax appropriate elections in connection

with the showroom.

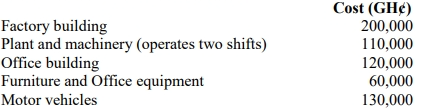

xi) Details of Zimbo’s other fixed assets are provided below. These were all acquired/constructed

during the year to 31 December 2020:

Required:

a) Calculate the capital allowances claimable by Zimbo for the year ended 31 December 2021,

assuming all favourable elections are made. (6 marks)

b) Calculate the provisional tax which should have been paid by Zimbo for the year ended 31

December 2021, clearly indicating the due dates and the respective tax amounts. (3 marks)

c) Calculate the chargeable income and company tax payable by Zimbo for the year ended 31

December 2021. (10 marks)

Note: Your calculations should assume that the provisional tax paid was as calculated in

part b) of the question.

d) Compute any other tax liability apart from the company tax. (1 mark)

(Total: 20 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Business income, Capital Allowance, chargeable income, Provisional Tax, Rental Tax

- Level: Level 3

- Topic: Capital allowance

- Series: AUG 2022