- 20 Marks

FR – Mar/Jul 2020 – L2 – Q5b – Gbebody Nigeria Limited Adjusted Retained Earnings and Statement of Financial Position

Preparation of adjusted retained earnings and statement of financial position considering property revaluation and deferred tax impact.

Question

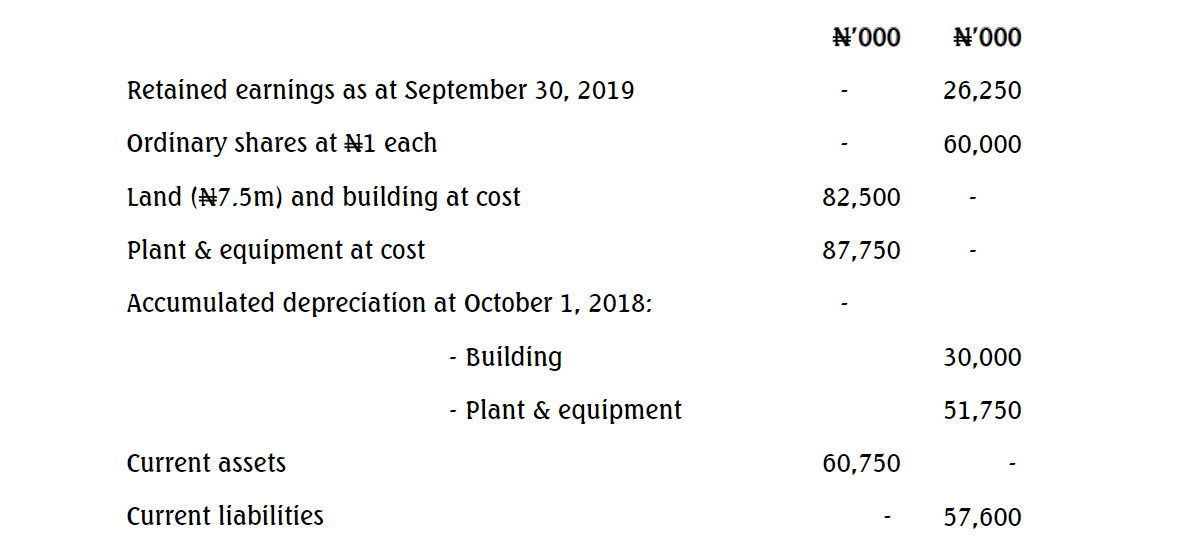

b. The assistant accountant of Gbebody Nigeria Limited after preparing the company‟s draft statement of profit or loss for the year ended September 30, 2019 and adding the current year‟s profit to retained earnings extracted a summarised trial balance of the company as at that date are as follows:

The chief accountant of Gbebody Nigeria Limited on reviewing the draft trial balance discovered that the following information were not taken into consideration by the assistant accountant of the company.

- The price of property has increased significantly in recent years and on October 1, 2018, the directors decided to revalue the land and building.

- The directors accepted the report of an independent valuer who valued the land at N12m and the building at N58.5million on that date. The remaining life of the building at October 1, 2018 was 15 years. Gbebody Nigeria Limited does not make an annual transfer to retained earnings to reflect the realisation of the revaluation gain, however, the revaluation will give rise to a deferred tax liability. The company income tax rate is 30%.

- Plant and equipment is depreciated at 12½% per annum using reducing balance method. No depreciation has been charged on any non-current assets for the year ended September 30, 2019.

- Provision of N3.6million is required for current income tax on the profit for the year to September 30, 2019. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary difference relating to the information in the note above. Gbebody Nigeria Limited has further taxable temporary difference of N15m as at September 30, 2019.

You are required to prepare:

(i) Adjusted retained earnings after taking into consideration the additional information in the notes above.

(5 Marks)

(ii) The statement of financial position of Gbebody Nigeria Limited as at

September 30, 2019.

Find Related Questions by Tags, levels, etc.