- 5 Marks

FA – Nov 2024 – L1 – Q2b – Allowance for Receivables and Irrecoverable Debt

Prepare the allowance for receivables and irrecoverable debt expense accounts for a financial period.

Question

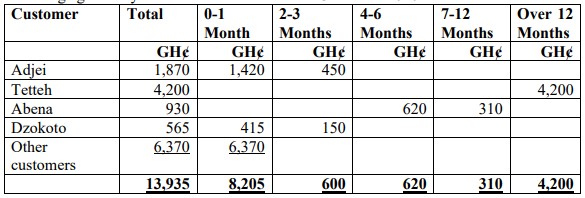

At 1 August 2023, the balance on the allowance for receivables account was GH¢12,600.

At 31 August 2023, the company’s management decided that the revised balance should be 10% of the month-end accounts receivable.

Required:

Prepare the Allowance for Receivables and Irrecoverable Debt Expense accounts, showing the necessary entries for the financial period ending 31 August 2023.

Find Related Questions by Tags, levels, etc.