- 22 Marks

CR – May 2023 – L3 – Q1a – Consolidated Financial Statements (IFRS 10)

Prepare a consolidated statement of financial position for Omi PLC and subsidiaries.

Question

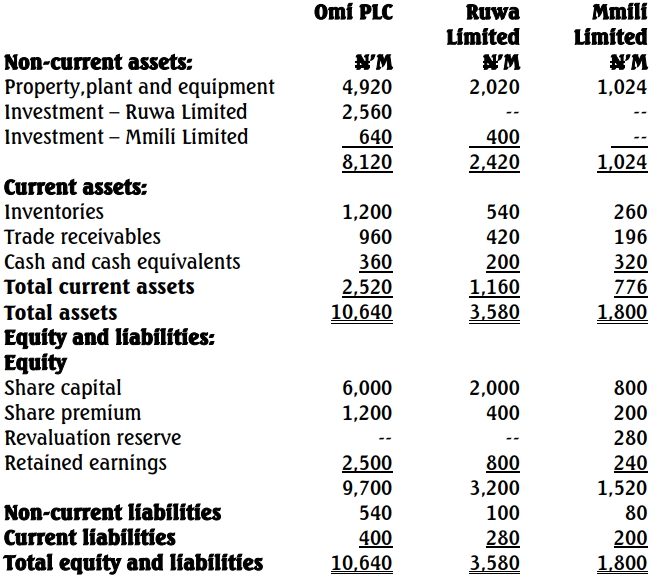

The draft statement of financial position of Omi PLC, Ruwa Limited, and Mmili Limited as of November 30, 2020, are as follows:

Additional Information for Consolidated Financial Statements Preparation:

- Acquisition of Ruwa Limited:

- Omi PLC acquired 80% of Ruwa Limited’s ordinary share capital on December 1, 2017.

- Retained earnings of Ruwa Limited at acquisition: N400 million.

- Fair value of Ruwa Limited’s net assets: N2,840 million.

- Any fair value adjustment pertains to net current assets, which had been realized by November 30, 2020.

- No new issue of shares occurred in the group since the establishment of the current structure.

- Acquisition of Mmili Limited:

- On December 1, 2018, Omi PLC acquired 40% and Ruwa Limited acquired 25% of Mmili Limited’s ordinary share capital.

- Retained earnings of Mmili Limited at acquisition: N200 million.

- Retained earnings of Ruwa Limited at acquisition: N600 million.

- No revaluation surplus existed in Mmili Limited’s books at acquisition, and the fair value of Mmili Limited’s net assets was consistent with their carrying amount.

- Development Costs:

- Significant expenditure incurred on developing internet products. These were initially written off but later reinstated as development inventories upon commercial use.

- Costs do not meet the recognition criteria of IAS 38 – Intangible Assets.

- Ruwa Limited included N80 million of these costs in its inventory, of which N20 million relates to expenses from periods before December 1, 2017.

- The group wishes to ensure compliance with IFRS for this treatment.

- Internet Equipment:

- Ruwa Limited purchased new internet equipment for N200 million, excluding a trade discount of N24 million.

- The discount was recorded in the income statement.

- Depreciation is calculated using the straight-line method over six years.

- Property, Plant, and Equipment Policy:

- The group transitioned from the revaluation model to the cost model under IAS 16 – Property, Plant, and Equipment in 2020.

- Mmili Limited’s assets were revalued on December 1, 2019, creating a revaluation surplus of N280 million.

- Mmili Limited’s property was originally purchased in December 2018 for N1,200 million, with depreciation over six years.

- The group does not transfer excess depreciation from revaluation reserves to retained earnings.

- Valuation of Non-controlling Interests:

- The group values non-controlling interests at acquisition using their proportionate share of the subsidiary’s identifiable net assets.

- Defined Benefit Pension Scheme:

- Omi PLC established a defined benefit pension scheme, contributing N400 million to it.

- Details as of November 30, 2020:

- Present value of obligation: N520 million.

- Fair value of plan assets: N500 million.

- Current service cost: N440 million.

- Interest cost (scheme liabilities): N80 million.

- Expected return on pension assets: N40 million.

- Actuarial gain: N60 million.

- The only recorded entry was the cash contribution, included in Omi PLC’s trade receivables.

- Directors propose recognizing actuarial gain immediately in the statement of profit or loss.

Required:

Prepare the consolidated statement of financial position of Omi Group for the year ended November 30, 2020, in accordance with relevant IFRS.

Find Related Questions by Tags, levels, etc.